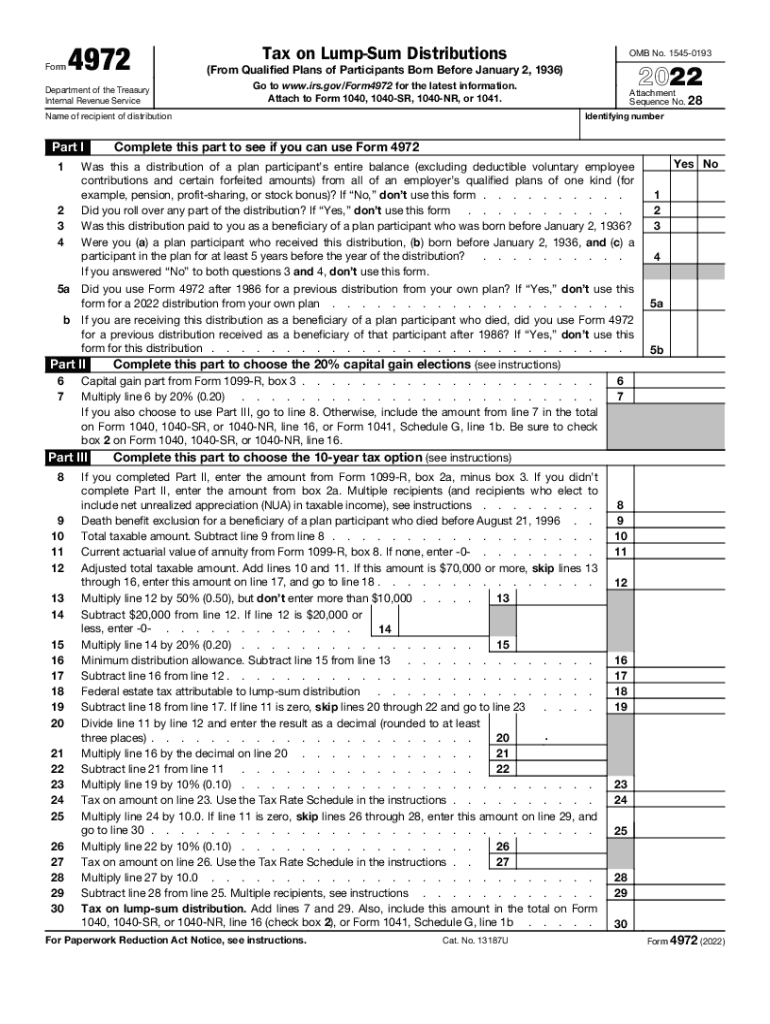

Definition and Meaning of 2022 Form 4972

Form 4972, known as the Tax on Lump-Sum Distributions, is utilized by taxpayers who receive lump-sum distributions from qualified retirement plans. This form is particularly relevant for individuals who were born before January 2, 1936. It allows for special tax treatments that can potentially lower the tax liability compared to regular income tax reporting.

The form provides a structured method to calculate the tax owed on these distributions, ensuring compliance with IRS regulations. It distinguishes between ordinary income and capital gains, enabling taxpayers to make advantageous elections that may affect their overall tax burden.

Key Components of Form 4972

- Eligibility: Primarily tailored for individuals receiving lump-sum distributions from retirement plans.

- Tax Treatments: Options like the 20% capital gain election and the 10-year tax option.

- Reporting Instructions: Comprehensive guidelines on how to report the distributions correctly.

- Calculation Methods: Steps to determine the taxable amounts based on specific distribution figures.

How to Use the 2022 Form 4972 for Lump-Sum Distributions

To effectively utilize the 2022 Form 4972, taxpayers must follow guidelines set by the IRS for reporting lump-sum distributions. The first step is to ensure that eligibility criteria are met, which generally includes receiving distributions from qualified plans as defined by IRS regulations.

Steps for Completing Form 4972

-

Gather Necessary Information: Before starting, collect all relevant information regarding the distribution, including the total amount received and the plan from which it originated.

-

Choose the Appropriate Tax Treatment: Taxpayers should evaluate whether to opt for the 20% capital gains election or the 10-year tax option based on their specific financial situation.

-

Fill Out the Form Accurately: Input comprehensive details such as your name, Social Security number, and relevant figures regarding the distribution on the form.

-

Calculate the Tax Owed: Use the designated calculation methods outlined in the form instructions to determine your tax burden accurately.

-

Submit the Form: Follow procedures for submitting Form 4972, ensuring compliance with IRS regulations and timelines.

Illustration

For instance, if a taxpayer received a lump-sum distribution of $100,000, they could evaluate whether taking a flat rate capital gain tax versus spreading the tax over ten years would be more beneficial depending on their income for those years.

Important Terms Related to the 2022 Form 4972

Understanding key terms associated with Form 4972 is crucial for accurate completion and compliance. Familiarity with these terms helps taxpayers navigate the taxation of lump-sum distributions more effectively.

- Lump-Sum Distribution: A one-time payment from a retirement plan rather than a series of payments over time.

- Qualified Plan: A retirement plan that meets IRS requirements to offer tax advantages, such as 401(k) plans or pension plans.

- Capital Gain Election: A choice allowing taxpayers to treat part of their distribution as capital gain, which often results in a lower tax rate.

- Taxable Amount: This is the portion of the distribution subject to taxes, calculated after permissible exclusions and elections.

IRS Guidelines for Completing the 2022 Form 4972

IRS guidelines provide essential insights into the completion and submission of Form 4972. Understanding these guidelines can help minimize errors and ensure that taxpayers take advantage of all available benefits.

Detailed Guidelines

-

Eligibility Verification: Taxpayers must confirm they meet the age requirement, specifically those born before January 2, 1936.

-

Documentation Requirements: Keeping accurate records of the distribution is necessary, including any related plan documents and previous tax returns.

-

Deadline for Filing: Adhering to IRS deadlines is essential to avoid penalties; typically, Form 4972 should be filed with the main tax return.

-

Audit Trails: Ensuring all information submitted can be verified through solid documentation is critical for compliance and protection against audits.

Steps to Obtain the 2022 Form 4972

Obtaining the 2022 Form 4972 is straightforward and can be done through several channels. Being organized and knowing the methods for acquiring the form will aid in a timely filing process.

Methods to Obtain the Form

-

Direct Download from IRS Website: Immediate access is available for taxpayers who wish to download and print Form 4972 directly from the IRS website.

-

Tax Preparation Software: Many popular tax preparation software programs will include Form 4972 and guide the user through the completion process.

-

Request a Physical Copy: Taxpayers may contact the IRS directly or visit local IRS offices to request a physical copy of the form, especially for those who prefer traditional filing methods.

Examples of Using the 2022 Form 4972 for Tax Reporting

Practical scenarios illustrate how Form 4972 can be applied in various taxpayer situations. Understanding these examples can aid in better comprehension and application of the form.

Scenario Illustrations

-

Retired Individual: A retired individual receives a lump-sum distribution of $50,000. By using Form 4972, they opt for the capital gains election, resulting in a lower overall tax liability compared to reporting the entire sum as ordinary income.

-

Early Retirement Distribution: An individual born before January 2, 1936, takes an early withdrawal of $20,000, opting for the ten-year tax option, successfully lowering their taxable income for the current year.

-

Multiple Distributions: A taxpayer who received two lump-sum distributions in 2022 can use Form 4972 to calculate the tax impact on their total income efficiently.

These examples can assist taxpayers in visualizing their options and potential benefits when dealing with lump-sum distributions, further emphasizing the importance of Form 4972 in tax planning.