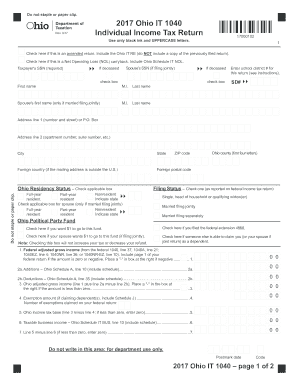

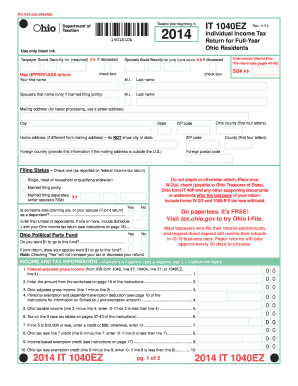

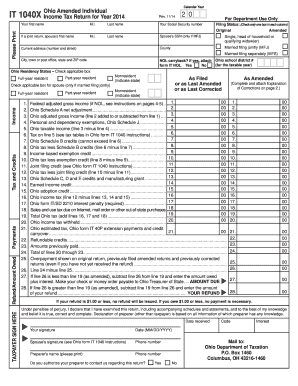

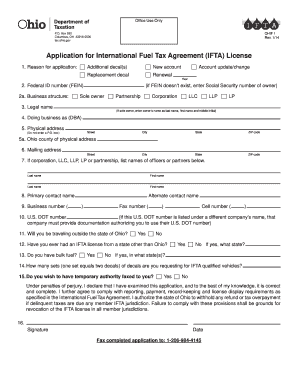

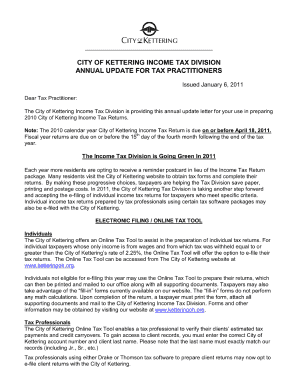

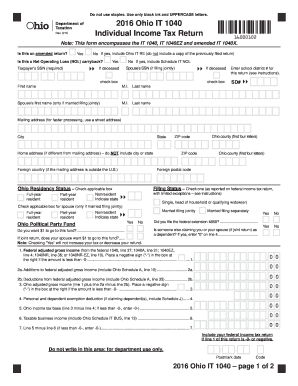

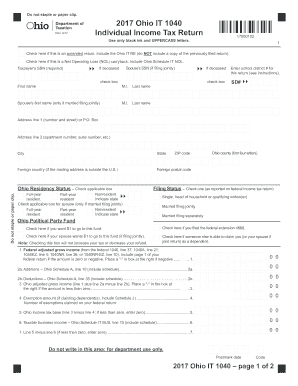

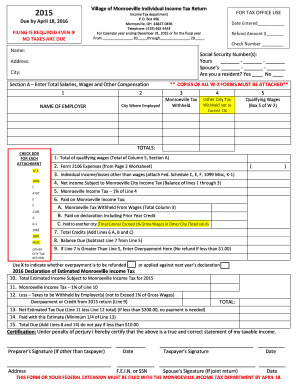

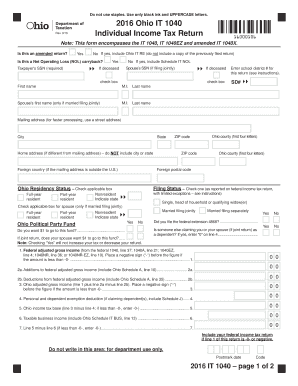

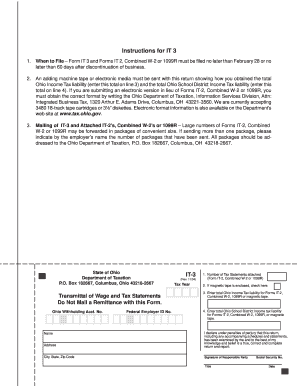

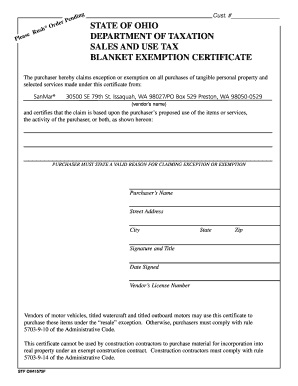

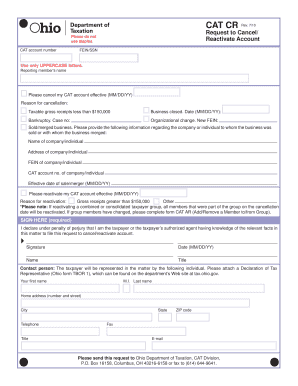

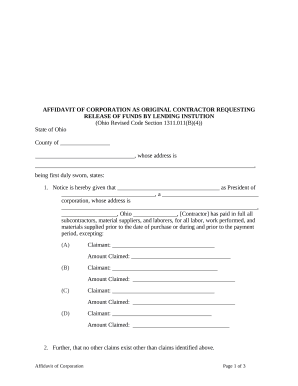

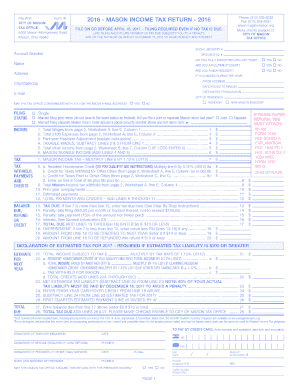

Boost productivity with our modifiable Ohio tax by mail Order Forms templates. Modify and tailor templates to fit your specific business needs in just a few steps.

Record managing takes up to half of your business hours. With DocHub, it is possible to reclaim your office time and enhance your team's efficiency. Access Ohio tax by mail Order Forms online library and check out all form templates related to your day-to-day workflows.

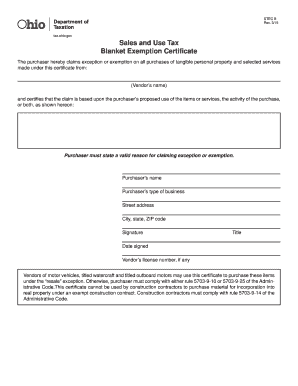

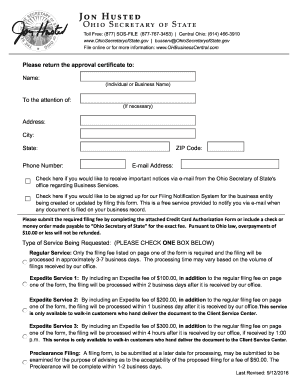

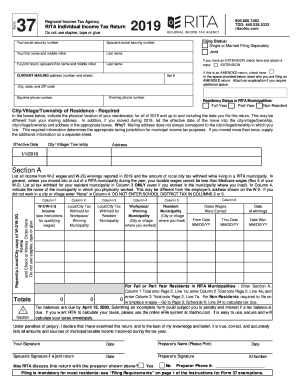

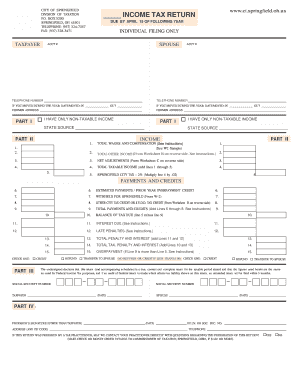

Easily use Ohio tax by mail Order Forms:

Improve your day-to-day document managing with our Ohio tax by mail Order Forms. Get your free DocHub profile today to discover all templates.