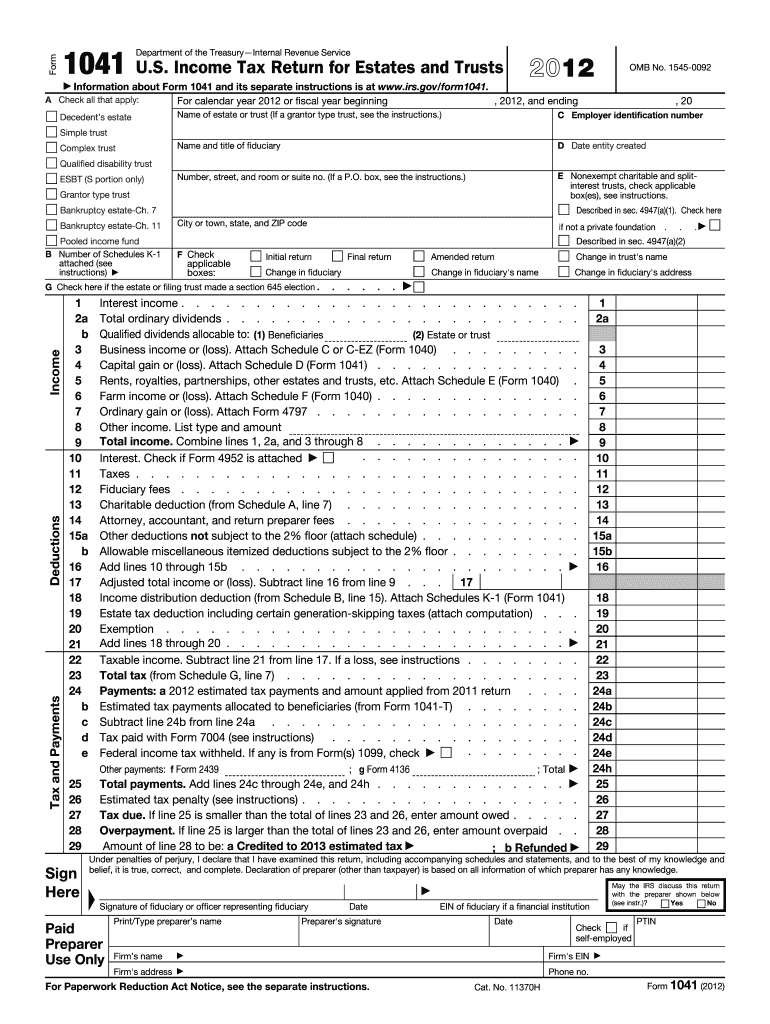

Definition and Purpose of the 2012 IRS 1041 Form

The 2012 IRS Form 1041 is the official tax return document for estates and trusts in the United States. It is designed for fiduciaries—individuals or entities tasked with managing an estate or trust—to report income, deductions, gains, and losses associated with the trust or estate. This form is essential for ensuring compliance with federal tax laws and accurately reporting financial activities on behalf of the estate or trust.

- Who Uses Form 1041: The form is typically used by fiduciaries managing estates or trusts. These can include executors, administrators, or trustees.

- Filing Requirements: If an estate or trust has a gross income exceeding $600, it is required to file Form 1041. In cases of estates with multiple beneficiaries, the necessity to file is further emphasized.

Key Elements Included in the 2012 IRS 1041 Form

Form 1041 comprises several critical sections that facilitate comprehensive reporting. Understanding each element is vital for accurate completion and compliance.

- Identification Section: This part gathers basic information about the estate or trust, including its legal name, employer identification number (EIN), and address. Proper identification helps in avoiding administrative snafus.

- Income Section: Fiduciaries report various types of income here, such as interest, dividends, and capital gains. Accurate reporting of income is essential to determine the total tax liability.

- Deductions: This section outlines allowable deductions, such as administrative expenses and distributions to beneficiaries. Statutory limits and eligibility criteria for deductions must be observed.

- Tax Calculation: Fiduciaries calculate the taxable income by subtracting deductions from total income. Tax liability is then calculated based on applicable rates.

- Distribution to Beneficiaries: A significant aspect of Form 1041 is detailing income distribution to beneficiaries, which can affect their individual tax liabilities.

Steps to Complete the 2012 IRS 1041 Form

Fiduciaries should follow a structured approach when completing Form 1041 to ensure accurate reporting and compliance with IRS regulations.

- Gather Necessary Information: Collect financial records, including income statements, paperwork for deductions, and details of all beneficiaries.

- Fill Out Identification Information: Enter the estate or trust's name, EIN, and address in the identification section.

- Report Income: Carefully document all sources of income under the income section. Use the fiscal year data to ensure accuracy.

- Claim Deductions: List all qualifying deductions clearly, including valid justification for each deduction claimed.

- Calculate Tax: Subtract total deductions from total income to arrive at taxable income, then apply the appropriate federal tax rates.

- Complete Distribution Details: Provide accurate details of income distributed to beneficiaries, ensuring that the distributions align with the estimates provided in the earlier sections.

Filing Deadlines and Important Dates for Form 1041

Adherence to timelines is crucial for compliance. Missing deadlines can result in penalties, so understanding vital dates for the 2012 IRS 1041 form is important.

- Filing Deadline: Form 1041 is typically due on the 15th day of the fourth month following the end of the estate or trust's tax year. For a calendar year filer, this means the deadline falls on April 15.

- Extensions: If necessary, fiduciaries may apply for an extension of time to file, extending the deadline by six months. However, this does not extend the payment deadline for any taxes owed.

- Estimated Tax Payments: If the estate or trust is expected to owe taxes, estimated tax payments may need to be made quarterly throughout the year to avoid penalties.

Legal Use and Compliance with the 2012 IRS 1041 Form

Understanding the legal framework surrounding the use of Form 1041 is essential for fiduciaries to ensure compliance and avoid any potential penalties.

- Legal Framework: Form 1041 must be filed in accordance with Internal Revenue Code regulations. Fiduciaries are legally obligated to complete the form accurately and timely.

- Penalties for Non-Compliance: Failure to file or late submissions may incur penalties, including a fine based on the length of the delay.

- IRS Audits: Inaccuracies or discrepancies can attract IRS audits. Maintaining clear records and documentation can protect against potential scrutiny.

Important Terms Related to the 2012 IRS 1041 Form

Familiarity with specific terminology related to Form 1041 can aid fiduciaries in understanding the complexities of tax reporting for estates and trusts.

- Fiduciary: An individual or entity responsible for managing the assets of the estate or trust.

- Beneficiary: A person or entity designated to receive assets or income from the estate or trust.

- Administrative Expenses: Costs incurred during the administration of an estate or trust, often deductible from the overall income.

- Distributable Income: The income that the fiduciary must distribute to beneficiaries, which may impact their individual tax returns.

Examples of Common Scenarios for Using the 2012 IRS 1041 Form

Real-world examples can illustrate how various situations may necessitate the use of the 2012 IRS 1041 form.

- Decedent’s Estate: When an individual dies, the executor files Form 1041 to report income generated from the estate’s assets, such as rental properties or investments held during the estate administration.

- Family Trust: A family trust that earns interest and dividends throughout the year must file Form 1041 to report this income even if no distributions occur within that year.

- Post-Mortem Filing: After the death of the trustor, a trust that continues to generate income might also be required to file Form 1041, even if it has been established for beneficiaries to inherit assets.

By following these comprehensive guidelines surrounding the 2012 IRS 1041 form, fiduciaries can effectively manage compliance, ensuring that all financial activities of estates and trusts are accurately reported to the IRS.