Definition and Purpose of Form 1040-ES

Form 1040-ES, Estimated Tax for Individuals, is a critical tool for taxpayers in the United States who need to pay estimated taxes. This form is used primarily by individuals whose income is not subject to withholding taxes, such as self-employed individuals, freelancers, landlords, and investors. The purpose of the form is to calculate and pay estimated taxes on a quarterly basis to prevent a significant tax bill at the end of the year and avoid penalties for underpayment.

When Estimated Taxes Are Necessary

- Self-employed individuals, freelancers, or contract workers who do not have regular withholdings.

- Taxpayers who receive substantial income from dividends, interest, rent, or capital gains.

- Individuals with earnings from self-employment, partnerships, or certain S corporations.

Examples and Scenarios

For instance, a freelance graphic designer earning $50,000 annually without deductions or withholdings should use Form 1040-ES to estimate and pay quarterly taxes. Similarly, a landlord with rental income must estimate tax liabilities that aren't covered by withholding.

How to Use Form 1040-ES

Form 1040-ES is used to calculate and remit quarterly estimated tax payments. It comes along with worksheets and instructions to help taxpayers estimate their taxes accurately.

Steps to Use the Form

- Estimate Your Total Income: Include all sources of income, such as wages, self-employment earnings, and investment gains.

- Determine Taxable Income: Subtract allowable deductions from your total income to find your taxable income.

- Calculate Tax Owed: Use current tax rates to find out what you owe.

- Break Down into Payments: Divide the total tax by four to determine quarterly payments.

Practical Example

Consider a retired individual with investment income. By using the worksheet within Form 1040-ES, they can project annual income, apply the relevant tax rate, and calculate quarterly amounts to submit to the IRS, ensuring compliance with tax obligations.

Obtaining Form 1040-ES

Taxpayers can obtain Form 1040-ES through several reliable channels.

Access Methods

- IRS Website: Downloadable directly from the IRS website in PDF format.

- Mail Order: Request a physical copy through IRS mail service.

- Tax Preparation Software: Available within popular tax software programs.

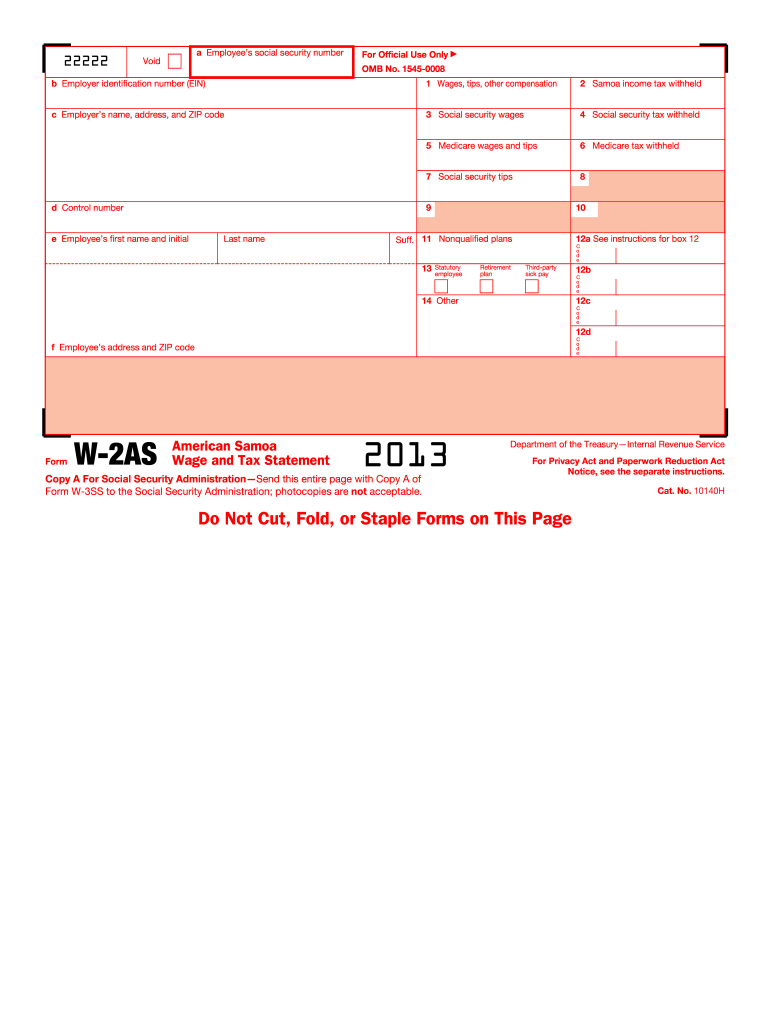

Steps to Complete Form 1040-ES

Completing Form 1040-ES involves several detailed steps to ensure accuracy.

Detailed Procedure

- Fill Out the Personal Information Section: Include your full name, address, and social security number.

- Complete the Payment Voucher: Each of the four vouchers needs to be completed if mailing payments.

- Calculate Estimated Tax Payments: Use the worksheet provided to estimate taxes accurately.

- Enter Payments: Transfer calculation results onto payment vouchers for submission.

Key Considerations

Ensure all figures are estimated accurately to avoid underpayments that could result in IRS penalties. Review and verify information before submission.

Why Use Form 1040-ES?

Utilizing Form 1040-ES is essential for managing tax liabilities effectively.

Benefits of Estimated Tax Payments

- Avoid Penalties: Regular estimated payments prevent underpayment fines.

- Budget Management: Spread out tax obligations to manage cash flow efficiently.

- Stay Compliant: Maintain good standing with IRS obligations throughout the year.

Example

A consultant with irregular income can use these quarterly payments to balance the financial workflow, maintaining budget stability and avoiding lump-sum year-end payments.

Individuals Who Need Form 1040-ES

Form 1040-ES is crucial for a select group of taxpayers.

Typical Users

- Self-Employed Individuals and Freelancers: No automatic withholding from their earnings.

- Landlords: Consistent rental income not withheld automatically.

- Investors: Earning substantial non-withholding income from dividends and interests.

Unique Considerations

Partnership members and S-corp shareholders must navigate quarterly estimated payments efficiently to prevent discrepancies in cash flow and tax compliance.

Legal Implications and Compliance

Ensuring correct use of Form 1040-ES is imperative to avoid legal issues.

Important Legal Considerations

- Timely Payments: Late submissions can incur interest and penalties.

- Accurate Reporting: Incorrect calculations posing risks of additional scrutiny from the IRS.

- Documentation: Maintain records of estimates and payments for future reference and audits.

IRS Guidelines and Compliance

The IRS provides specific guidelines for using Form 1040-ES.

Adhering to IRS Protocols

- Use of Worksheets: Guide taxpayers through computation accurately.

- Understand Penalties: Clearly defined for underpayment, essential to catch early.

- Follow Deadlines: Ensure payments are sent by the due date to avoid penalties.

Key Elements to Include in Form 1040-ES

Understanding the components and sections within Form 1040-ES is crucial for accurately completing the form and fulfilling tax obligations efficiently.

Important Sections

- Personal Information: Ensures all identifying information is correct.

- Tax Payment Calculation: Requires precise numbers and understanding of deductions.

- Payment Vouchers: Must include proper information for fund allocation.

Example and Analysis

For a photographer working independently, precision in filling out each section ensures that quarterly taxes align with IRS requirements, mitigating risks of penalties.