Definition and Meaning of the 1998 IRS Form

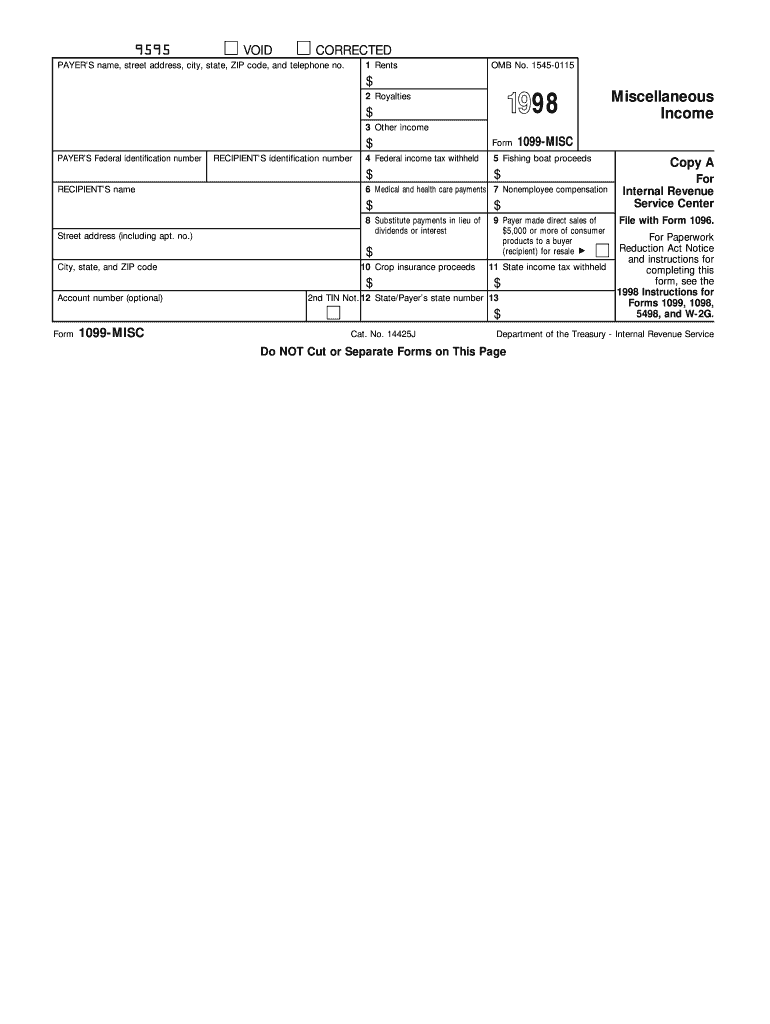

The 1998 IRS Form is a specific tax form issued by the Internal Revenue Service. Each year, the IRS updates its forms to reflect any changes in tax law, so the 1998 version corresponds to that year's guidelines and regulations. The most common form for 1998 is the 1099-MISC, which is used to report various types of income that taxpayers may receive outside of traditional employment wages. This form typically includes payments for rents, royalties, and nonemployee compensation, serving as an essential tool for accurate income reporting.

The primary purpose of the 1998 IRS Form is to ensure that all income is documented correctly, enabling both recipients and the IRS to verify reported amounts on tax returns. By standardizing how income is reported, the IRS can facilitate tax compliance and help prevent tax evasion. Understanding the content and purpose of this form is crucial for anyone interacting with various income types during the tax year.

Key Components of the 1998 IRS Form

- Payer Information: Identifying details for the entity making the payment, including name, address, and tax identification number.

- Recipient Information: Similar details for the individual or business receiving income, including any pertinent identification numbers.

- Income Categories: Distinct sections where different income types are specified, such as rents and nonemployee compensation.

- Withholding Information: Any federal or state taxes withheld from the reported income, which can affect both the payer’s and recipient’s reportable amounts.

Understanding these components is important for accurately filling out and submitting the 1998 IRS Form.

How to Use the 1998 IRS Form

Using the 1998 IRS Form effectively involves several steps that ensure accuracy and compliance with tax regulations. The first step typically requires collecting all necessary financial information related to the income being reported. Once this information is gathered, users can proceed to accurately fill out each section of the form, following the given instructions carefully.

Step-by-Step Process for Using the Form

- Gather Financial Records: Collect all records of payments made or received during the tax year, including invoices, receipts, and any previous tax forms.

- Complete the Payer Section: Enter accurate details regarding the payer, including name, address, and taxpayer identification number.

- Fill In Recipient Information: Provide the same level of detail for the payee, ensuring that all names and identification numbers are accurate.

- Report Income Types: For each relevant income category, accurately document the amounts earned, ensuring alignment with other financial documentation.

- Check Withholding: If applicable, specify any amounts withheld for taxes, as this information is crucial for both parties’ tax obligations.

- Review for Accuracy: Carefully proofread the entire form, ensuring compliance with IRS instructions and reflecting accurate numbers.

- File the Form: Submit the completed form to the IRS by the official filing deadline, which helps avoid potential penalties for late submission.

Following this process leads to a better experience in filing and reporting taxes accurately.

Obtaining the 1998 IRS Form

Acquiring the 1998 IRS Form can be done through various methods, ensuring that users can easily access the required documentation for their tax reporting needs.

- IRS Website: The official IRS website typically hosts downloadable versions of past forms, including the 1998 editions. Users can navigate to the forms section and search for specific years.

- Local IRS Offices: Visiting or contacting local IRS offices can yield physical copies of the form for those who prefer in-person assistance.

- Tax Preparation Software: Many tax preparation software solutions include the capability to generate past tax forms, including the 1998 IRS Form, streamlining the retrieval process for users.

Having multiple ways to access the form ensures compliance with tax regulations, even for historical reporting.

Important Terms Related to the 1998 IRS Form

Understanding the terminology associated with the 1998 IRS Form is essential for effective preparation and filing.

Glossary of Key Terms

- Payer: The entity or individual who provides payment to the recipient and is responsible for filing the form.

- Recipient: The individual or business receiving the income, required to report it on their tax return.

- Nonemployee Compensation: Payments made to individuals not on the payroll, often reflected on the 1099-MISC.

- Withholding Tax: Portions of income that are deducted for federal or state taxes before payment is made, listed on the form.

- Tax Identification Number (TIN): A unique number used by the IRS to identify taxpayers, crucial for accurate reporting.

Familiarity with these terms can significantly improve the user’s understanding of the form, aiding in accurate completion and filing.

Filing Deadlines for the 1998 IRS Form

Each tax year has specific deadlines for filing IRS forms, including the 1998 version of the 1099-MISC.

- General Filing Deadline: For most tax documents, including the 1998 IRS Form, the deadline typically falls on January 31 of the following year. This date ensures both taxpayers and the IRS receive necessary reporting data promptly.

- Extended Deadlines: Certain situations may allow for extended filing deadlines. For instance, if the payer files electronically, the due date may shift to March 31.

- Recipient Notifications: Payers must ensure recipients receive copies of their respective forms by the same deadlines, ensuring they have sufficient notice to report income on their tax returns.

Being aware of these deadlines is critical for compliance and avoids unnecessary penalties.

Key Elements of the 1998 IRS Form

The structure of the 1998 IRS Form consists of several key elements that serve particular functions in the reporting process. Understanding these elements can help users navigate the form more effectively.

Main Structure Components

- Top Section: This typically includes the form’s title, year (1998), and essential instructions for filling out the document.

- Payer and Recipient Sections: Clearly labeled areas for entering payer and recipient information, ensuring that proper identification is provided.

- Income Reporting Categories: Sections divided by income types, highlighting the predominant forms of income that need reporting.

- Tax Withholding Information: Areas dedicated to reporting any withholdings, which can influence the overall tax obligations of both parties involved.

- Signature Line: A designated space for necessary signatures, verifying that the information provided is complete and accurate.

Each of these elements contributes to the overall functionality and compliance of the form, ensuring that all necessary information is reported and processed correctly.