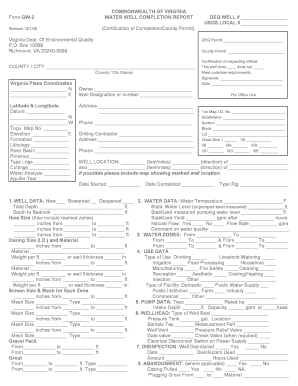

Definition & Meaning

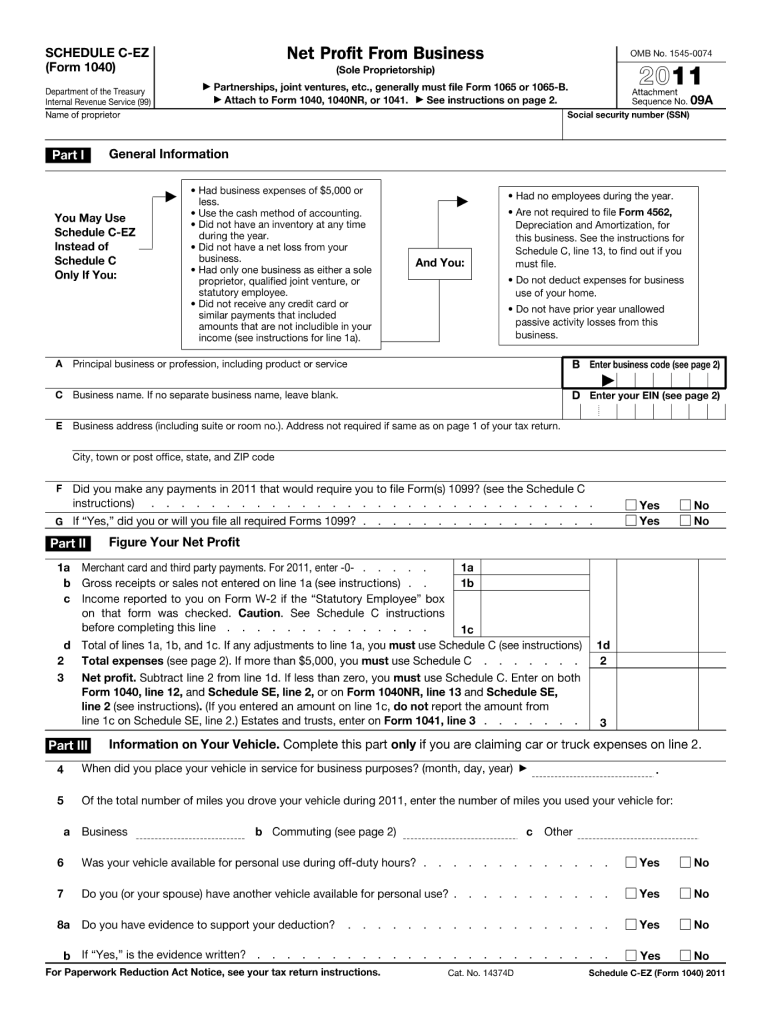

The 2011 fillable 1040 Schedule C-EZ form is a U.S. tax document designed specifically for sole proprietors to report net profit from their business operations. It serves to simplify the process for those who meet certain criteria, allowing a streamlined way to declare income and expenses without the complexities found in the full Schedule C form. This form focuses on sole proprietors with simpler financial situations, ensuring that they can comply with tax requirements efficiently. Key information includes gross receipts, total expenses, and net profit, alongside vehicle-related expense details if applicable.

Key Elements of the 2011 Fillable 1040 Schedule C-EZ Form

Basic Income and Expenses

- Gross Receipts: Your total income from the business must be declared. Ensure this includes all forms of payment received for services rendered.

- Total Expenses: Include all business-related expenses. This section is limited to those not exceeding $5,000, catering to businesses with minimal financial complexities.

- Net Profit Calculation: Deduct expenses from gross receipts to determine your net profit, which is the figure used for taxation.

Simplified Reporting Criteria

- No Employees: The form is specifically for businesses with no paid employees.

- No Depreciation: Users should not require depreciation or amortization deductions.

Steps to Complete the 2011 Fillable 1040 Schedule C-EZ Form

-

Gather Necessary Information: Collect all your business receipts, invoices, and banking records for the year 2011 to accurately report financials.

-

Download the Form: Obtain the fillable PDF version of the Schedule C-EZ for 2011, ensuring you have the correct year for your tax filing.

-

Enter Gross Receipts: Input all business revenues in the gross receipts field.

-

Report Expenses: Carefully list all allowable business expenses, ensuring they collectively do not exceed $5,000.

-

Calculate Net Profit: Subtract total expenses from your gross receipts to find your net profit.

-

Vehicle Expense Section: If applicable, fill in any vehicle expenses related to the business using precise records for mileage and maintenance costs.

-

Review and Submit: Double-check all entries for accuracy before submitting the form along with your 1040 tax return.

Who Typically Uses the 2011 Fillable 1040 Schedule C-EZ Form

Mainly, sole proprietors operating small or simple businesses utilize this form. It caters to entrepreneurs within the U.S. who meet the eligibility criteria, such as having minimal expenses and no hired staff. Additional users might include freelancers, independent contractors, and part-time business owners who engage in straightforward business activities without the complexities of larger enterprises.

IRS Guidelines

Eligibility Criteria

To use the 2011 Schedule C-EZ, you must:

- Have business expenses not exceeding $5,000.

- Not employ any staff or require payroll processing.

- Be free from the need for depreciation deductions.

Filing Requirements

- Attach the completed Schedule C-EZ with your annual 1040 tax return.

- Ensure all reported figures are accurate and substantiated with appropriate documentation.

Form Submission Methods

Online Submission

- Utilize e-filing services accepted by the IRS, which may speed up the processing of your tax returns.

- Ensure the digital version of the form is completed accurately and uploaded in the required format.

Mail Submission

- Some may prefer to send a physical copy via the U.S. Postal Service. Ensure you retain copies for your records.

Penalties for Non-Compliance

Failing to submit the Schedule C-EZ properly or omitting required information may result in:

- Fines and interest: These apply to unpaid taxes due to underreporting or late filing.

- Legal consequences: Ensure all entries are truthful and substantiated to avoid legal scrutiny.

Software Compatibility

The 2011 fillable Schedule C-EZ form can be completed using common tax software platforms such as TurboTax and QuickBooks. These programs offer step-by-step guidance to help ensure that all sections of the form are filled correctly, leveraging built-in checks to minimize errors. Many users prefer these tools for their ease of use and the built-in support features they offer.

Important Terms Related to 2011 Fillable 1040 Schedule C-EZ Form

- Sole Proprietor: An individual who owns an unincorporated business themselves.

- Gross Receipts: Total revenue received from business activities.

- Net Profit: Amount remaining after all allowable business deductions are subtracted from gross receipts.

These components and terms are crucial for effective use and understanding of the form, ensuring compliance with IRS regulations and proper determination of tax liabilities.