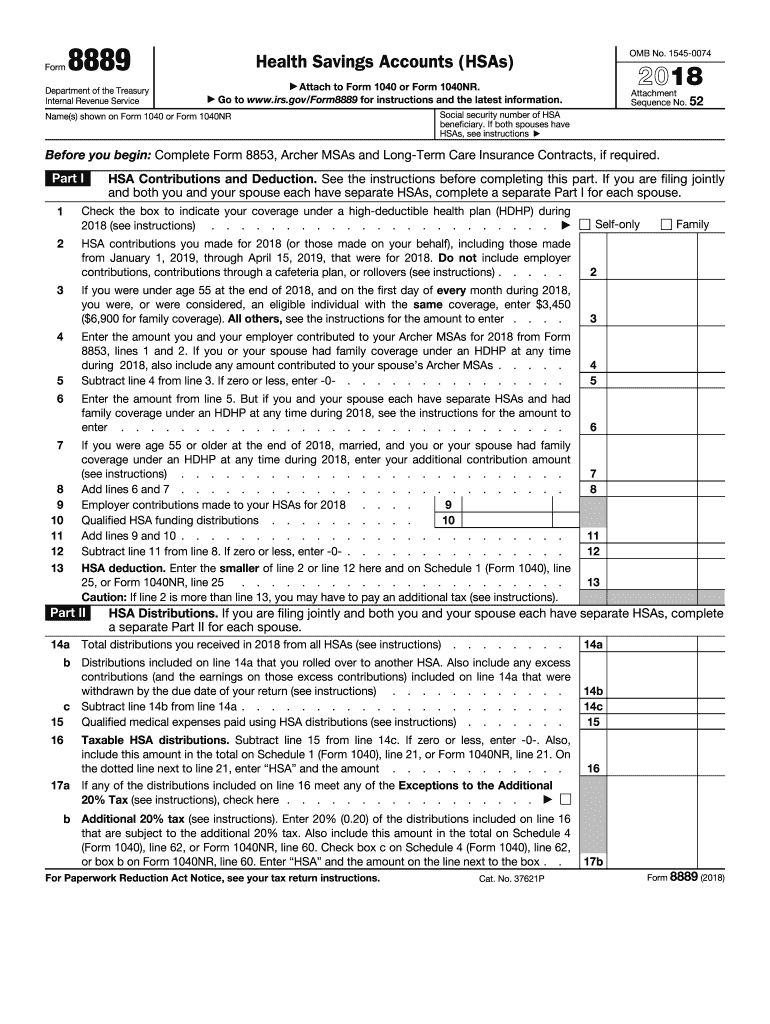

Understanding Form 8889 for Health Savings Accounts

Form 8889 is primarily used by individuals in the United States for reporting contributions to and distributions from Health Savings Accounts (HSAs) during the tax year. The form is essential for those who want to take advantage of tax benefits associated with HSAs, which are designed to offer tax incentives for individuals enrolled in high-deductible health plans.

Key Sections of Form 8889

-

HSA Contributions: This section is where taxpayers report the total contributions made to their HSAs, including those from employers. It is crucial to ensure accuracy, as over-contribution can lead to penalties.

-

HSA Deductions: Taxpayers can claim deductions for contributions made to their HSAs. This deduction directly reduces the taxpayer’s adjusted gross income, providing immediate tax savings.

-

Distributions: This part details any distributions made from the HSA. It is important to differentiate between qualified medical expenses and other distributions, as non-qualified distributions may incur taxes and penalties.

-

Additional Taxes: Taxpayers must report any additional taxes owed if they made excess contributions to their HSAs or used their HSAs for non-qualified expenses.

How to Obtain and Access Form 8889 for 2016

The 2016 version of Form 8889 can be downloaded directly from the official IRS website, or it can be accessed via reliable document management platforms like DocHub. These platforms often provide enhanced features such as editing and direct online filing, which can streamline the preparation process.

Steps to Access the Form

- Visit the IRS Website: Search for Form 8889 in the publications section.

- Use Document Management Platforms: Platforms like DocHub offer the ability to fill out the form online and save it securely.

- Download and Save: Ensure you download a copy for your records and future reference.

Completing Form 8889: A Step-by-Step Guide

Filling out Form 8889 for the 2016 tax year involves several steps that require meticulous attention to detail:

- Enter Personal Information: Start with your name, social security number, and other identifying details.

- Report HSA Contributions: Include self and employer contributions.

- Calculate Tax Deduction: Deductible contributions are calculated and reported.

- Document Distributions: Clearly state amounts used for qualified medical expenses.

- Calculate Taxable Distributions: Any distributions not used for qualified expenses are taxable and must be reported.

- Review and Submit: Double-check the entire form for accuracy before submitting it along with your Form 1040 or 1040NR.

Who Typically Uses Form 8889

This form is typically used by:

- Employees with HSAs: Individuals whose employers contribute to their HSAs.

- Self-employed Individuals: Those who have an HSA as a part of their tax strategy.

- Retirees with HSAs: Older individuals using HSAs to pay for qualifying medical expenses not covered by Medicare.

IRS Guidelines and Filing Deadlines

The IRS has specific guidelines for correctly filing Form 8889 to ensure compliance:

- Correct Reporting: Make sure all figures are accurate and reflect both contributions and distributions.

- Filing Timeline: Form 8889 must be filed by the annual tax deadline, typically April 15, unless an extension is filed.

Penalties for Non-Compliance

Failing to properly fill out and submit Form 8889 can lead to:

- Monetary Penalties: For excess contributions or non-qualified distributions.

- Audit Risks: Increased scrutiny from the IRS for omissions or inaccuracies.

Key Terms Associated with Form 8889

Several specific terms are central to understanding and correctly completing Form 8889:

- Qualified Medical Expenses: These expenses are defined by the IRS and must be adhered to avoid penalties.

- Excess Contributions: Contributions that exceed IRS limits can result in penalties unless addressed appropriately in the filing.

Legal Uses and State-Specific Variations

Form 8889 must align with both federal and state regulations concerning HSAs:

-

Federal Compliance: Ensures the taxpayer meets national standards for contributions and reporting.

-

State-Specific Rules: Some states may have distinctive rules regarding HSAs, and it's important to consult state tax resources for specific guidance.

Digital vs. Paper Submissions

Form 8889 can be submitted in either digital or paper form, though digital submission is generally encouraged due to its convenience and speed:

-

Digital Submissions: Enable faster processing and often include built-in error-checking tools.

-

Paper Submissions: While still accepted, they require physical mailing and may take longer to process.

Taxpayer Scenarios and Practical Examples

Various taxpayer scenarios demonstrate the diverse use cases for Form 8889:

-

Self-Employed Professionals: Utilizing HSAs to save on taxes while managing health coverage.

-

Families on High-Deductible Plans: Using HSAs to cover unexpected medical expenses tax-free.

-

Early Retirees: Drawing from HSAs to bridge the gap between employment health insurance and Medicare.

By comprehensively addressing the features, requirements, and practical applications surrounding Form 8889, individuals can effectively optimize their tax strategies while ensuring compliance and maximizing HSA benefits.