Definition and Meaning of Form 940

Form 940, officially known as the Employer's Annual Federal Unemployment (FUTA) Tax Return, is a crucial document for employers in the United States. This form is primarily used to report and calculate the Federal Unemployment Tax Act (FUTA) taxes owed by employers based on the wages paid to employees. Employers use this form to determine their annual tax liability and submit payment to the Internal Revenue Service (IRS).

Understanding Form 940 is essential for employers as it impacts their payroll tax obligations. Specifically, the federal unemployment tax provides funds for unemployment compensation to workers who have lost their jobs. The FUTA rate for 2021 is six percent on the first seven thousand dollars of each employee’s wages. However, employers in states that qualify for credits can substantially reduce this rate.

Key Elements of Form 940

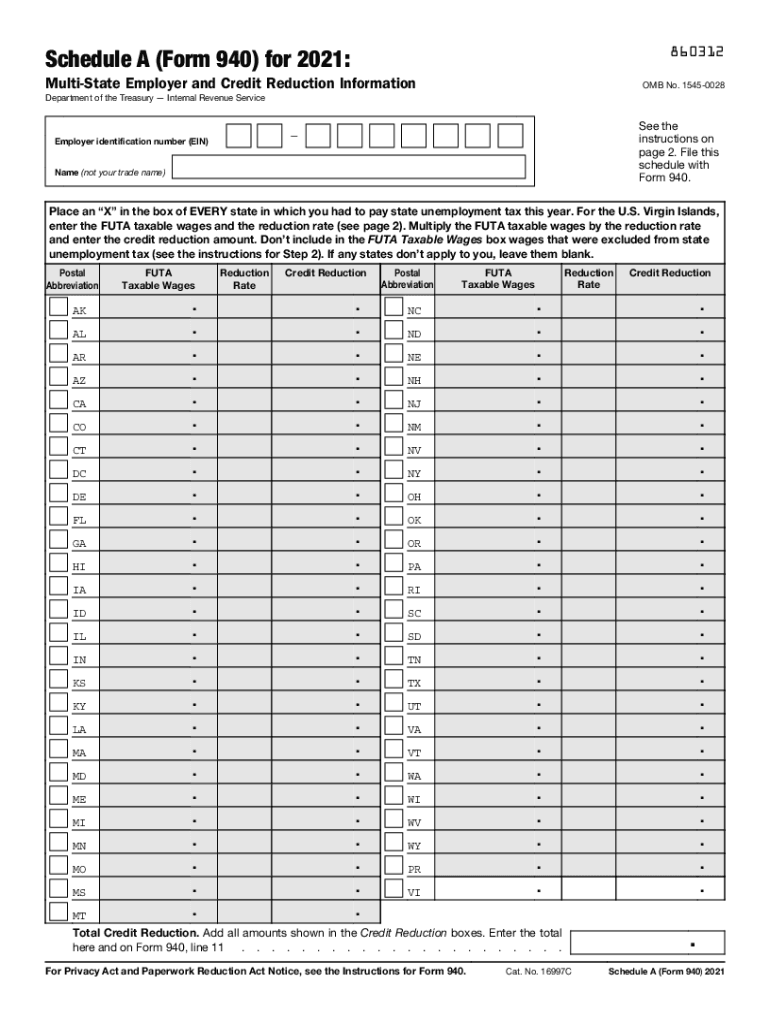

- FUTA Tax Calculation: Employers must calculate the total taxable wages for each employee and determine the FUTA tax due.

- Credit Reductions: Certain states may impose credit reductions, which can increase the effective FUTA tax rate.

- Filing Frequency: Form 940 is filed annually, summarizing the year’s tax liabilities rather than on a quarterly or monthly basis.

Steps to Complete Form 940

Completing Form 940 involves several detailed steps to ensure accuracy and compliance with IRS regulations. These steps help employers determine their FUTA tax obligations correctly.

-

Gather Necessary Information: Before starting the form, collect data on total wages paid to employees, the number of employees, and state unemployment tax payments.

-

Calculate Taxable Wages: Determine the total FUTA taxable wages for each employee. This includes all wages up to the annual limit of seven thousand dollars.

-

Apply the FUTA Rate: Multiply the taxable wages by the FUTA tax rate to calculate the owed tax. Remember, base rate is six percent but may vary if state's credit reductions apply.

-

Account for Credit Reductions: If your business operates in states with credit reductions, adjust the tax calculation accordingly. This step is crucial to ensure that the calculated tax reflects any potential increases.

-

Complete the Form: Fill in the necessary sections of Form 940 accurately. This includes employer details, total wages, and computed tax liability.

-

Review and File: Double-check the completed form for accuracy and file it with the IRS before the due date. Ensure that any payment due is also submitted in accordance with IRS guidelines.

Important Terms Related to Form 940

Familiarity with specific terminology related to Form 940 and the FUTA tax system is pivotal for employers. Understanding these terms will help in the correct completion and interpretation of the form.

- FUTA Tax: A federal tax that funds unemployment compensation for workers. It is paid entirely by employers.

- Taxable Wage Base: The maximum amount of wages that can be taxed under the FUTA; in 2021, this is set at seven thousand dollars per employee.

- Credit Reduction States: States that have not repaid federal unemployment loans may experience an increased FUTA tax rate due to credit reductions.

Filing Deadlines and Important Dates for Form 940

Being aware of the deadlines for filing Form 940 is essential for compliance and avoiding penalties. The primary deadline for submitting Form 940 is January 31 of the year following the reporting year. Here are additional important dates associated with Form 940:

- Quarterly Payments: Although Form 940 is an annual form, employers must be mindful of the quarterly deposit schedule for FUTA taxes.

- State Tax Payment Deadlines: Many states have differing deadlines for state unemployment tax payments, which can impact federal calculations.

- Extension Requests: If an employer requires extra time, an extension request can be filed using Form 7004.

Who Typically Uses Form 940?

Form 940 is primarily utilized by employers who are subject to the Federal Unemployment Tax Act, which applies to various types of organizations. Here are common users of Form 940:

- Businesses with Employees: Any business that pays wages to employees must file this form.

- Non-Profit Organizations: Non-profits that employ staff are also required to submit Form 940.

- Government Agencies: Government entities that employ individuals need to report their unemployment tax liabilities through Form 940 as well.

Understanding and complying with Form 940 is essential for these organizations to fulfill their federal tax responsibilities and ensure proper support for unemployment insurance programs.