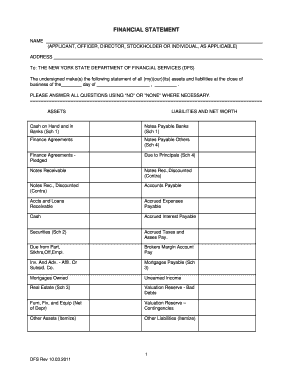

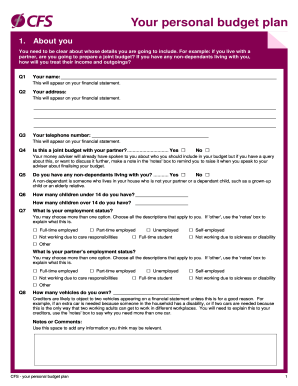

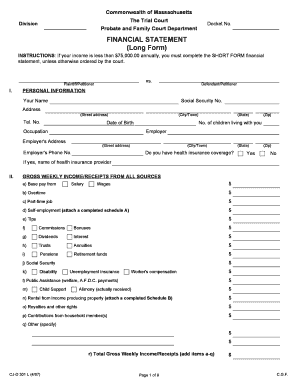

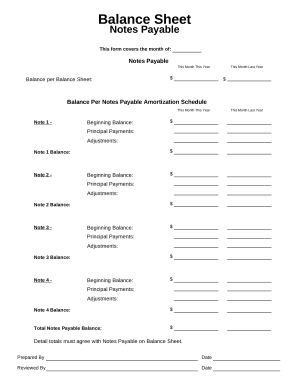

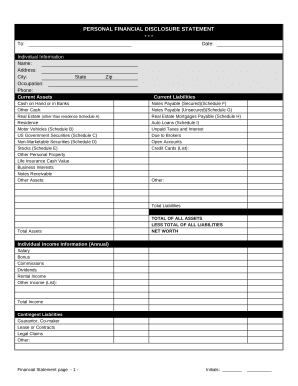

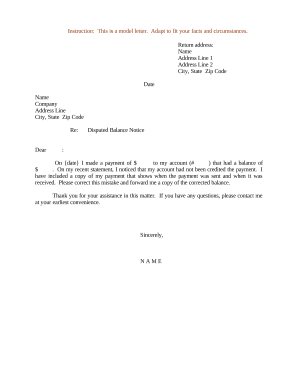

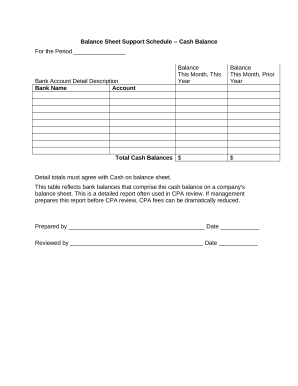

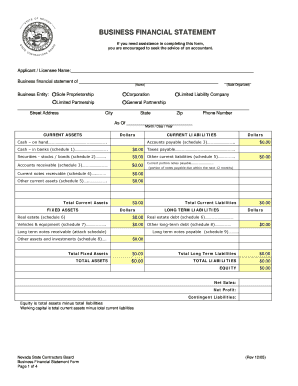

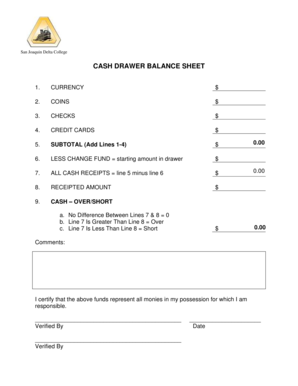

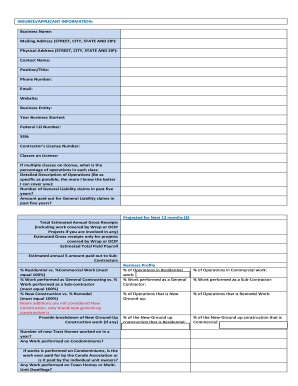

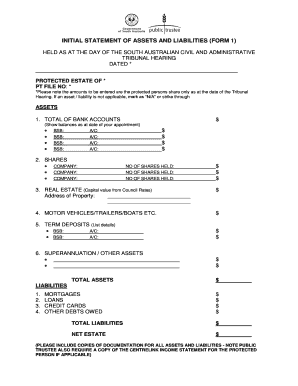

Boost your productivity and financial statement accuracy with DocHub's Blank accounting Balance Sheet Templates. Stay compliant and complete your balance sheets online.

Your workflows always benefit when you can easily get all the forms and files you require on hand. DocHub provides a wide array of form templates to ease your daily pains. Get a hold of Blank accounting Balance Sheet Templates category and quickly find your form.

Begin working with Blank accounting Balance Sheet Templates in a few clicks:

Enjoy fast and easy form administration with DocHub. Explore our Blank accounting Balance Sheet Templates category and locate your form right now!