Overview of Schedule EIC (Form 1040)

Schedule EIC, part of Form 1040, is vital for taxpayers in the United States seeking the Earned Income Credit (EIC) based on qualifying children. This credit aims to reduce the tax burden on individuals and families with low to moderate income. Understanding and accurately completing this schedule is essential to claim the credit and avoid potential penalties.

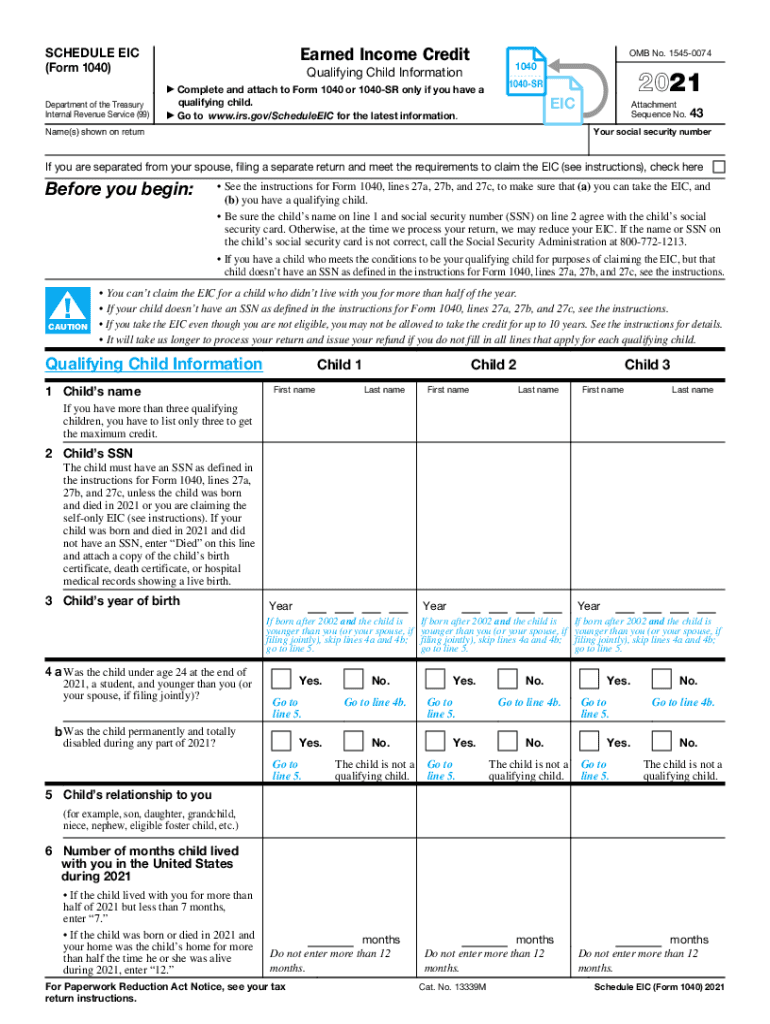

Steps to Complete the Schedule EIC

-

Gather Required Information

- Collect valid Social Security Numbers (SSNs) for each qualifying child.

- Ensure you have accurate birthdates and residency details.

-

Determine Eligibility

- Verify your adjusted gross income (AGI) falls within IRS limits for your filing status.

- Confirm each child meets age, relationship, and residency tests.

-

Fill Out the Form

- Enter your name and SSN as shown on your Form 1040.

- Provide details for each qualifying child: name, SSN, year of birth, and relationship to you.

- Follow IRS instructions for the specific child-related questions.

-

Calculate the Credit

- Use IRS tables or online calculators to determine the Earned Income Credit amount based on your income and the number of qualifying children.

-

Attach to Tax Return

- Attach Schedule EIC to your Form 1040 when filing your taxes.

Eligibility Criteria for Schedule EIC

-

Income Requirements

- Your earned income and AGI must be below specified IRS thresholds based on your filing status and number of qualifying children.

-

Qualifying Child Tests

- Children must meet age criteria (under 19, or under 24 if a full-time student, or any age if permanently disabled).

- Children must have lived with you for more than half of the tax year.

- Each child must have a valid SSN.

Important Terms Related to Schedule EIC

-

Earned Income Credit (EIC)

- A refundable tax credit aimed at low to moderate-income working individuals and families.

-

Qualifying Child

- A dependent who meets criteria for age, relationship, and residency, and has a valid SSN.

-

Adjusted Gross Income (AGI)

- Total income, including wages and other sources, minus specific deductions.

Legal Use of the Schedule EIC

- Compliance with IRS Guidelines

- Ensure all information is accurate; intentional misrepresentation can lead to penalties.

- Data Accuracy

- Double-check all entries for errors; errors can delay credit processing and result in audits.

Examples of Using the Schedule EIC

-

Single Parent with Two Children

- A single mother working part-time with two children under 18 may qualify for the EIC if her AGI falls within the IRS limits.

-

Married Couple with One Child

- A married couple with a single income and one child, where the child lives with them throughout the year, may also claim the EIC if income requirements are met.

Penalties for Non-Compliance

- Improper Claims

- Incorrectly claiming the EIC can result in repayment of credit, additional taxes, and possible interest.

- Eligibility Misrepresentation

- Fraudulently claiming the credit without meeting eligibility requirements may result in a ban from claiming the EIC for up to ten years.

Filing Deadlines and Important Dates

- Tax Filing Deadline

- Typically April 15th, unless extended for weekends or holidays.

- Extensions

- Taxpayers may request an extension; however, any taxes owed are still due by the original deadline.

Required Documents for Schedule EIC

- Identification and Residency Proof

- Keep copies of documents validating children's SSNs and proof of residency.

- Income Documentation

- Have W-2s, 1099s, and other income records ready to substantiate your claim on the EIC.

Accurate and precise completion of Schedule EIC is critical for taxpayers wishing to claim the Earned Income Credit. Understanding the detailed requirements and following IRS guidelines can maximize the benefits and minimize legal risks.