Definition and Meaning of Forms W-2 and W-3

Forms W-2 and W-3 are essential tax documents in the United States, specifically used for reporting employee wages and tax withholdings. Form W-2, titled "Wage and Tax Statement," is issued by employers to employees, detailing the total compensation paid, taxes withheld, and other relevant tax information for the calendar year. Form W-3, known as the "Transmittal of Wage and Tax Statements," acts as a summary of all W-2 forms submitted by an employer to the Social Security Administration (SSA).

Understanding these forms is crucial for both employers and employees. Employers are required to file W-2 forms for each employee by a specified deadline, providing necessary wage information for the IRS to compute employees' tax obligations. Employees utilize their W-2 forms to accurately file personal income tax returns, ensuring compliance with federal tax law. The information on W-2s assists in determining tax credits, deductions, and overall tax liability.

- Common Use Case: Employers must provide W-2 forms to employees by January 31 each year.

- Employee Responsibility: Employees must report their W-2 information accurately on their tax filings.

How to Use the General Instructions for Forms W-2 and W-3

Navigating the General Instructions for Forms W-2 and W-3 can simplify the filing process for both employers and tax professionals. These instructions serve as an authoritative guide outlining legal requirements, effective filing methods, and deadlines.

- Step-by-Step Guide: The instructions specify how to correctly fill out W-2 and W-3 forms, highlighting key data points like employee information and wage details.

- Online Filing: The guidelines address electronic wage reporting options, offering insight on how to file W-2s and W-3s through approved electronic platforms.

Additionally, the instructions cover essential corrective measures when errors are detected, such as issuing corrected W-2 forms (W-2c). This ensures both accuracy and compliance with IRS requirements, minimizing potential penalties due to filing mistakes or omissions.

Steps to Complete Forms W-2 and W-3

Completing Forms W-2 and W-3 involves several critical steps that ensure accuracy and compliance with IRS regulations.

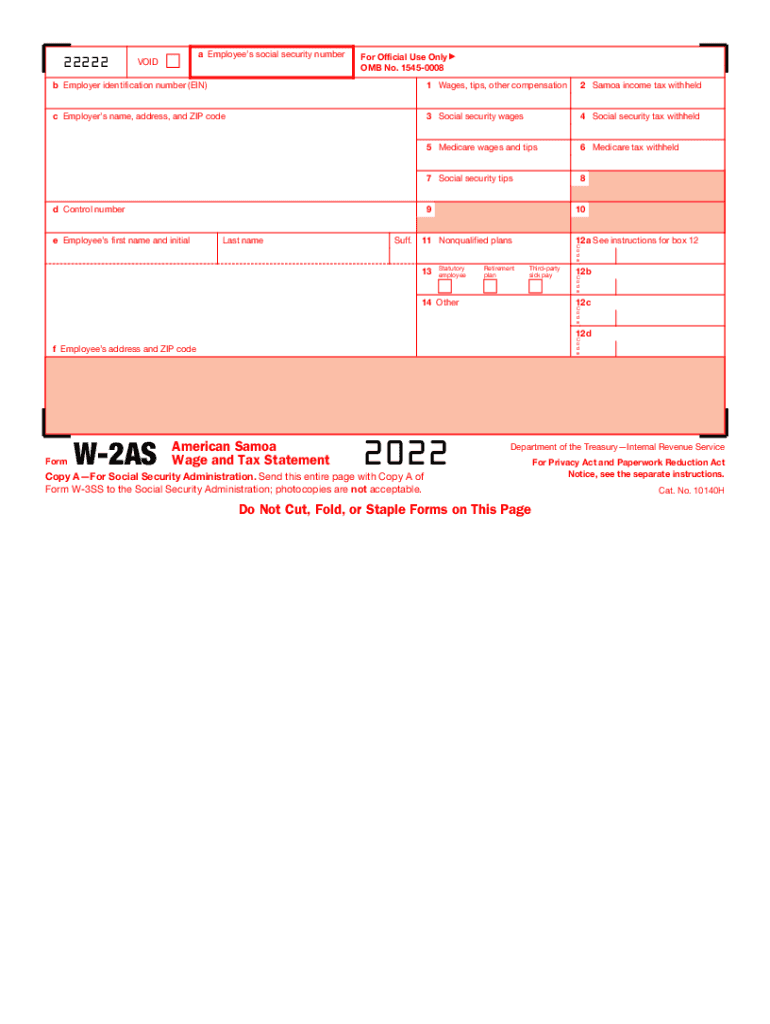

- Collect Employee Information: Gather the necessary details including the employee's name, address, Social Security number, and total wages paid for the year.

- Input Wage and Tax Data: Fill in the appropriate boxes on Form W-2, ensuring correct entries for federal, state, and local tax withholdings. Attention to detail is key; any inaccuracies can lead to complications.

- Complete W-3 Form: Prepare Form W-3, summarizing all W-2 forms submitted. This document informs the SSA of the total wages paid and taxes withheld across all employees.

- Review for Accuracy: Conduct a thorough review of both forms to ensure all data is accurate and complete.

- File Timely: Submit Forms W-2 and W-3 electronically or via mail by the required deadlines, which are usually January 31 for W-2s and the last day of February for W-3s.

Understanding these steps is vital in avoiding penalties related to late or incorrect filings, ultimately facilitating a smooth tax reporting process.

Important Terms Related to Forms W-2 and W-3

Familiarity with specific terminology regarding Forms W-2 and W-3 can enhance comprehension and facilitate efficient filing processes. Key terms include:

- Statutory Employee: A worker who is considered an employee for tax purposes but may not have traditional employer-employee relationships. These individuals receive a W-2 but may be responsible for paying their own taxes.

- Electronic Wage Reporting: The process of submitting W-2 forms electronically to the IRS. This method provides benefits such as faster processing times and reduced error rates.

- W-2c Form: A corrected version of a previously submitted W-2. This form is used to amend errors in wage or tax reporting, ensuring compliant updates are made to reflect accurate data to the IRS.

These terms are essential for understanding the broader context of wage reporting and compliance.

Filing Deadlines and Important Dates for W-2 and W-3 Forms

Meeting deadlines when filing W-2 and W-3 forms is critical to avoid penalties and ensure compliance with IRS regulations.

- January 31: Employers must issue W-2 forms to employees. This is the last date for providing employees with their wage statements, allowing them ample time to prepare their tax returns.

- Last Day of February: If filing paper forms, employers are required to submit W-3 forms to the SSA by this date. For electronic filings, the deadline extends to March 31.

- Mailing Deadline for Recipients: Employees must have their W-2s in hand by January 31 to prepare their personal tax filings.

Understanding and adhering to these timelines will aid employers in maintaining compliance while preventing unnecessary fines associated with late submissions.

Why Understanding Forms W-2 and W-3 is Important

Understanding Forms W-2 and W-3 is crucial due to their significant impact on income tax filings and compliance.

- Implications for Employees: When employees understand their W-2 forms, they can accurately report their income, claim appropriate deductions, and ensure they are not over- or under-reporting their earnings.

- Employers’ Legal Responsibilities: Employers must comprehend the responsibilities that come with filing W-2s and W-3s, including correct information entry and timely submission. Failing to adhere to these guidelines can result in legal consequences, including financial penalties.

- Tax Planning and Strategy: Awareness of W-2 details helps employees navigate tax planning more effectively, recognizing key areas that may affect their overall tax liabilities.

This understanding is indispensable for ensuring compliance and optimizing tax obligations for both employees and employers.