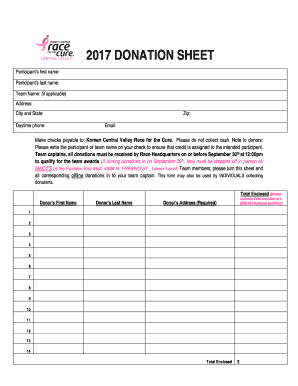

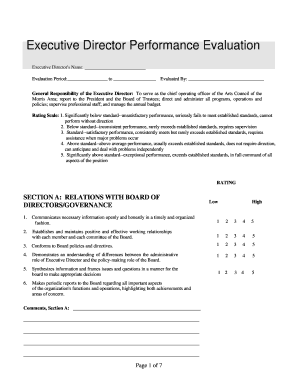

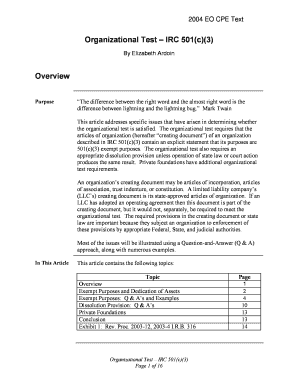

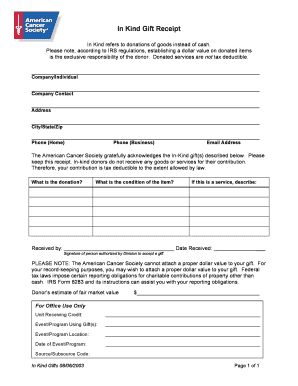

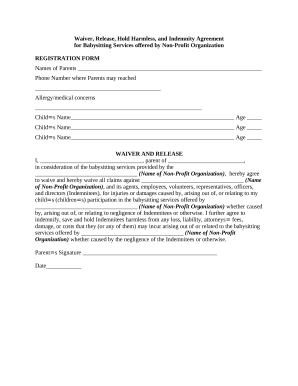

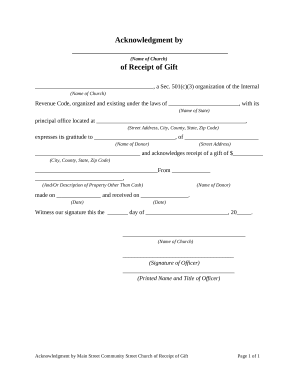

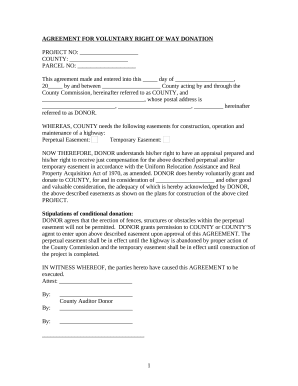

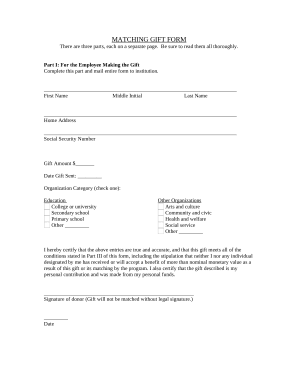

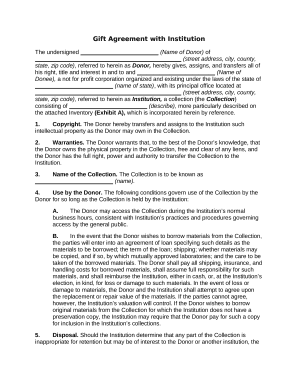

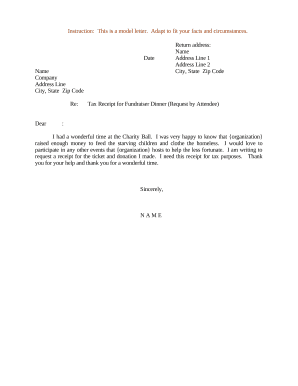

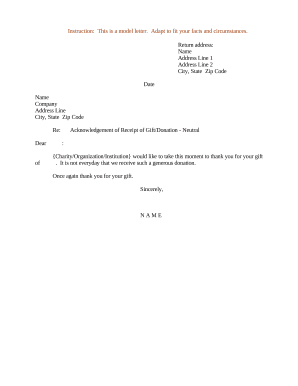

Discover appropriate documents with our 501c3 receipt of services Donation Forms catalog. Guarantee a compliant document management process with DocHub's robust document editing features.

Improve your file administration using our 501c3 receipt of services Donation Forms category with ready-made form templates that meet your needs. Access the form, alter it, complete it, and share it with your contributors without breaking a sweat. Start working more efficiently together with your forms.

The best way to manage our 501c3 receipt of services Donation Forms:

Explore all of the possibilities for your online file management with our 501c3 receipt of services Donation Forms. Get your totally free DocHub profile today!