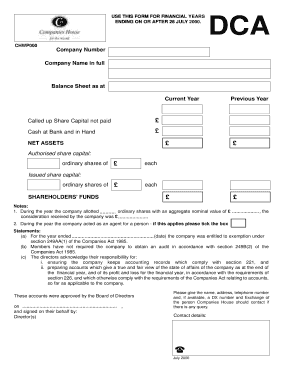

Personalize Chase business Balance Sheet Templates online with DocHub flexible modification capabilities. Develop and manage your financial records all in one place without compromising your information and security.

Document management occupies to half of your office hours. With DocHub, it is simple to reclaim your office time and increase your team's efficiency. Access Chase business Balance Sheet Templates category and check out all document templates related to your day-to-day workflows.

Effortlessly use Chase business Balance Sheet Templates:

Accelerate your day-to-day document management with the Chase business Balance Sheet Templates. Get your free DocHub profile right now to explore all templates.