Definition & Meaning

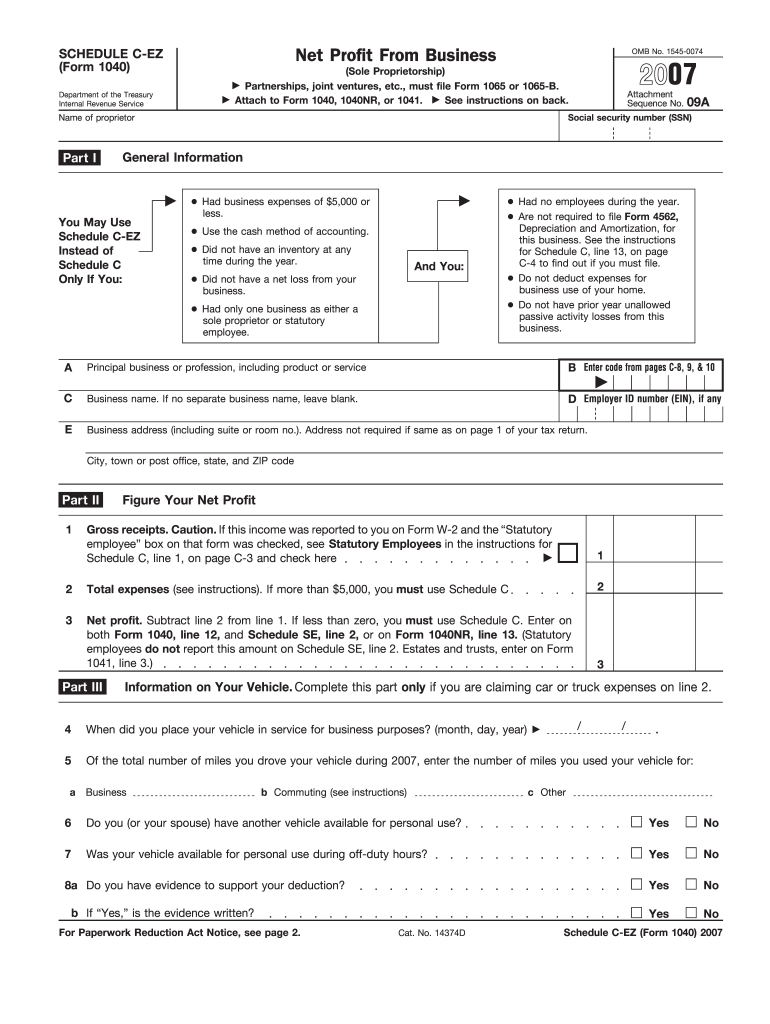

The Schedule C-EZ form for the 2007 tax year serves as a streamlined version of the Schedule C. It is used by sole proprietors to report their net profits from a business. This form is designed for individuals whose business expenses do not exceed a certain limit, offering a simpler filing process compared to the standard Schedule C. It allows for the reporting of gross receipts, total expenses, and net profit in a more concise manner.

Eligibility Criteria

Sole proprietors must meet certain requirements to be eligible to use the Schedule C-EZ form for the 2007 tax year. Criteria include having less than $5,000 in business expenses and not using inventory in their operations. Additionally, businesses cannot have employees and must operate on a cash accounting basis rather than accrual to qualify for this simplified form. Understanding these requirements is crucial for ensuring compliance and avoiding errors during the filing process.

How to Obtain the Printable Schedule C-EZ 2007 Form

The printable Schedule C-EZ 2007 form can be accessed from several sources. It's available for download on the IRS website, where taxpayers can find official forms and publications. Additionally, the form may be available through tax preparation software, offering electronic versions that can simplify the filing process. Ensuring access to the correct version is essential for accurate completion and submission.

Steps to Complete the Printable Schedule C-EZ 2007 Form

- Gather Required Information: Collect all necessary documentation, including gross receipts and evidence of business expenses.

- Fill Out Basic Information: Provide personal details such as your name, address, and social security number at the top of the form.

- Report Gross Receipts and Expenses: Enter gross receipts and calculate your total expenses to determine your net profit.

- Include Vehicle Information if Applicable: For those deducting vehicle expenses, complete the relevant section outlining mileage and related costs.

- Review and Confirm: Carefully review all entries to ensure accuracy before submission.

- Submit the Form: Submit the completed form to the IRS along with your individual tax return by mail or any applicable electronic submission methods.

Key Elements of the Printable Schedule C-EZ 2007 Form

- Identifying Information: Ensures the form is linked to the correct taxpayer.

- Gross Receipts: Capture total income generated from business activities.

- Total Expenses: Record allowable business expenses to offset income.

- Net Profit Calculation: Subtract expenses from gross receipts to determine net income.

- Vehicle-related Deductions: Specific section for reporting car and truck expenses if applicable.

Legal Use of the Printable Schedule C-EZ 2007 Form

The Schedule C-EZ form is recognized by the IRS as an official document for reporting business income and expenses for sole proprietors. It provides a legal means for taxpayers to declare their earnings and deduct legitimate business expenses. Complying with IRS rules and guidelines is necessary to ensure no discrepancies arise which could prompt an audit or penalties.

IRS Guidelines

The IRS provides specific instructions for completing the Schedule C-EZ form. These guidelines include details on what constitutes allowable expenses, how to accurately report income, and instructions for calculating net profit. Adhering to these guidelines minimizes errors and aids in the smooth processing of tax returns.

Filing Deadlines / Important Dates

The deadline for submitting the Schedule C-EZ form for the 2007 tax year coincides with the filing date for individual tax returns, typically April 15 of the following year. Some taxpayers may qualify for extensions, but it is important to request these in advance and ensure all documentation is prepared and submitted by any new deadlines.

Who Typically Uses the Printable Schedule C-EZ 2007 Form

This form is specifically tailored for sole proprietors with minimal expenses and straightforward financial structures. It is ideal for freelancers or small business owners who manage operations without the complexities of employees, inventory, or significant year-end adjustments. Understanding who should use the form helps in deciding if this simplified option is applicable to one's business scenario.

Required Documents

Taxpayers must compile several documents to accurately complete the Schedule C-EZ form, including:

- Income Records: Documentation of gross receipts.

- Expense Receipts: Proof of all business expenses claimed.

- Mileage Logs: If vehicle expenses are claimed, detailed logs of business mileage are required.

- Previous Tax Returns: For reference to ensure consistency in reporting.

Taxpayer Scenarios

Different taxpayer scenarios illustrate the applicability of the Schedule C-EZ form:

- Freelancers: Those with straightforward finances find this form beneficial due to fewer reporting requirements.

- Part-time Business Owners: Individuals running a side business with limited expenses.

- Consultants: Professionals offering services without needing to manage inventory or extensive operational costs.