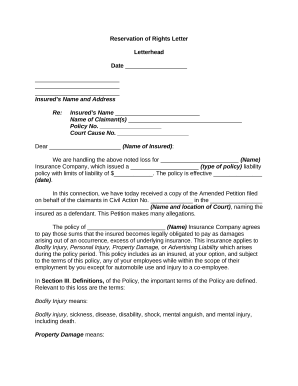

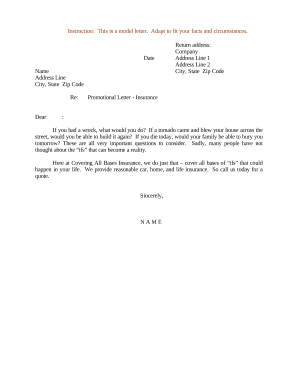

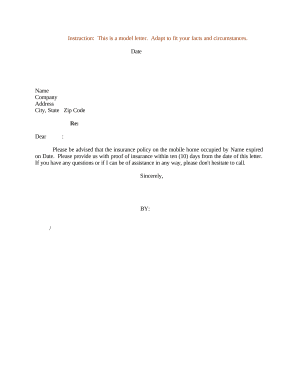

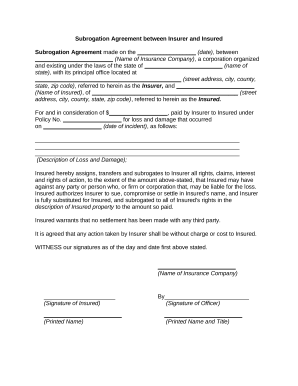

Your workflows always benefit when you can locate all the forms and files you need on hand. DocHub delivers a a huge collection of form templates to relieve your daily pains. Get a hold of Insurance Forms category and quickly browse for your form.

Begin working with Insurance Forms in a few clicks:

Enjoy effortless file managing with DocHub. Check out our Insurance Forms collection and look for your form today!