Definition and Meaning of Form 940 for 2011

Form 940, also known as the Employer's Annual Federal Unemployment (FUTA) Tax Return, is a tax form used by employers in the United States to report and pay unemployment taxes. This form is essential for calculating and remitting the FUTA tax, which funds state unemployment agencies and reimburses them for unemployment benefits paid to workers who have lost their jobs. The 2011 version of Form 940 is specifically designed for employers to report their tax responsibilities for that year. Understanding the function and necessity of this form is critical to ensure compliance with IRS regulations.

Steps to Complete the Form 940 for 2011

Completing Form 940 for 2011 involves several steps to ensure accurate and comprehensive reporting:

- Gather Required Information: Collect the total wages paid to employees, any exempt payments, and the FUTA wages subject to tax.

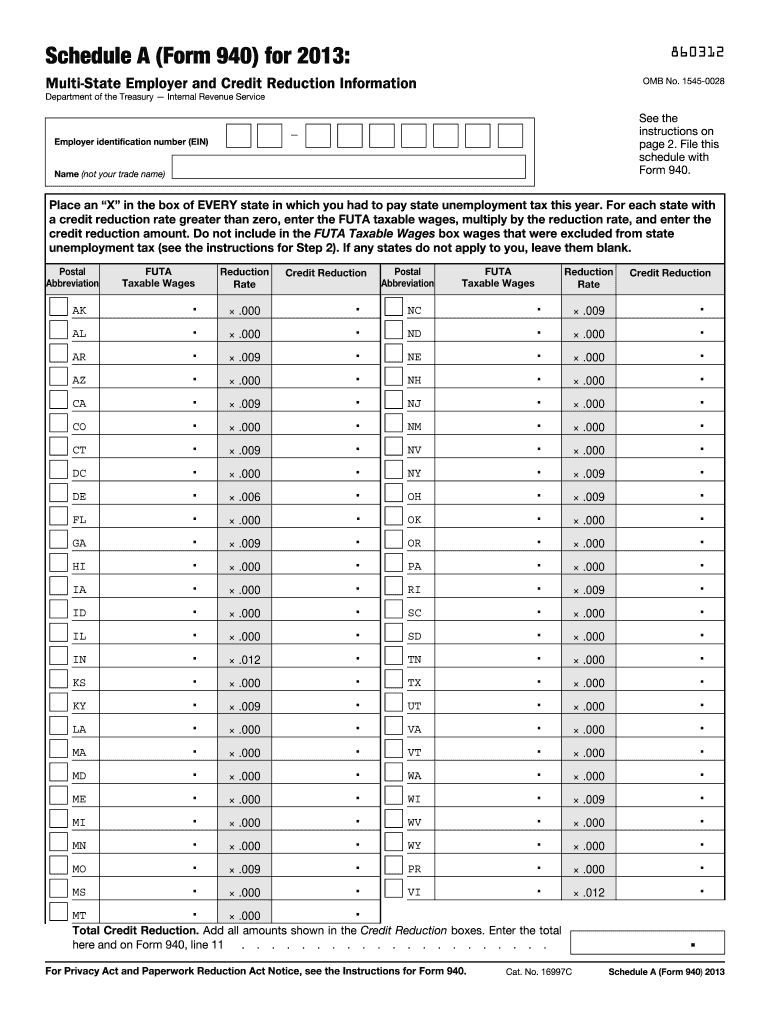

- Calculate FUTA Taxes: Use the form to calculate the FUTA tax by applying the tax rate to the FUTA wages. This rate may be adjusted for specific states with credit reductions.

- Fill Out the Form: Enter the calculated tax and provide the total payments made in each section of the form.

- Adjust for Credit Reductions: If any employees are paid in states with credit reductions, adjust the total tax accordingly.

- Review and Finalize: Double-check all entries for accuracy and completeness before signing and dating the form.

How to Obtain the Form 940 for 2011

Employers can obtain Form 940 for 2011 through multiple methods:

- Download from the IRS Website: The IRS provides a downloadable PDF version of the form, which can be printed and filled out manually.

- Tax Software: Many tax preparation software platforms, including TurboTax and QuickBooks, offer access to historical forms like the 2011 edition.

- Order by Mail: Employers can request physical copies through the IRS’s forms distribution service, though this may take longer.

Key Elements of the Form 940 for 2011

Understanding the key elements of Form 940 is crucial for accurate reporting:

- Total Wages Paid: This is the gross amount paid to all employees.

- Exempt Payments: Certain payments, such as fringe benefits and group-term life insurance, may be exempt from FUTA tax.

- FUTA Wages: Only specific wages are subject to FUTA tax; it's critical to differentiate these from total wages.

- Credit Reductions: States with financial difficulties may have reduced credits against federal unemployment taxes, affecting the total FUTA tax liability.

IRS Guidelines for Form 940

The IRS provides specific guidelines to ensure businesses comply with tax laws when using Form 940:

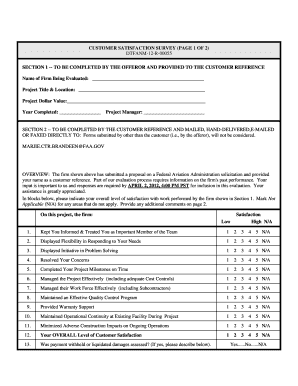

- Accuracy: Employers must accurately calculate tax liabilities and report them using the form.

- Documentation: Retain supporting documentation for all reported amounts, including wage records and unemployment tax reports.

- Submission: Submit the completed form and any taxes owed by the established deadlines.

Filing Deadlines and Important Dates

For Form 940 for 2011, it is critical to adhere to established deadlines:

- January 31, 2012: File Form 940 by this date to avoid penalties. An extension may be granted if all taxes are paid by the due date.

- Deposit Deadlines: If owed taxes exceed $500, deposits might be required throughout the year, generally due by the last day of the month following the end of a quarter.

Penalties for Non-Compliance with Form 940

Non-compliance with the filing and payment requirements of Form 940 can result in penalties:

- Late Filing Fee: If the form is late, there may be a percentage fee based on the amount due, increasing with the delay.

- Underpayment Penalty: Any taxes that are incorrectly calculated or unpaid can incur penalties.

- Failure to Deposit: Not adhering to deposit schedules could also result in financial penalties.

Business Entity Types Impacted by Form 940

Different business entity types are responsible for filing Form 940, including:

- Corporations: Both C-Corps and S-Corps must file this form to report FUTA taxes.

- Partnerships and LLCs: These entities also report wages and tax responsibilities using this form.

- Non-profits: Although some may be exempt, others might be required to file, depending on specific payroll circumstances.

Understanding the intricacies of Form 940 for 2011 allows businesses to fulfill their tax obligations adequately, avoiding penalties and ensuring compliance with federal tax regulations.