Definition & Meaning

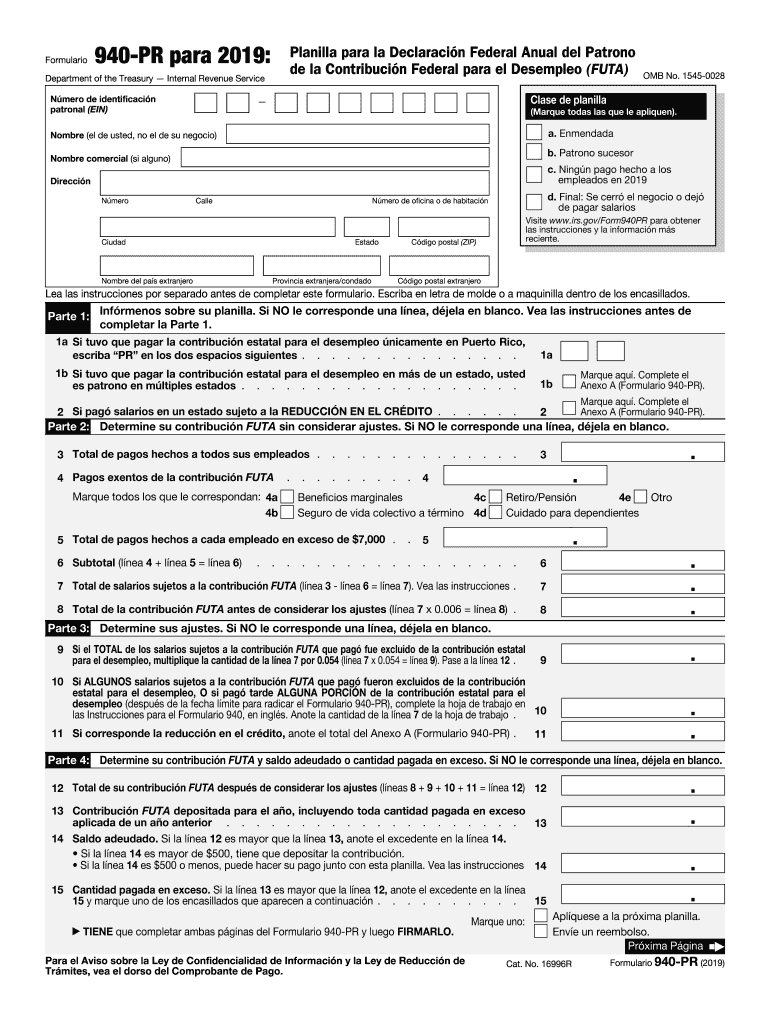

The 940-PR form is an essential document used for reporting annual federal unemployment taxes (FUTA) specifically by employers in Puerto Rico. This form allows businesses to report their FUTA tax, which is a federal tax that provides temporary funding for unemployed workers. Employers must ensure they correctly report their employee's wages and any state unemployment taxes paid, as it directly impacts FUTA tax calculations. The form acts not only as a financial report but also ensures compliance with both federal and Puerto Rican tax regulations.

How to Use the 940-PR

Employers need to accurately fill out the 940-PR to report their FUTA tax liabilities. This includes gathering detailed information about their payroll and any compensation that falls under federal unemployment criteria. The form must be filled out with the employer's identification details, total wages paid, and any adjustments or credits related to state contributions. It is used to compute the tax due after accounting for applicable exemptions and payments, ensuring the employer meets their annual tax obligations under the FUTA.

Steps to Complete the 940-PR

- Collect Employer Information: Enter your Employer Identification Number (EIN) and contact details.

- Report Wages Paid: Detail all wages paid during the calendar year that are subject to FUTA.

- Calculate Taxable Wages: Deduct allowable exemptions to determine taxable wages.

- Determine Tax Liability: Apply the current FUTA tax rate to taxable wages.

- Account for State Credits: Subtract any state unemployment tax credits.

- Report Adjustments: Include any adjustments for FUTA tax overpayments from previous years.

- Payment: Compute the total tax owed; if necessary, make a payment or request a refund.

Important Terms Related to 940-PR

- FUTA: The Federal Unemployment Tax Act, which mandates employers to pay a federal tax to fund state unemployment agencies.

- EIN: Employer Identification Number, required for tax filing and reporting.

- Taxable Wages: Portion of gross wages subject to FUTA tax after exemptions.

- State Unemployment Tax Credit: Credit for contributions paid to state unemployment funds, which reduces the federal tax burden.

Who Typically Uses the 940-PR

The form is used by employers operating in Puerto Rico who must report and pay federal unemployment taxes on wages paid to employees. It's pertinent for businesses of various types, including corporations, partnerships, and sole proprietorships, that have employees subject to FUTA tax. Even small businesses with minimal staffing are required to comply if they meet the wage thresholds.

Filing Deadlines / Important Dates

The 940-PR must be filed annually. The deadline for submission is typically January 31st following the year for which the tax is reported. If the employer has made timely FUTA tax deposits, the deadline extends to February 10th. Staying compliant with these deadlines helps avoid interest and penalties for late filing or uncompleted payments.

Required Documents

To accurately complete the 940-PR, gather supporting documentation including payroll records, prior state unemployment tax returns, and any receipts of state unemployment contributions paid. Accurate financial records throughout the tax year simplify the preparation and ensure all figures reported are verifiable, minimizing the risk of audits or discrepancies.

IRS Guidelines

The IRS provides specific guidelines for completing the 940-PR, ensuring correct calculation and filing of the unemployment tax. Employers must follow these stipulations to determine who qualifies as an employee, what constitutes taxable wages, and how to apply tax credits. The IRS also outlines how to handle amendments and corrections to previously filed forms should errors be discovered after submission.

State-Specific Rules for the 940-PR

While the 940-PR pertains to federal unemployment taxes, it aligns closely with Puerto Rico's specific rules and requirements. Employers must take into account any state-specific stipulations regarding unemployment contributions which may affect the federal reporting. Understanding both federal and local regulations ensures appropriate compliance and accurate reporting.

Penalties for Non-Compliance

Failing to file or inaccurately completing the form 940-PR can result in significant penalties. The IRS may impose fines for late submissions, incorrect payments, or inaccurate information. Non-compliance could also lead to interest on unpaid taxes and potential audits, which is why accurate, timely filing is crucial for employers.

Digital vs. Paper Version

Employers have the option to file the 940-PR electronically or via a paper form. Electronic filing is often more efficient and reduces errors associated with manual entries. Many employers prefer using digital platforms that offer direct integration with accounting software, making it easier to compile and submit essential data accurately and quickly.