Definition & Meaning

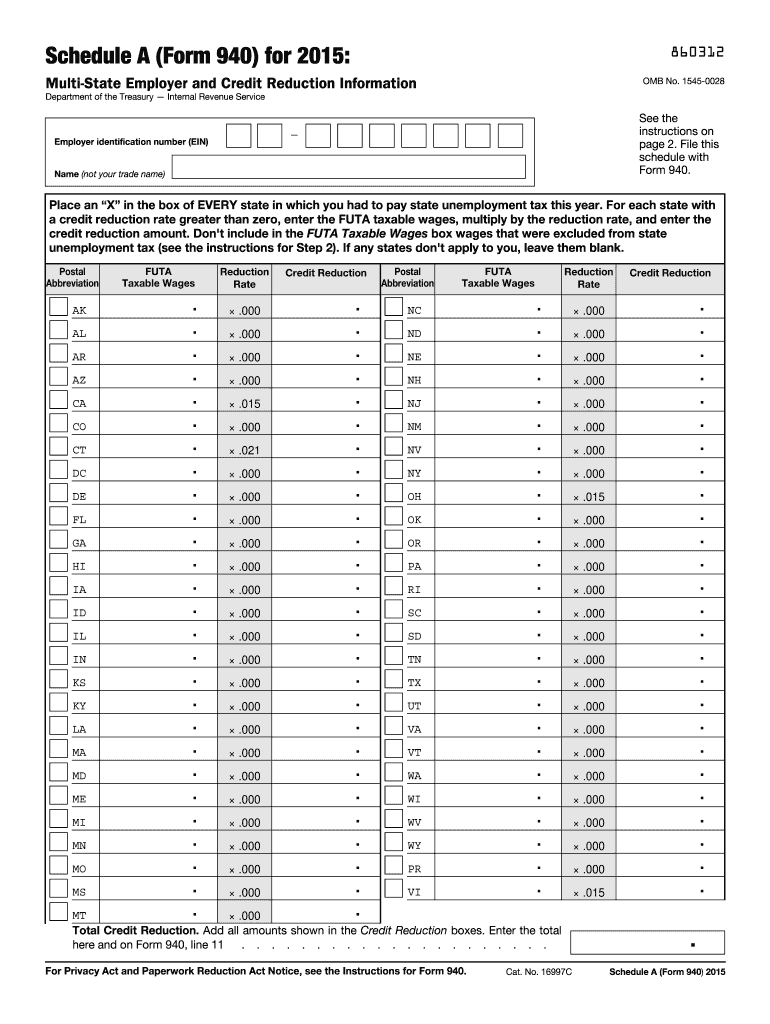

The 2015 Form 940 Schedule A is an integral part of the Employer's Annual Federal Unemployment (FUTA) Tax Return. It is specifically designed to assist employers in calculating and reporting unemployment taxes paid across multiple states. While Form 940 itself is used to report federal unemployment taxes, Schedule A provides critical details for multi-state employers who must account for varied state unemployment tax obligations, including any credit reductions that may apply.

Purpose and Importance

- Credit Reduction Calculation: Employers use Schedule A to determine the credit reduction rate for states with unpaid federal loans. This affects the amount of credit reduction they will report on Form 940.

- Multi-State Employment Tracking: For businesses operating in multiple states, the Schedule A form is vital for tracking and aligning each state's unemployment tax payments.

- Compliance and Reporting: Proper use of Schedule A ensures compliance with both federal and state unemployment tax rules, minimizing the risk of penalties or audits.

Steps to Complete the 2015 Form 940 Schedule A

Completing the 2015 Form 940 Schedule A involves several critical steps that must be followed meticulously to ensure accuracy and compliance.

- Identify State Employment Activity: Determine all states where your business had employee engagement during the year. This forms the basis for your multi-state reporting.

- Gather State Unemployment Tax Data: Collect information on unemployment tax payments made to each state. Ensure that all data is current and accurate, reflecting payments from January through December 2015.

- Determine Credit Reduction States: Refer to the IRS guidelines to identify states with credit reduction statuses for 2015. This is critical for calculating credit reductions applicable to your total wages.

- Calculate Credit Reduction Amounts: Use the IRS-provided credit reduction rate to compute any reductions applicable to wages paid in affected states.

- Complete Schedule A Section by Section: Start with line inputs for each state's total taxable FUTA wages before noting any relevant credit reductions. Ensure calculations are accurate and supported by your tax data.

- Review and Finalize Your Form: Double-check all entries on Schedule A for accuracy. Cross-reference with your Form 940 draft to ensure consistent and accurate reporting.

Why Should You Use the 2015 Form 940 Schedule A

Utilizing the 2015 Form 940 Schedule A is crucial for any business with multi-state operations, ensuring compliance with both state and federal tax laws.

- Enhanced Financial Accuracy: By accurately capturing and reporting tax obligations across states, businesses can avoid discrepancies that may trigger fines or audits.

- Streamlined Operations: Using Schedule A simplifies the process of managing multi-state tax liabilities, merging them into a single, comprehensive report.

- Regulatory Compliance: It aids businesses in adhering to the IRS mandates on unemployment reporting, mitigating potential legal and financial risks.

Key Elements of the 2015 Form 940 Schedule A

Understanding and accurately filling out the key sections of Schedule A ensures its effectiveness and regulatory compliance.

- State Identification: Clearly label each state where your business paid unemployment taxes, reflecting any variations in tax obligations.

- Taxable Wage Reporting: For each listed state, include the total wages subject to unemployment taxes.

- Credit Reduction Information: For relevant states, provide the credit reduction rate and calculate the financial impact on your overall unemployment tax payment.

- Final Calculation: Sum the taxable amounts and credit reductions for a comprehensive tax report aligned with Form 940 requirements.

IRS Guidelines for the 2015 Form 940 Schedule A

The IRS provides established guidelines for completing Schedule A alongside Form 940, emphasizing accuracy and compliance.

Key IRS Recommendations

- Verification of Credit Reduction States: Ensure you are referencing the latest IRS credit reduction list for 2015.

- Strict Adherence to Filing Dates: All Schedule A forms must be submitted alongside the Form 940 by the IRS deadline to avoid penalties.

- Detailed Record Keeping: Maintain thorough documentation for all unemployment tax payments and related correspondence with states.

Filing Deadlines / Important Dates

Understanding the timelines for submitting the 2015 Form 940 Schedule A is crucial to maintaining compliance and avoiding late fees.

- Deadline: The form is generally due on January 31 following the tax year (i.e., January 31, 2016, for the 2015 form). If you've deposited all FUTA taxes on time, the deadline may extend to February 10.

- Avoiding Late Penalties: Ensure forms are accurately completed and submitted by the due date to prevent fines and interest on late payments.

Eligibility Criteria

Not all employers are required to submit the 2015 Form 940 Schedule A. Understanding eligibility criteria can clarify who needs to report.

Eligible Parties

- Multi-State Employers: Firms with employees in more than one state where state unemployment taxes are paid.

- Employers in Credit Reduction States: Businesses must report on Schedule A if operating in states with a credit reduction status in 2015.

State-Specific Rules for the 2015 Form 940 Schedule A

Each state has unique guidelines that affect how unemployment taxes are reported and calculated on Schedule A.

Common Considerations

- State Tax Variations: Watch for differences in wage bases and tax rates. Some states may have differing rules on what wages are taxable.

- Credit Reduction Application: States with federal loan defaults will have additional credit reduction calculations to be included.

Creating a detailed, accurate, and compliant 2015 Form 940 Schedule A is essential for multi-state employers to fulfill their unemployment tax obligations efficiently. With this guide, businesses are better equipped to meet the IRS and state-specific requirements smoothly.