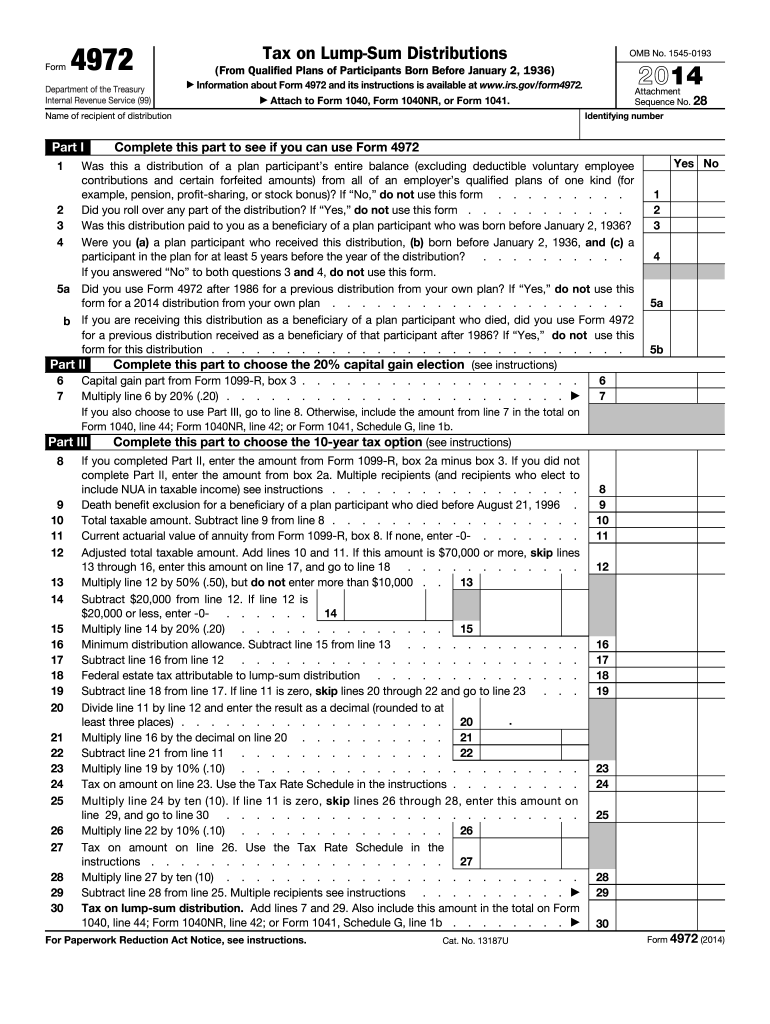

Definition and Overview of the 2 Form

The 2 form, formally named the "Tax on Lump-Sum Distributions," is a specialized tax form used by recipients of lump-sum distributions from qualified retirement plans, primarily those born before January 2, 1936. This form enables taxpayers to calculate their tax liability based on the unique rules that apply to these distributions. By using this form, taxpayers can often benefit from reduced tax rates through choices such as the 20% capital gain election or a 10-year tax option. The ability to choose these tax options can significantly lower the overall tax burden when compared to recognizing the distribution as ordinary income, which is the default treatment.

How to Use the 2 Form

Using the 2 form effectively involves several steps that ensure accurate reporting of lump-sum distributions. Taxpayers should first confirm their eligibility for the various options available on the form. Here’s a brief outline on how to appropriately engage with this form:

- Gather Required Information: Collect all necessary details related to your lump-sum distribution, including the total distribution amount, the taxable portion, and pertinent personal information.

- Determine Eligibility: Verify that you qualify to use this form based on your age, the type of retirement plan, and the nature of the distribution.

- Complete the Form: Fill out the relevant sections of the 4972 form, which includes calculations of tax owed and the election of capital gains if applicable.

- Review for Accuracy: Double-check all figures and ensure that calculations are correctly performed to avoid any discrepancies that may lead to issues with the IRS.

- File with Your Tax Return: Attach the completed 2 form to your primary tax return — generally, Form 1040 — and submit it to the IRS by the designated deadline.

How to Obtain the 2 Form

Accessing the 2 form is a straightforward process. Taxpayers can obtain this form from a few reliable sources:

- IRS Website: The IRS provides downloadable PDFs of all current forms, including the 4972 form. By navigating to the IRS forms section, you can search for the 2014 version easily.

- Tax Preparation Software: Many tax preparation software platforms include the 4972 form within their systems. These programs often offer guided assistance and can automatically fill out necessary calculations.

- Local IRS Offices: Physical copies of the form are available at local IRS offices, where taxpayers can also seek additional assistance and information if needed.

- Libraries and Community Centers: Some public libraries or community service centers carry copies of necessary tax forms during tax season.

Steps to Complete the 2 Form

Completing the 2 form can be methodical when broken down into clear instructions. Follow this guideline to ensure accuracy:

- Personal Information Section: Fill out your name, Social Security Number, and filing status.

- Lump-Sum Distribution Details: Provide information about the total distribution and any deductions or exclusions applicable to the amount received.

- Tax Computation: Calculate the tax amount due. This includes deciding which special tax options to apply, such as the ten-year option or capital gains election.

-

- If applicable, indicate the amount you wish to treat as capital gains, thus separating it from ordinary income.

-

- Sign and Date: Ensure you sign and date your form to validate the information provided.

Key Elements of the 2 Form

The 2 form consists of several key components that are crucial for effective completion and filing:

- Lump-Sum Distribution Information: Details of the distribution, including the date received and total amount.

- Tax Options: Special tax elections available, including capital gains treatment.

- Qualified Plans: Information indicating whether the distribution is from a qualified retirement plan.

- Instructions for each section: Clear guidelines on what information must be entered, including the calculation of tax owed.

- Signature Line: Essential for confirming that the information provided is accurate and that you are accountable for the filing.

Understanding these elements will help taxpayers ensure they meet all necessary requirements and avoid common pitfalls associated with filing.

Important Terms Related to the 2 Form

Several key terms and concepts are essential for correctly understanding and utilizing the 2 form:

- Lump-Sum Distribution: A one-time payment received from a retirement plan, usually upon retirement or leaving a job.

- Qualified Retirement Plan: Plans that meet specific IRS requirements, including 401(k) plans and pension plans, from which distributions qualify for tax advantages.

- Capital Gain Election: A taxpayer option that allows the lump-sum distribution to be treated as capital gains, potentially reducing tax liability.

- 10-Year Tax Option: An option allowing certain taxpayers to defer tax on the distribution over a ten-year period, resulting in potentially lower overall tax rates.

Understanding these terms will facilitate the correct and effective use of the 2 form, ensuring that taxpayers take full advantage of their potential tax benefits.

IRS Guidelines for the 2 Form

The IRS provides specific guidelines regarding the use and filing of the 2 form, emphasizing several points:

- Eligibility Requirements: Only individuals meeting specific conditions, notably age and source of the distribution, may use this form.

- Filing Requirements: The 4972 form is typically filed with the regular Form 1040, ensuring all related tax matters are consolidated into one submission.

- Recordkeeping: The IRS recommends retaining any documentation related to lump-sum distributions for at least three years after filing, as this can facilitate any future audits or inquiries.

- Submission Deadline: The form, along with the complete tax return, must be filed by the specified tax deadline to avoid penalties or interest on unpaid taxes.

Following the IRS guidelines helps ensure compliance and decreases the risk of issues arising during tax processes.