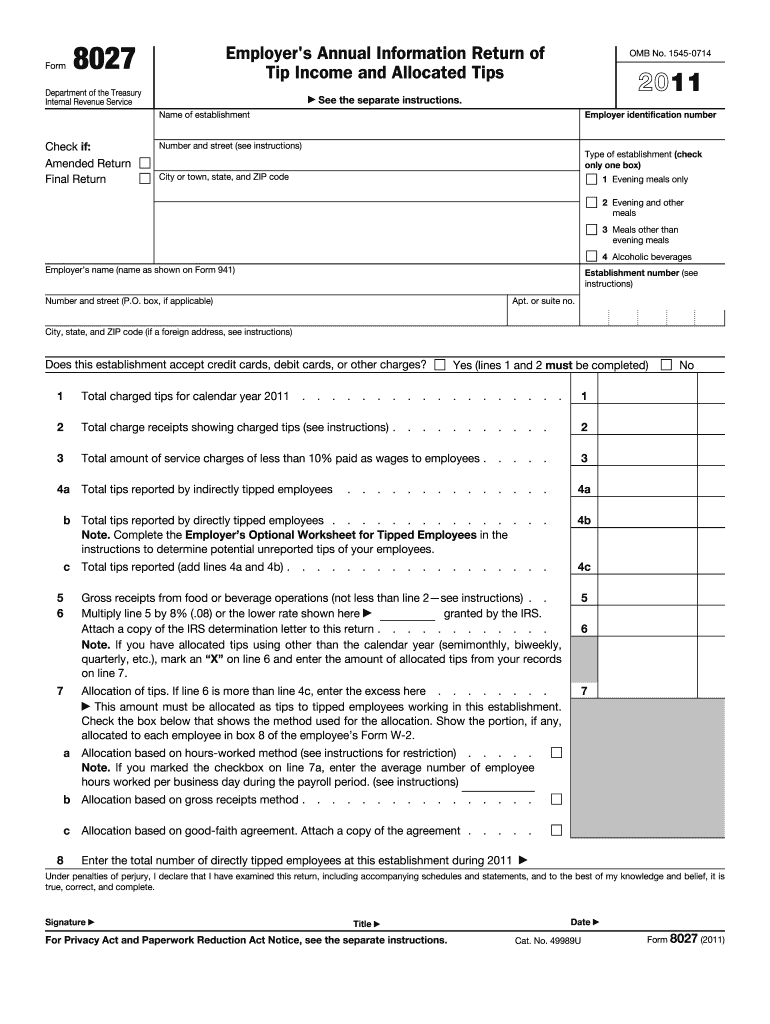

Definition & Meaning of 2011 Form 8027

The 2011 Form 8027 is the Employer's Annual Information Return of Tip Income and Allocated Tips, used by employers in the United States to report employee tip income and associated allocations. Issued by the Internal Revenue Service (IRS), this form captures detailed information about tips in establishments where tipping is customary, such as restaurants, bars, and nightclubs. The form tracks the total amount of reported tip income, charged tips, the establishment's name, and employer identification.

Importance of Accurate Reporting

Employers must ensure all tipped income is accurately reported to avoid legal complications. Tips directly received by employees, as well as those allocated by the employer, must be accounted for, providing the IRS with a comprehensive view of the business's tipping dynamics. Accurate completion of this form ensures compliance with federal tax laws, which is crucial for businesses to avoid penalties and audits.

Steps to Complete the 2011 Form 8027

Completing the 2011 Form 8027 involves a systematic approach to ensure accuracy. Follow these steps:

- Gather Necessary Documentation: Before beginning, collect payroll records, tip reports from employees, and data on charge receipts with tips.

- Fill Employer Information: Enter the employer identification number (EIN) and the name and address of the business.

- Report Total Tips: On Line 1, report total tips that employees received during the year, including charged and directly received tips.

- Calculate Allocated Tips: If required, use Employer Tip Credit to determine allocated tip amount to ensure accurate distribution.

- Employ Correct Calculations: Use Form 8027's instructions to calculate percentages and ensure calculations meet IRS standards.

- Review and Sign: Verify all data entered is correct and complete, then have an authorized person sign the form.

Detailed Breakdown of Allocation

Allocation of tips may be required if the reported tip amount is below a required percentage of gross receipts. The employer must then report this on the form under specific allocation methods, such as the Good Faith Agreement or directly using gross receipts and total sales to calculate allocations fairly among employees.

Key Elements of 2011 Form 8027

Several key components are critical to correctly filling out the 2011 Form 8027:

- Business Identification: Includes the legal name, trade name, and EIN of the business.

- Total Gross Receipts: Total from receipts on which tips were reported.

- Total Charge Receipts: Charge receipts indicating service charges and tips, also affecting allocations.

- Tip Percentage Rate: Adjusted through calculations based on employee-tip reports and total gross receipts.

- Allocated Tips: Employers can distribute these based on a variety of factors including employee agreements and total pool of tips.

Legal Use of the 2011 Form 8027

Legally, employers must use Form 8027 to comply with IRS tip reporting requirements. Complete reporting aids in accurate distribution of tip credits among employees and ensures that the business adheres to fair labor practices. Failure to comply with regulations related to tip reporting may result in audits and potential penalties for underreporting.

Addressing Penalties for Non-Compliance

Non-compliance can result in financial penalties from the IRS, including fines for incorrect reporting or failure to file. Employers may also face scrutiny for labor law violations if tip allocations are incorrectly managed, reinforcing the importance of accurate completion.

Who Typically Uses the 2011 Form 8027

Form 8027 is primarily used by businesses where tipping is regular, such as:

- Restaurants and Dining Establishments: Businesses where tipping represents a significant portion of income.

- Bars and Nightclubs: Venues with high volume sales and service charges.

- Casino and Hotel Services: Where both cash and credit tips are frequently used.

Business Entity Types

Different business structures such as sole proprietorships, partnerships, LLCs, and corporations in the service industry all require adherence to form requirements, based on their operational scale and tipping culture.

Filing Deadlines / Important Dates

The 2011 Form 8027 must be filed annually, with significant dates including:

- Filing Due Date: Normally due by the last day of February if filed by paper or March 31 if filed electronically.

- Extension Requests: Submissions may request extensions under certain conditions for unforeseen business circumstances, following IRS guidelines.

- Amendments: If errors are found after submission, corrections should be promptly filed to avoid late penalties.

Influence on Tax Seasons

The form content directly impacts employees' W-2 forms, thus affecting both employer and employee filings during tax season. Proper filing ensures seamless tax processing for both parties.