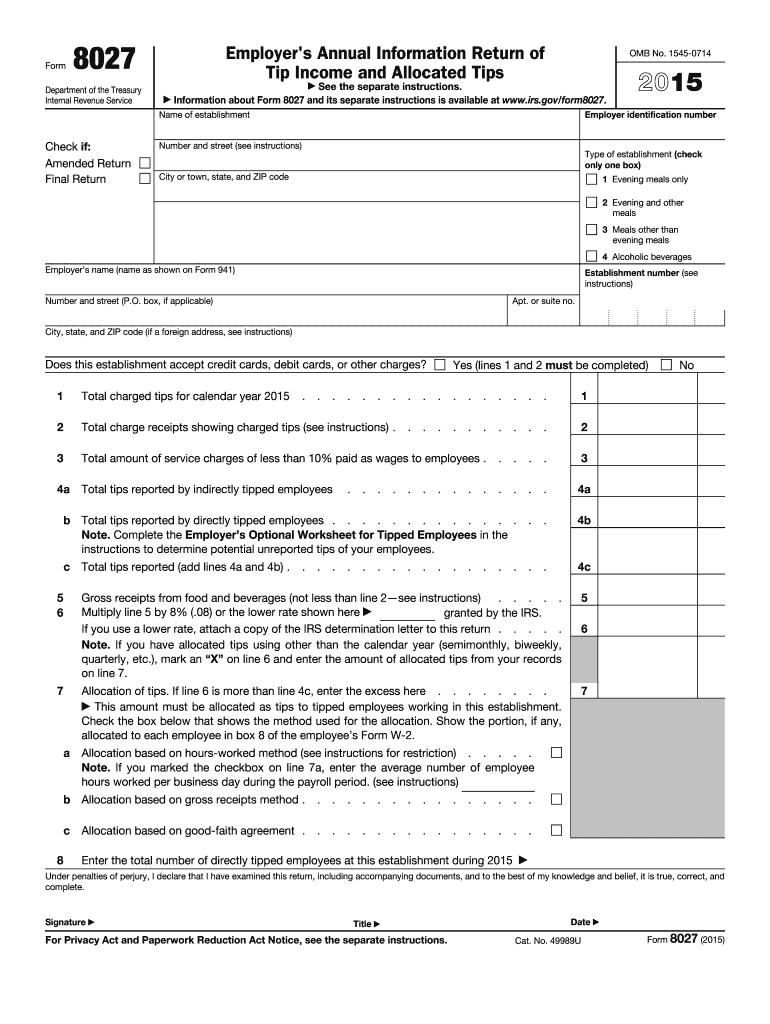

Definition and Meaning of Form 8027

Form 8027, or the Employer's Annual Information Return of Tip Income and Allocated Tips, is a critical document used by certain establishments, primarily in the food and beverage industry, to report tip income and allocated tips for the year 2015. This form ensures that businesses accurately document tip amounts received by employees and reflect the proper allocation required under IRS regulations. It includes several key components such as employer identification, establishment details, and methods for accurately reporting tips.

- Employer Identification: Each business must supply its Employer Identification Number (EIN) to ensure proper tracking and record-keeping.

- Establishment Details: Businesses are required to provide specific information about their establishment to ascertain compliance with regulations regarding tipped employees.

Key Elements of Form 8027

Form 8027 is structured in a way that captures various crucial data points. Understanding these components helps businesses comply with legal requirements and ensures accurate reporting of tip allocations.

- Total Charged Tips: Total charged tips are those added to credit card payments.

- Service Charges: Businesses must report service charges, which are automatically added to customer bills, as distinct from voluntary tips.

- Tip Allocation Methods: Form 8027 includes details on several methods for tip allocation among employees, mandating transparency and accuracy.

- Penalties for Perjury: The form requires certification to establish the accuracy of information under penalties of perjury, emphasizing the importance of precise data entry.

Steps to Complete Form 8027

Completing Form 8027 involves several systematic steps to guarantee compliance and accuracy. A concise guide can assist businesses in navigating this process effectively.

- Gather Necessary Documents: Ensure all documentation regarding tips, sales, and employee data is readily available.

- Fill Out Establishment Information: Include the name, address, and EIN of the business as the first step.

- Document Tip Income: Accurately record both cash and credit card tips received.

- Service Charge Reporting: Clearly distinguish between service charges and genuine tips.

- Complete Tip Allocation: Deploy the appropriate methods for allocating tips among employees.

- Review and Certify: Double-check all input data for accuracy before certifying under penalties of perjury.

Important Terms Related to Form 8027

Understanding specific terminology related to Form 8027 enriches comprehension and ensures precision during form completion.

- Allocated Tips: These tips are pre-assigned based on establishment policies and assume standard percentages of gross receipts.

- Charged Sales: Any sales wherein a credit card or similar charge payment method is used.

- Good Faith: Compliance with good faith efforts in tip allocation and accurate reporting mitigates legal risks.

IRS Guidelines for Form 8027

The IRS provides comprehensive guidelines on the completion and submission of Form 8027 to ensure compliance.

- Record Keeping: Employers must maintain records of all tips reported by employees and the methods of allocation applied.

- Filing Requirements: Businesses must submit the completed form by the IRS-specified deadline to avoid penalties.

- Accuracy and Honesty: The IRS mandates truthful and accurate reporting, penalizing false declarations or misrepresentations.

Filing Deadlines for Form 8027

Form 8027 must be filed by a specific deadline to maintain compliance and avoid late penalties.

- Annual Due Date: Typically, the form is due by February 28 of the year following the reporting period if filed on paper, or March 31 if filed electronically.

- Extension Requests: Businesses can request a one-month extension using Form 8809 if necessary.

Penalties for Non-Compliance with Form 8027

Non-compliance entails financial repercussions that underscore the importance of timely and accurate form submission.

- Monetary Penalties: Failure to file Form 8027 on time, or filing with incorrect information, can result in fines.

- Legal Repercussions: Persistent non-compliance can lead to more severe legal action, emphasizing the need for adherence to IRS regulations.

Form Submission Methods

There are several methods available for submitting Form 8027, each with advantages suited to different business needs.

- Electronic Submission: Filing electronically can streamline the process, reduce errors, and extend the filing deadline.

- Paper Submission: Traditional mail submission is available for those preferring or requiring physical documentation.

- In-Person Filing: Although less common, certain businesses may opt for in-person filing at relevant IRS offices.

Understanding the intricacies of Form 8027 in these facets ensures businesses can navigate federal requirements with proficiency and accuracy, safeguarding against potential penalties and maintaining legal compliance.