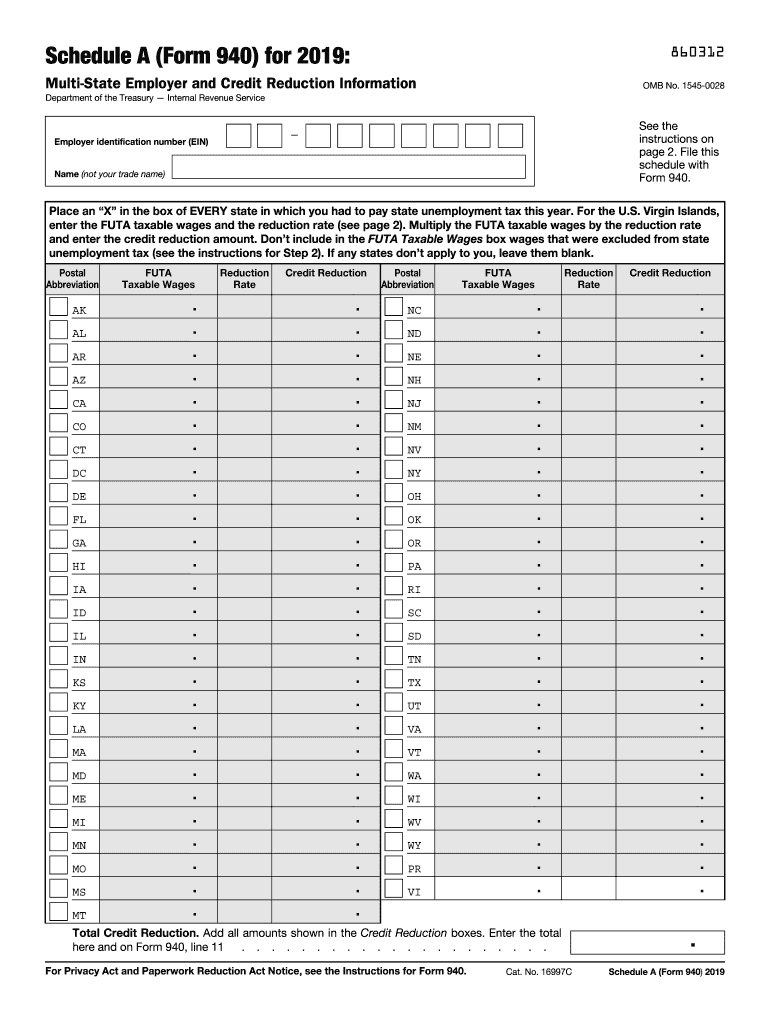

Definition and Purpose of Form 940 for 2019

Form 940, officially known as the Employer's Annual Federal Unemployment (FUTA) Tax Return, is a crucial document used by employers in the United States to report and calculate their federal unemployment tax liability for a given tax year. For 2019, this form captures essential tax information, specifically the amount of wages subject to the Federal Unemployment Tax Act (FUTA) and the federal unemployment taxes that employers owe. Employers typically use this form if they paid $1,500 or more in wages in any calendar quarter or if they employed at least one person for a portion of a day in any 20 or more weeks during the year.

Understanding Form 940 for 2019 is vital for maintaining compliance with tax regulations, ensuring that employers fulfill their obligations regarding federal unemployment taxes. Upon properly completing and filing this form, employers contribute toward the unemployment compensation system and protect their workforce against unemployment-related losses.

How to Complete Form 940 for 2019

Completing Form 940 for 2019 involves several steps that provide a clear pathway for reporting federal unemployment taxes accurately.

-

Gather Required Information:

- Compile total wages paid to employees subject to FUTA.

- Document any payments made to excluded positions that are not subject to federal unemployment tax.

-

Fill Out the Form:

- Enter the employer's identification details: name, address, and Employer Identification Number (EIN).

- Report total payments made to employees during the year and compute the taxable wages.

-

Calculate Tax Owed:

- Multiply the FUTA taxable wages by the applicable tax rate (typically six percent).

- Subtract any applicable credits from state unemployment taxes paid, which may vary by state.

-

Review and Sign:

- Double-check all entries for accuracy.

- Sign and date the form to affirm its correctness before submission.

-

File the Form:

- Submit the completed Form 940 to the IRS either online or by mail, depending on your preferred method.

Recognizing the importance of accuracy in each section of Form 940 will prevent delays and reduce the chances of penalties from the IRS.

Filing Deadlines for Form 940 for 2019

Employers must adhere to specific deadlines when filing Form 940 for 2019 to avoid potential penalties. The form is generally due on January 31 of the following year. However, if the employer deposits all FUTA tax when due, the deadline extends to February 10. It is essential for employers to maintain awareness of these deadlines to ensure timely compliance.

Additionally, employers should account for any state-specific deadlines that may affect their overall unemployment tax filings, as they can influence the correct submission of Form 940.

Required Documents for Form 940 for 2019

To complete Form 940 effectively, several supporting documents may be essential:

- Payroll Records: These provide an accurate account of total wages paid to employees and are necessary for calculating FUTA taxable wages.

- State Unemployment Tax Returns: Details regarding the state unemployment taxes already paid will be needed to compute any available credits correctly.

- Employer Identification Number (EIN): This is a unique number assigned by the IRS, crucial for identifying the employer on the tax form.

Ensuring that you have the required documents readily available before starting the completion of Form 940 will streamline the process and enhance accuracy.

Legal Use and Compliance of Form 940 for 2019

Filing Form 940 for 2019 is not just a procedural task but also a legal requirement for qualifying employers. Non-compliance can lead to financial penalties as well as interest on unpaid taxes. It's important to note that the form must be submitted for every year in which the employer meets the filing criteria, even if no tax is owed.

Legal use means that employers must ensure all information reported is truthful and substantiated by their payroll records and related documentation. Additionally, electronic filing options provided by the IRS offer a compliant method for submitting Form 940 securely.

Employers should retain copies of submitted forms and all supporting documentation for at least four years, as the IRS may audit and request these records for verification purposes.

Key Elements and Sections of Form 940 for 2019

Several key sections make up Form 940, and understanding these components is essential for accurate completion:

- Employer Information: This includes basic identifying information, such as the employer's name, address, and EIN.

- Total Payments and Taxable Wages: Section where employers report total payments made to employees and calculate how much of that amount is subject to the FUTA tax.

- Tax Calculation: Employers must calculate the FUTA tax based on eligible wages and apply any credits for state unemployment taxes paid.

- Signature and Verification: The employer must sign the form to validate the information provided, affirming its accuracy and completeness.

Each section is essential for determining the total federal unemployment tax liability and ensuring compliance with IRS regulations. Understanding these elements allows employers to fill out the form correctly and efficiently.