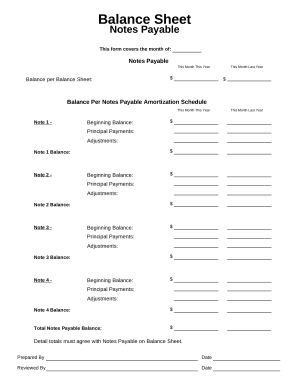

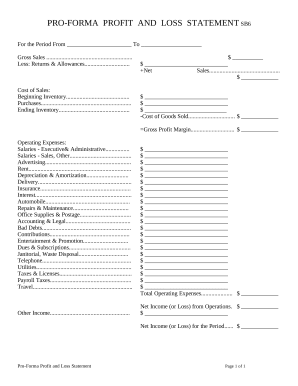

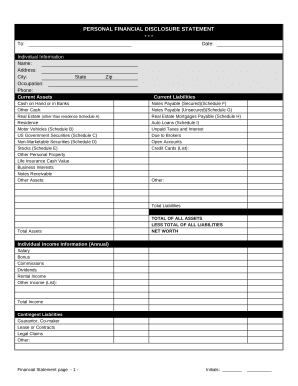

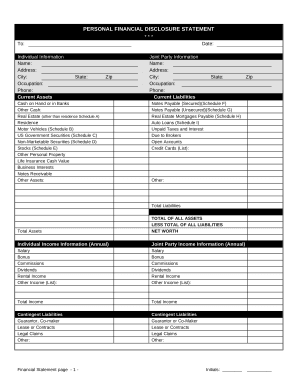

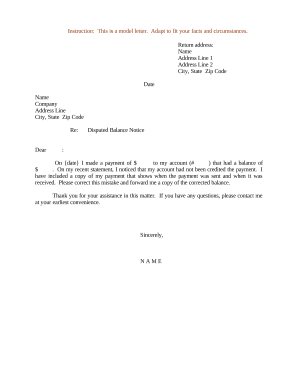

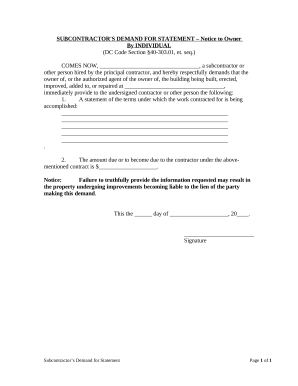

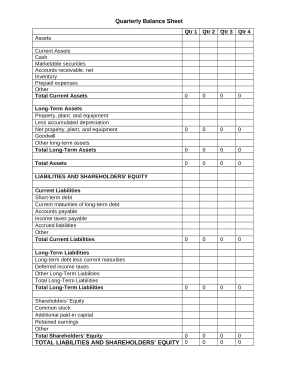

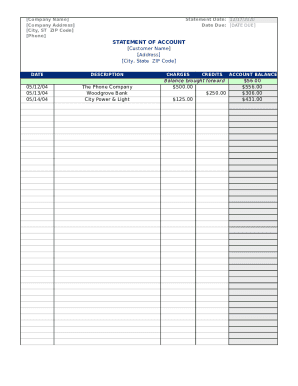

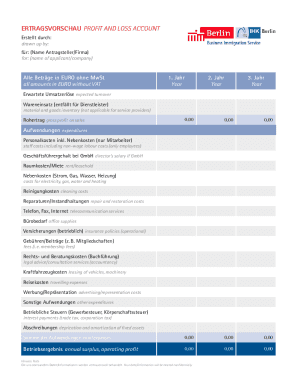

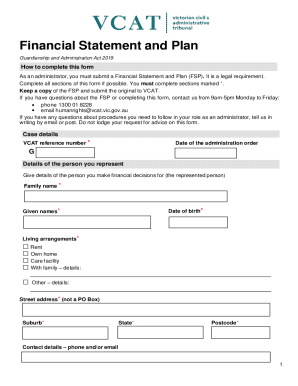

Download the best up-to-date Simple profit and loss Balance Sheet Templates with DocHub online catalog. Personalize and cooperate on your financial statements with your team in real-time without losing important data.

Form administration consumes to half of your business hours. With DocHub, you can easily reclaim your time and effort and enhance your team's efficiency. Access Simple profit and loss Balance Sheet Templates collection and check out all document templates related to your everyday workflows.

Easily use Simple profit and loss Balance Sheet Templates:

Accelerate your everyday file administration using our Simple profit and loss Balance Sheet Templates. Get your free DocHub account today to discover all forms.