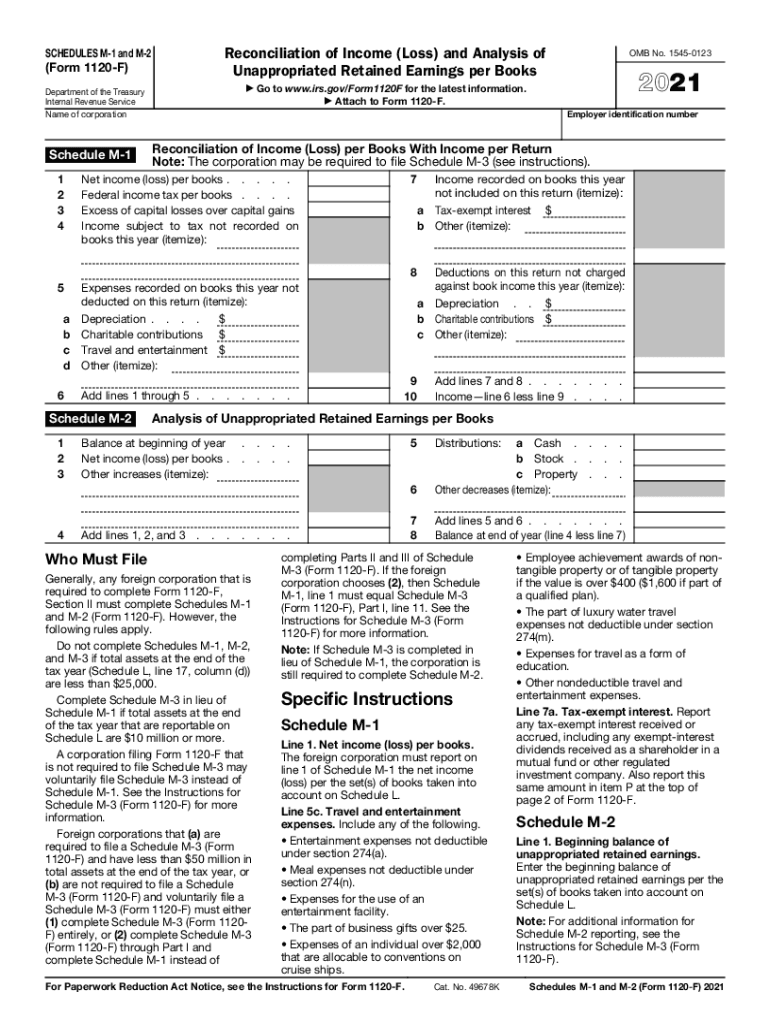

Definition and Meaning of Form M-2

Form M-2, often used in tax reporting for corporations, specifically addresses the analysis of unappropriated retained earnings of a company. This form serves as a financial tool to reconcile the earnings retained by a business after distributing dividends to shareholders. Understanding its purpose is crucial for accurate financial reporting and compliance with IRS regulations.

- Key Purpose: To help corporations report their retained earnings and ensure that financial statements reflect true economic performance.

- Unappropriated Retained Earnings: This refers to the portion of earnings that have not been designated for specific uses, showing a corporation's capacity to reinvest profits or distribute dividends in the future.

- Importance in Corporate Finance: It provides insights into a firm's financial health, indicating how much capital is available for reinvestment or distribution.

How to Obtain Form M-2

Obtaining Form M-2 is straightforward, as it is available through several channels that facilitate easy access for corporate taxpayers.

- IRS Website: The form can be directly downloaded from the IRS website, ensuring you have the most current version.

- Tax Preparation Software: Many commercial tax software programs, like TurboTax and H&R Block, include Form M-2 as part of their tax filing packages, making it convenient for businesses to fill out and submit.

- Professional Tax Advisors: Engaging with a certified public accountant (CPA) or tax professional can assist in obtaining not only the form but also in navigating its complexities.

Steps to Complete Form M-2

Filling out Form M-2 requires attention to detail to accurately represent retained earnings. Below are the step-by-step instructions to ensure compliance and correctness.

- Gather Financial Data: Collect all necessary accounting records, including previous years' retained earnings and current financial statements.

- Fill Personal Information: Input the corporation's name, Employer Identification Number (EIN), and the tax year for which the form is being filed.

- Report Earnings:

- Enter the beginning balance of unappropriated retained earnings.

- Include net income or loss for the year.

- Subtract any dividends paid during the tax year.

- Additional Adjustments: Make note of any adjustments that may affect retained earnings, such as prior period adjustments or accounting changes.

- Final Review and Signatures: Review all entries for accuracy and completeness before submission.

Important Terms Related to Form M-2

Understanding key terminology is essential for accurately preparing and interpreting Form M-2. Here are critical definitions to consider when working with this form.

- Retained Earnings: Cumulative profits retained for reinvestment in the business rather than distributed to shareholders.

- Net Income: The profit of a corporation after all expenses have been deducted from revenue, impacting retained earnings.

- Dividends: Payments made to shareholders from earnings, reducing the amount of retained earnings reported on Form M-2.

Key Elements of Form M-2

Several core elements must be included when completing Form M-2 to ensure comprehensive and compliant reporting.

- Beginning Balance: State the unappropriated retained earnings at the start of the tax year.

- Net Income or Loss: Accurately reflect the net result of the corporation’s operations for the year as it significantly impacts retained earnings.

- Dividends Paid: Record any dividends distributed during the year to give a complete picture of the retained earnings.

- End Balance: The concluding figure representing the total unappropriated retained earnings.

IRS Guidelines for Form M-2

The IRS provides specific guidelines for the proper use and completion of Form M-2 to ensure compliance with federal tax regulations.

- Filing Requirements: Corporations must accurately report retained earnings as part of their tax return, often required for corporations that file Form 1120.

- Record Keeping: It is essential for corporations to maintain accurate financial records, supporting each entry made on Form M-2.

- Timeliness: Adhering to the filing deadlines set forth by the IRS protects against penalties and ensures compliance with tax regulations.

Examples of Using Form M-2

Real-world scenarios illustrate how Form M-2 is used by corporations in various contexts.

- Corporation A: Reports a beginning retained earnings balance of $50,000, nets $20,000 in profits, and pays $5,000 in dividends, finishing the year with $65,000 in retained earnings.

- Corporation B: Experiences a net loss of $10,000 with no dividends, resulting in an adjusted balance of $40,000 in retained earnings when starting with $50,000 at the year's beginning.

Filing Methods for Form M-2

Corporations have several options available for submitting Form M-2, catering to different preferences and situations.

- Online Filing: Many tax software solutions facilitate electronic filing of Form M-2 along with the corporate tax return.

- Mail Submission: Corporations can also choose to print and mail the completed form to the designated IRS address provided in their tax instructions.

- In-Person Submission: While less common, some corporations may opt to deliver their forms to local IRS offices during tax season for confirmation.