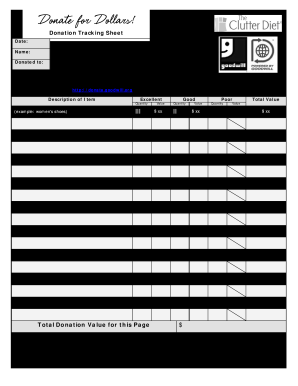

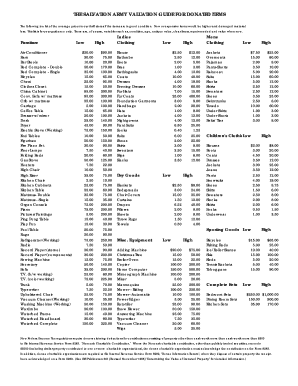

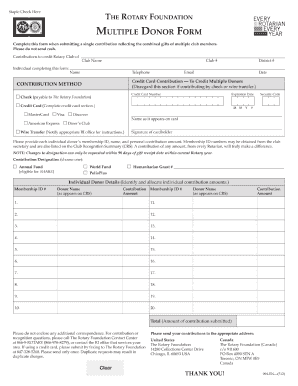

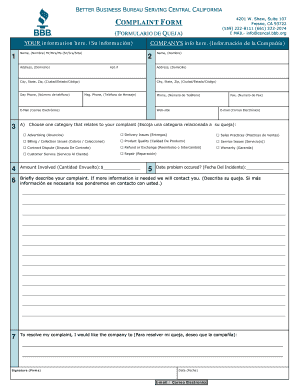

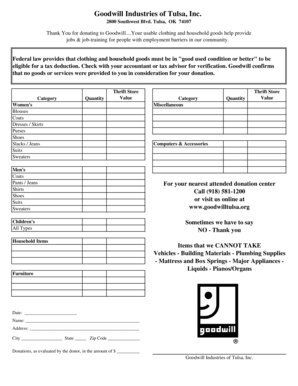

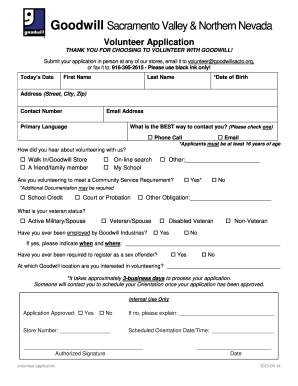

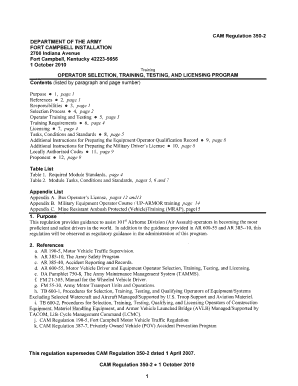

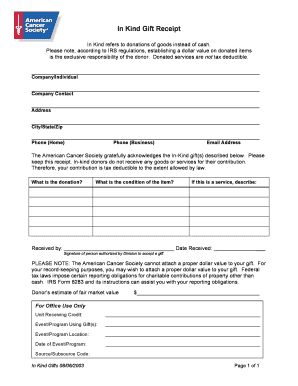

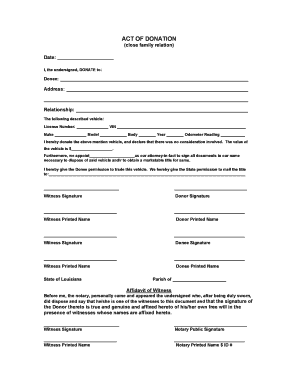

Enhance your document management with DocHub's Value guide goodwill Donation Forms collection. Effortlessly modify, collect data, and securely keep finished documents in your profile.

Accelerate your document management using our Value guide goodwill Donation Forms online library with ready-made templates that meet your needs. Access your document, change it, fill it, and share it with your contributors without breaking a sweat. Start working more effectively with your documents.

The best way to manage our Value guide goodwill Donation Forms:

Discover all of the opportunities for your online document administration with our Value guide goodwill Donation Forms. Get a free free DocHub account right now!