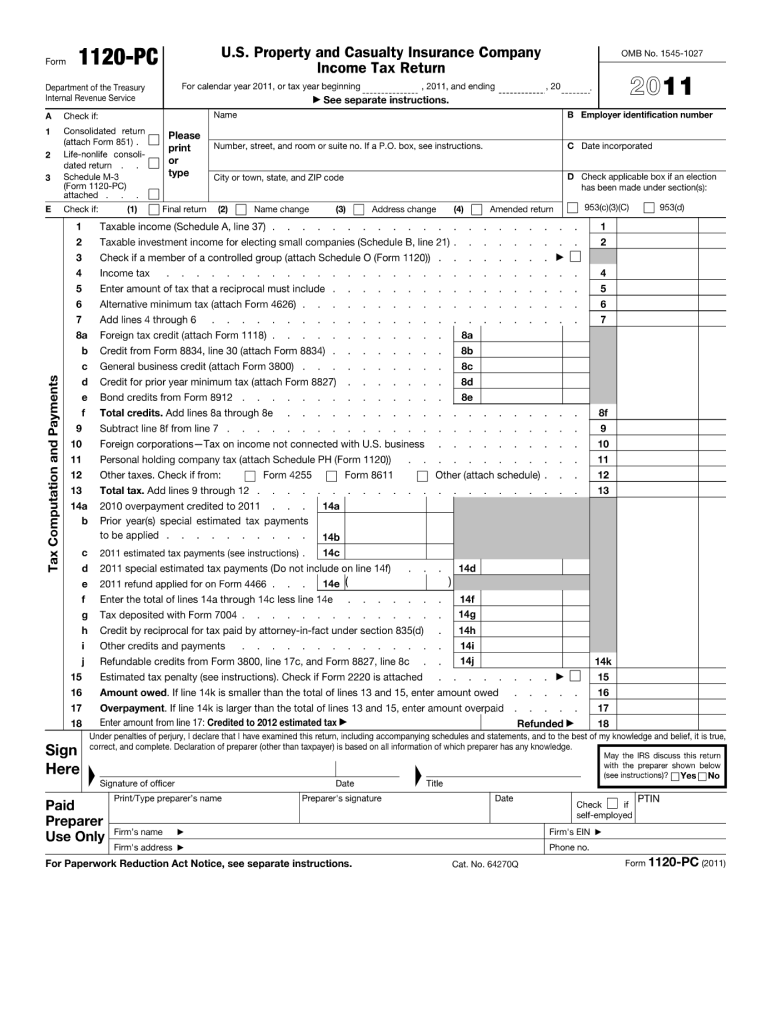

Definition and Meaning

Form 1120-PC, also known as the U.S. Property and Casualty Insurance Company's Income Tax Return, is a critical tax document used specifically by property and casualty insurance companies. This form captures comprehensive financial data including taxable income, allowable deductions, tax credits, and other relevant financial disclosures unique to these insurance entities. It ensures compliance with U.S. tax laws by detailing vital aspects such as premiums earned, losses incurred, and dividends received, ultimately aiding in precise tax computation.

How to Use Form 1120-PC 2011

When utilizing the Fillableform, companies must first gather all necessary financial documentation for accurate data entry. This includes:

- Revenue Documentation: Compile records of premiums earned and investment income.

- Expense Reporting: Detail all losses incurred, including claims paid and adjustment expenses.

- Deductions and Credits: Identify and document eligible deductions and credits to reduce taxable income.

To fill out the form, begin by entering all required financial information in the specific sections provided. Each section guides users through the process of disclosing financial data, ensuring compliance with IRS requirements.

Steps to Complete Fillableform

- Gather Necessary Documentation:

- Collect financial records, such as income statements and balance sheets.

- Access the Form:

- Available via the IRS website or platforms like DocHub for a fillable format.

- Fill Out the Form:

- Enter company details, including EIN and fiscal year.

- Fill in the income section with premiums and other income data.

- Complete the deductions and credits sections accurately.

- Review and Verify:

- Double-check all entries for accuracy and consistency.

- Ensure all mandatory fields are correctly filled.

- Sign and File:

- Electronically sign using DocHub’s e-signature tool if filing digitally.

- Submit completed form through IRS-approved channels (e.g., electronic submission platforms).

Required Documents

To complete Form 1120-PC, insurance companies must prepare:

- Income Statements: For a detailed account of premiums earned and other income.

- Claims and Payments Records: Documentation of all losses paid and outstanding claims adjustments.

- Deduction Proofs: Legal proofs for deductions such as dividends paid and operational expenses.

- IRS Correspondence: Previous tax filings or IRS notices relevant to the return.

Who Typically Uses Form 1120-PC

Form 1120-PC is primarily used by property and casualty insurance firms operating within the United States. These entities choose this form to report their annual income and deductions to the IRS, ensuring they meet tax obligations efficiently. It is not intended for other types of corporations or businesses outside the insurance sector.

Legal Use of Form 1120-PC

The Fillableform serves as a legally binding document for reporting a company's annual financials to the IRS. Failing to file accurately can lead to penalties, so entities must ensure comprehensive and honest disclosure. The form must be filed according to the IRS calendar, aligning with the company’s fiscal year. Adhering to the ESIGN Act, electronic submissions ensure legal compliance, preserving authenticity and integrity.

IRS Guidelines for Form 1120-PC

The IRS provides guidelines outlining:

- Eligibility: Only property and casualty insurance companies should use this form.

- Instructions: Step-by-step completion guidance found on the official IRS website.

- Filing Deadlines: The form is due by the 15th day of the third month following the end of the company's tax year.

- Audit Preparedness: Ensure records meticulously support form entries to withstand audits.

Penalties for Non-Compliance

Failure to file Form 1120-PC accurately and promptly can result in severe penalties, including fines and interest on unpaid taxes. Incorrect or incomplete disclosures may trigger audits, increasing administrative burdens and potential legal challenges. Timely and accurate filing is imperative to avoid these liabilities.

Filing Deadlines / Important Dates

For the 2011 Fillableform1120, companies must submit by the 15th day of the third month post fiscal year-end, usually March 15 for calendar year-end companies. These deadlines are crucial, and any extensions must be applied for in advance through IRS Form 7004 submission.