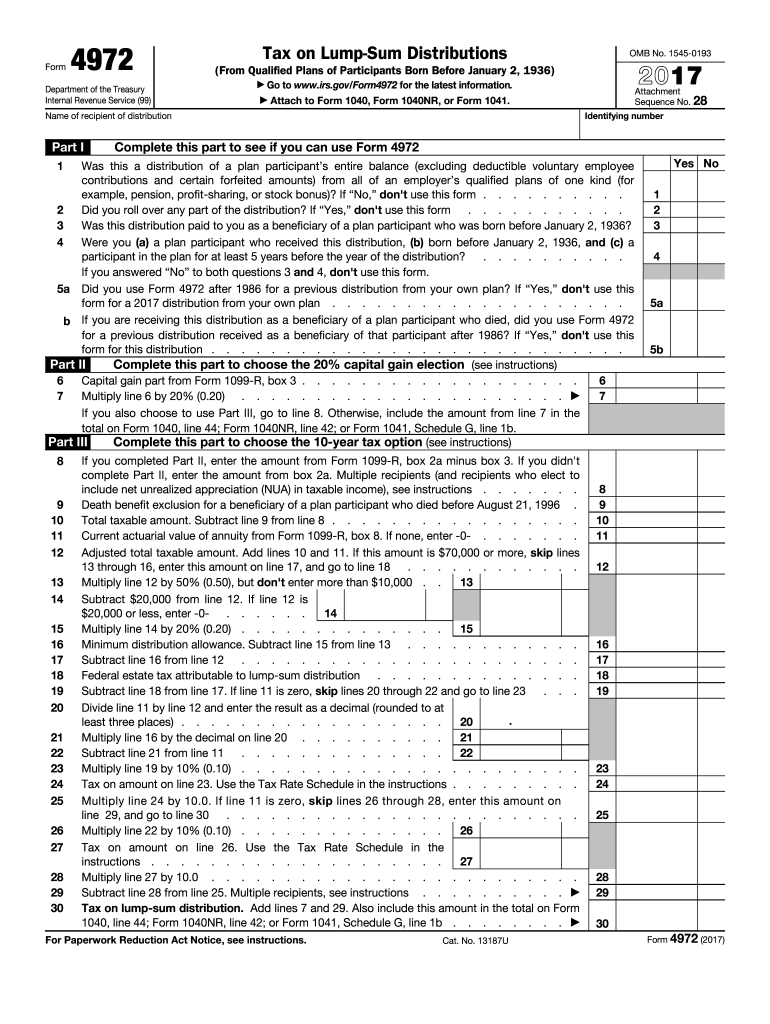

Definition and Purpose of Form 4972 (2017)

Form 4972 is designed for taxpayers who need to calculate the tax on lump-sum distributions from qualified retirement plans. This form is specifically applicable to individuals who were born before January 2, 1936. Its primary purpose is to allow eligible taxpayers to minimize their tax liability through special tax options, distinguishing it from the conventional method of reporting distributions as ordinary income.

Key Features of Form 4972

- Special Tax Options: The form provides options like the 20% capital gain election, which allows taxpayers to treat part of their distribution as capital gains to achieve a potentially lower tax rate.

- 10-Year Tax Option: This allows the taxpayer to spread the tax liability over ten years rather than incurring it all at once, which can be advantageous in managing their overall tax burden.

- Eligibility Requirements: The form outlines specific criteria that taxpayers must meet to use these options, ensuring compliance with IRS regulations.

How to Use Form 4972 (2017)

Using Form 4972 involves several steps, ensuring the accurate calculation of tax liability on lump-sum distributions. Understanding how to correctly complete this form is essential for maximizing potential tax benefits.

Steps to Complete the Form

-

Gather Necessary Information:

- Obtain your Form 1099-R, which details your distribution.

- Understand the total amount received and any amounts withheld.

-

Determine Eligibility:

- Confirm that you were born before January 2, 1936, to utilize this form and its special options.

-

Complete the Form:

- Fill out the calculation sections according to the instructions provided.

- Utilize the section for capital gain elections if applicable.

-

Review Calculations:

- Double-check all entries to ensure accuracy. Errors may lead to overpayment or penalties.

-

Submit Alongside Tax Return:

- Attach Form 4972 to your annual tax return when filing, ensuring it is included in your total tax documents.

Key Elements of Form 4972 (2017)

Understanding the key components of Form 4972 is vital for successful completion and compliance with tax regulations.

Important Sections of the Form

- Personal Information: Basic identification details such as your name, social security number, and filing status.

- Distribution Details: This section requires exact amounts of distributions and any related tax withholdings.

- Capital Gain Election Calculation: Specific calculations that show how much of your distribution may be treated as capital gains.

- Tax Computation: Shows the overall tax owed based on your calculations, including any adjustments for the special tax options selected.

Important Terms Related to Form 4972 (2017)

Familiarity with key terms associated with Form 4972 helps in understanding its implications and functionalities fully.

Glossary of Terms

- Lump-Sum Distribution: A one-time payment of the full amount from a retirement plan.

- Qualified Plan: A retirement plan that meets IRS requirements, allowing tax advantages.

- Capital Gain Election: An option to treat part of a distribution as a capital gain.

- Ordinary Income: Income that is taxed at regular income tax rates, differing from capital gains which may be taxed at lower rates.

Filing Deadlines and Important Dates for Form 4972 (2017)

Being aware of the relevant deadlines for Form 4972 helps avoid late submissions and potential penalties.

Key Deadlines

- Tax Filing Deadline: Normally, April 15 of the year following the tax year for which you are filing. Extensions may apply, so check IRS guidelines for specifics.

- Additional Forms: If you require any amendments or corrections, make sure to follow the timeline for submitting amended returns, typically within three years from the original filing date.

By understanding these key aspects of Form 4972 (2017), taxpayers can navigate its requirements more effectively, potentially enabling tax savings on retirement distributions.