Definition and Purpose

IRS Form 944, officially titled "Employer's Annual Federal Tax Return," is a crucial tax document required by the Internal Revenue Service (IRS). The primary function of Form 944 is for small employers to report their annual payroll taxes. This form consolidates the reporting of wages, tax liabilities, and any adjustments into a single submission, aimed at simplifying the process for businesses with smaller payrolls. Employers who owe $1,000 or less in annual payroll taxes are typically eligible to use this form instead of the more frequent Form 941. Utilizing Form 944 allows eligible employers to reduce the frequency of tax filings from quarterly to annually, easing administrative burdens.

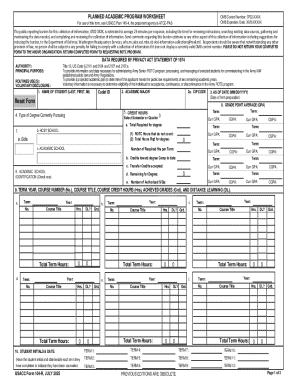

How to Use IRS Form 944 for 2017

To effectively use the IRS Form 944 for 2017, employers must ensure accuracy in reporting employee wages and withholding amounts. The form is designed to capture detailed information about social security taxes, Medicare taxes, and any adjustments to previous filings. This includes accounting for tax credits such as the COBRA premium assistance credit. Employers should complete each section carefully, using the provided worksheets to calculate the exact tax liability. Once the form is completed, it should be reviewed thoroughly to prevent errors that could result in penalties or additional scrutiny by the IRS.

Steps to Complete IRS Form 944 for 2017

- Gather Necessary Information: Compile all payroll records, including wage amounts, taxes withheld, and any prior adjustments.

- Complete Part 1: Report wages paid during the year and calculate total social security and Medicare taxes.

- Determine Adjustments: Document any corrections from previous tax periods or overpayments.

- Compute Tax Liability: Use the form's worksheets to calculate eligible credits and total tax due.

- Verify Data Accuracy: Double-check all entries for numerical errors and ensure compliance with IRS instructions.

- Sign and Date: Form must be signed by an authorized person in the company.

- Submit the Form: File the completed form with the IRS by the specified deadline.

Filing Deadlines and Important Dates

For the 2017 tax year, businesses using Form 944 had to ensure submission by January 31, 2018. Payment of any taxes due must accompany the filing, or electronic payment options must be utilized through IRS systems. It is crucial to adhere to deadlines to avoid late filing penalties. Employers using direct deposit or electronic fund withdrawal for tax payments should allow sufficient processing time to ensure payments are credited by the due date.

Eligibility Criteria for Using Form 944

Eligibility to file Form 944 instead of the quarterly Form 941 is determined based on the employer's tax liability—specifically, those with a total tax liability of $1,000 or less. The IRS typically notifies eligible businesses to use Form 944. However, any business not receiving such notification but believing they are eligible must contact the IRS to confirm eligibility before proceeding. It is also vital to assess the total tax liability to ensure it aligns with eligibility before filing.

Legal Considerations for IRS Form 944

Understanding the legal implications of filing IRS Form 944 is essential. Employers must accurately and truthfully report all required information to avoid penalties for noncompliance. Failure to file or filing incorrect information can lead to financial penalties and interest charges on unpaid taxes. Furthermore, employers must maintain thorough records of all payroll transactions and tax filings, as required by IRS regulations, to demonstrate compliance and resolve any potential disputes.

Examples of Using Form 944 in Practice

-

Small Business Owners: Owners of small businesses with minimal employees often use Form 944 to streamline their tax reporting processes. For example, a local café employing three staff with consistent wages would find this form beneficial to reduce the administrative burden.

-

Non-Profit Organizations: Certain non-profits that have limited payroll expenditure utilize Form 944, enabling them to focus resources more effectively on their work rather than frequent tax filings.

Penalties for Non-Compliance with Form 944

Non-compliance with the filing and payment requirements of IRS Form 944 can result in serious penalties. Employers failing to file by the deadline may incur a penalty based on their outstanding tax liabilities. Additional fines can be applied for inaccuracies or fraud-related offenses. Interest on unpaid taxes continues to accrue until the full amount, including penalties, is paid. Thus, it is crucial for businesses to meet all requirements promptly to avoid these financial consequences.

Digital vs. Paper Versions of the Form

Employers can choose to submit IRS Form 944 either online through the IRS e-file system or via traditional paper filing. Electronic filing is encouraged for its convenience and quicker processing times. Businesses opting for digital submission benefit from immediate confirmation of receipt and reduced chances of filing errors, as the e-file system includes checks and prompts to ensure data accuracy. However, for those more comfortable with traditional methods, paper filing remains an available option, albeit with considerations for mailing time and physical record-keeping.