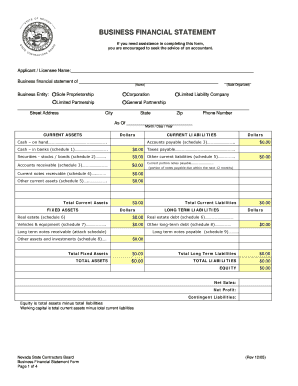

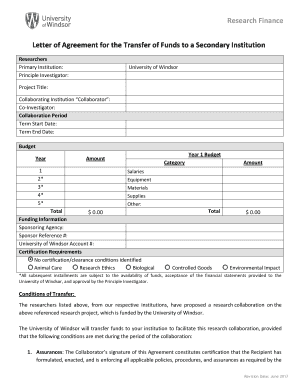

Browse Approach cash flow Balance Sheet Templates and create a tailored financial overview. Edit, complete, eSign, and send your financial statements without holdups.

Record administration occupies to half of your business hours. With DocHub, it is simple to reclaim your time and effort and enhance your team's productivity. Get Approach cash flow Balance Sheet Templates category and check out all document templates related to your day-to-day workflows.

The best way to use Approach cash flow Balance Sheet Templates:

Boost your day-to-day file administration using our Approach cash flow Balance Sheet Templates. Get your free DocHub account right now to explore all forms.