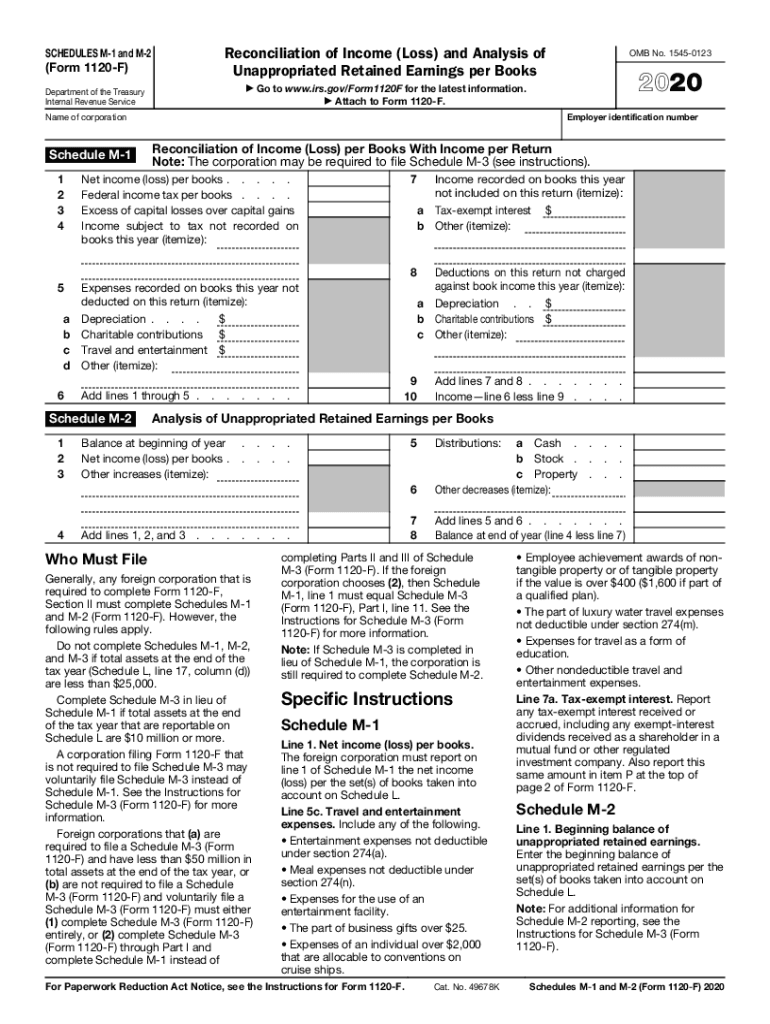

Definition and Purpose of Form M-1

Form M-1 is a tax form utilized by certain organizations, including partnerships, corporations, and non-profits, to reconcile their income as reported on their financial statements with the income reported on their tax returns. Its primary purpose is to identify discrepancies between these two figures through a detailed reconciliation process. The form not only aids in accurate tax reporting but also helps ensure compliance with IRS regulations by providing clear documentation of a company's financial activities.

Understanding the Terminology

- Reconciliation: The process of comparing two sets of financial statements to ensure consistency and accuracy.

- Tax Return: The official form submitted to tax authorities declaring income, expenses, and other pertinent tax information.

The use of Form M-1 is mandatory for specific qualifying entities, which enhances the integrity of financial reporting.

How to Obtain Form M-1

Individuals and businesses can obtain Form M-1 through several straightforward methods.

- IRS Website: The most reliable source is the official IRS website, where the form can be downloaded in PDF format.

- Tax Preparation Software: Many tax software programs integrate Form M-1 into their systems, allowing users to fill it out electronically.

- Tax Professionals: Consulting a tax advisor can also be beneficial, as they often have access to the latest forms and necessary updates.

- Local IRS Office: Physical copies can be obtained by visiting a local IRS office, though this option may be less convenient.

It is essential to ensure you are using the most current version of the form, as updates may occur annually.

Steps to Complete Form M-1

Completing Form M-1 involves a series of important steps that require careful attention to detail:

- Gather Relevant Financial Information: Collect financial statements, tax returns, and any prior year Forms M-1 if applicable.

- Provide Basic Identification Information: This includes the entity's name, address, and employer identification number (EIN).

- Record Income and Adjustments: Use the form's various sections to report the corporation’s book income and any necessary adjustments that were made, including items like tax-exempt income and nondeductible expenses.

- Reconcile Differences: This is the crux of the form where discrepancies between the income reported on financial statements and tax filings are evaluated and documented.

- Review and Confirm Accuracy: Before submission, review the document for accuracy and compliance with IRS guidelines to minimize potential penalties or audits.

It's critical to ensure that all figures are accurate to avoid complications with future tax filings.

Important Terms Related to Form M-1

Understanding common terminology associated with Form M-1 can be beneficial for proper its completion and compliance:

- Schedule M-1: A section of the larger reporting requirements that focuses directly on the reconciliation of income.

- Tax-exempt income: Income that is not subject to taxation, which can affect the reconciliation process.

- Nondeductible Expenses: Costs that cannot be deducted from taxable income, influencing the figures reported on Form M-1.

These terms are crucial for comprehensively grasping the implications of the form.

Legal Use of Form M-1

Form M-1 is legally mandated for specific entities, which must comply with its filing requirements to avoid potential penalties. Some critical legal aspects include:

- Mandatory Filing: Certain businesses, particularly partnerships and corporations, must file the form annually.

- Penalties for Non-compliance: Failure to file or discrepancies not reported on Form M-1 may result in fines or increased scrutiny from the IRS.

- IRS Regulations: The guidelines for Form M-1 are outlined by the IRS, ensuring that businesses maintain transparency and accuracy in their financial declarations.

Understanding the legal ramifications of Form M-1 ensures that entities remain compliant with federal tax laws.