Definition and Meaning of Form Forms

Form forms refer to standardized documents used to collect information, facilitate processes, or fulfill legal requirements across various contexts. These forms are crucial in sectors such as taxation, legal agreements, and administrative applications. For instance, a Form W-2 is essential for tax reporting, outlining an employee's income and taxes withheld. Understanding the purpose and scope of form forms is vital, as incorrect or incomplete forms can lead to significant delays and complications in processing.

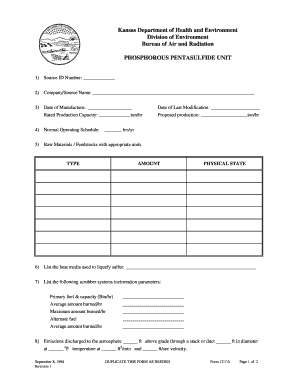

- Types of Forms:

- Tax forms (e.g., W-2, 1040)

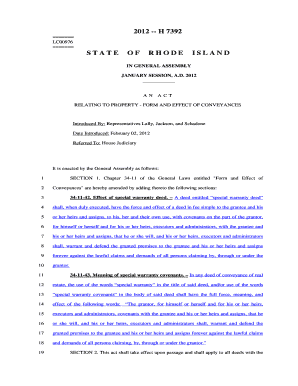

- Legal forms (e.g., contracts, agreements)

- Registration forms (e.g., business licenses, permits)

- Key Components: Typically includes fields for information such as names, addresses, specific identifiers (like SSN or EIN), and signatures where necessary.

How to Use Form Forms Effectively

Utilizing form forms effectively involves a systematic approach to ensure accuracy and compliance. Follow these guidelines to maximize efficiency:

- Identify the Correct Form: Determine the specific form needed based on your requirements—tax obligations often dictate different forms.

- Accurate Completion: Fill out all required fields carefully. Double-check entries for typos or inaccuracies that could render the form invalid.

- Review Before Submission: Go through the entire document to ensure all necessary information is provided and is truthful.

- Attach Required Documents: Some forms may necessitate supporting documentation; ensure these are compiled before sending.

- Submit by the Deadline: Familiarize yourself with any deadlines associated with your form to avoid penalties.

By breaking down the process into these manageable steps, users can navigate the intricacies of various form forms with ease.

Steps to Complete Form Forms

Completing form forms involves several crucial steps that vary depending on the type of form being used. However, the general procedure is similar across most forms:

- Gather Relevant Information: Before starting, compile any necessary data, including personal identification and financial information.

- Read Instructions: Carefully read all instructions provided with the form. Each form usually comes with specific guidelines.

- Complete Each Section: Fill out each section as per the instructions, paying special attention to mandatory fields.

- Sign and Date: Ensure that you have signed and dated the form where required. An unsigned form is typically considered incomplete.

- Keep a Copy: After submission, retain a copy of the completed form for your records. This is essential for future reference or in case of discrepancies.

Employing these systematic steps ensures that the forms are completed accurately and can facilitate quicker processing by relevant authorities.

Important Terms Related to Form Forms

Understanding the terminology associated with form forms enhances clarity and minimizes confusion during the preparation and submission process. Here are some essential terms:

- Applicant: The individual or entity submitting the form.

- Form Field: Areas within a form where specific information must be provided.

- Submission Method: The way in which the form can be submitted, whether electronically, by mail, or in person.

- Supporting Document: Additional paperwork required to accompany the form for validation.

- Signature: A person's written name, confirming that the provided information is accurate and authorized.

Familiarity with these terms is crucial for users as they navigate different documents and types of submissions.

Legal Use of the Form Forms

Form forms often hold a legal standing and need to comply with various regulations. The legal framework governing these forms ensures that they are recognized and binding under certain conditions:

- Compliance with Laws: Forms must adhere to applicable federal and state laws, such as the ESIGN Act for electronic signatures.

- Retention Requirements: Certain documents must be retained for specified periods as per legal guidelines, particularly for tax forms.

- Accuracy and Honesty: Providing false information on any form can lead to legal repercussions, including fines and penalties.

Understanding the legal implications of form forms aids individuals and businesses in safeguarding their interests while ensuring compliance.

Filing Deadlines and Important Dates

Being aware of filing deadlines is critical when dealing with form forms, particularly in the context of tax submissions. Here are some key considerations:

- Tax Forms: Many tax forms must be submitted annually by April 15. However, deadlines can vary for state taxes or other specific forms.

- Notice of Changes: Authorities often provide notifications for changes in deadlines; staying current with these updates prevents late submissions.

- Extensions: While requesting an extension may be possible for some forms, it is vital to submit necessary documentation in a timely manner to avoid penalties.

A solid grasp of deadlines ensures that users remain compliant and avoid potential fines that can arise from late filings.

Examples of Using Form Forms

Practical examples illuminate how different sectors utilize form forms, showcasing their functionality and importance in day-to-day operations. Consider these scenarios:

- Tax Forms: An employee receives a W-2 from their employer summarizing their yearly earnings and tax withholdings, crucial for filing federal income taxes.

- Business Registration: A new business owner completes the Articles of Incorporation form to legally establish their corporation, including information about shareholders and the business structure.

- Loan Applications: Banks require potential borrowers to fill out specific forms detailing financial information to determine loan eligibility and terms.

These examples reflect the various contexts in which form forms are utilized, emphasizing their role in both compliance and procedural efficiency.