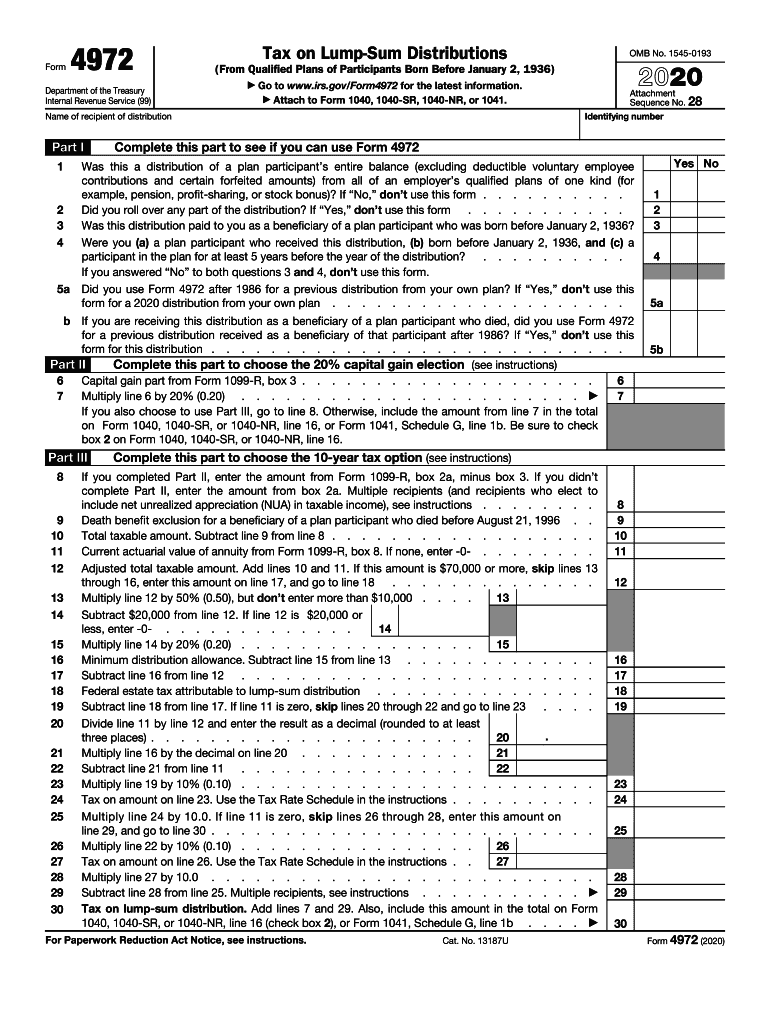

Definition and Purpose of Form 4972

Form 4972 is specifically designed to calculate the tax owed on qualified lump-sum distributions received from employer-sponsored retirement plans by taxpayers who were born before January 2, 1936. This form allows individuals to benefit from specific tax options that can result in a more favorable tax treatment compared to treating the distribution as ordinary income.

The tax options available include the 20% capital gain election and the 10-year tax option. By utilizing these options, qualifying taxpayers can often reduce their overall tax liability. It is pivotal for those historically receiving such distributions to understand when and how to use Form 4972 effectively to comply with IRS regulations while minimizing tax dues.

How to Obtain Form 4972

Obtaining Form 4972 is straightforward. Taxpayers can acquire this form through the IRS website or by contacting the IRS directly for a physical copy. Additionally, tax preparation software often includes this form within their filing options, assisting users in completing it as part of their tax returns.

For those who prefer a digital approach, the form can be downloaded and printed directly from the IRS website. It is advisable to ensure that the form is the most current version, as tax rules and requirements can change annually.

Steps to Complete Form 4972

Completing Form 4972 involves several specific steps to ensure accuracy:

-

Gather Required Information: Collect details on the lump-sum distributions received, including the total amount and the date of distribution.

-

Fill Out Personal Information: Input your name, Social Security number, and any other required personal details at the top of the form.

-

Calculate Taxable Amount: Using the instructions provided with the form, calculate the taxable amount of your distribution. This may involve determining how much of the distribution is eligible for capital gain treatment.

-

Choose Tax Option: Depending on your specific situation, select the appropriate tax option (e.g., the 20% capital gains option). This decision can significantly affect your tax liability.

-

Complete Additional Sections: Follow the form's instructions to fill out any additional necessary sections, ensuring all calculations align with your overall tax return.

-

Review for Accuracy: Double-check all entries for accuracy, as errors can lead to delays or complications in processing.

-

File with Your Tax Return: Once completed, attach Form 4972 to your federal income tax return when filing.

Legal Use of Form 4972

Form 4972 is legally sanctioned as a means for taxpayers to report and calculate the tax on certain distributions, aligning with IRS regulations under the Internal Revenue Code. Its legal use is primarily focused on ensuring compliance for qualified lump-sum distributions, which, if reported incorrectly, could result in penalties or increased tax liability.

Taxpayers should familiarize themselves with the stipulations of the form to avoid unintentional misuse. Understanding the nuances of when this form is required is essential for maintaining compliance with federal tax laws.

Important Terms Related to Form 4972

To navigate Form 4972 effectively, it is crucial to understand several key terms:

-

Qualified Lump-Sum Distribution: This refers to a single payment received from a retirement plan, typically after a qualifying event such as retirement, death, or disability.

-

20% Capital Gain Election: A tax option allowing taxpayers to treat part of their distribution as capital gains, potentially leading to a reduced tax rate on that portion.

-

10-Year Tax Option: An option to spread out the tax impact of a lump-sum distribution over ten years, beneficial for managing tax liabilities.

-

Ordinary Income: The default classification for income, usually taxed at a higher rate than capital gains.

Understanding these terms is vital for completing Form 4972 accurately and for ensuring a thorough grasp of the tax implications involved.

Examples of Using Form 4972

Consider a taxpayer named John who receives a lump-sum distribution from his employer's retirement plan of $100,000 at age 85. John can choose to file Form 4972 to utilize the 20% capital gain election, significantly lowering his taxable amount. Instead of being taxed on the entire distribution at ordinary income rates, he can elect to treat $40,000 of his distribution as capital gains, resulting in a lower tax burden.

In another scenario, Sarah, aged 90, opts for the 10-year tax option after receiving a $50,000 distribution. By spreading her tax liability over a decade, she ensures that her income remains manageable each year, avoiding a potentially steep upfront tax bill.

These examples highlight the strategic use of Form 4972 in real-world tax planning, showcasing its potential benefits for eligible taxpayers.