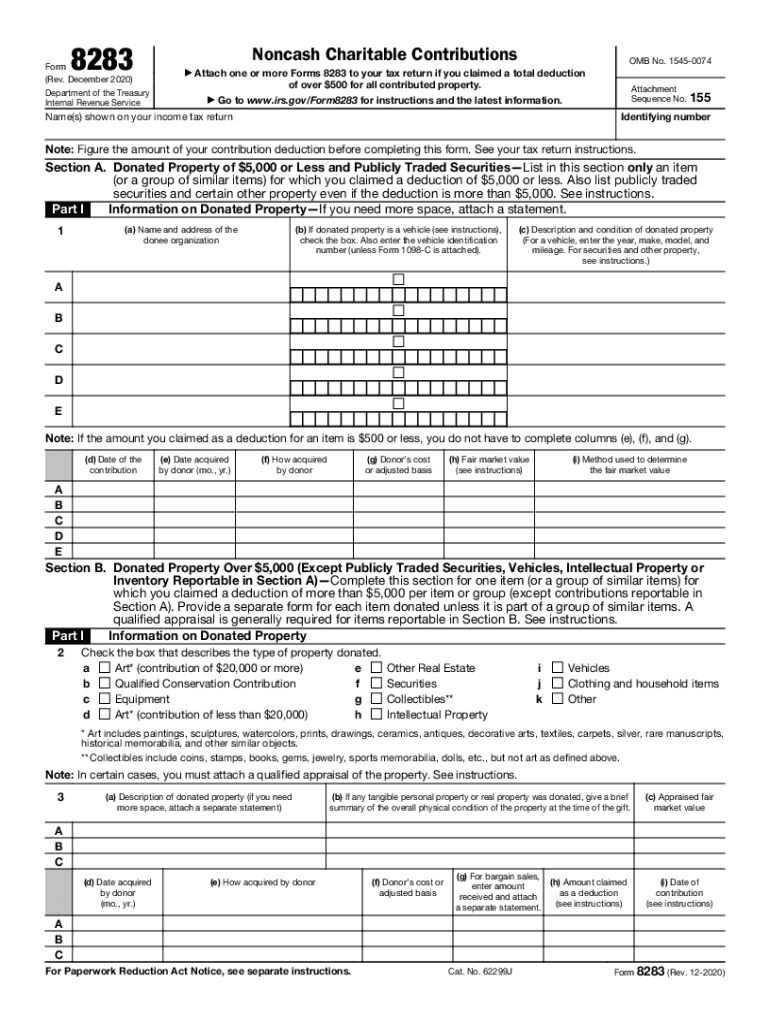

Definition and Purpose of Form 8283

Form 8283 is a tax document issued by the Internal Revenue Service (IRS) specifically tailored for reporting noncash charitable contributions. This form is necessary for taxpayers who plan to claim a deduction for property donations exceeding $500. Its primary role is to ensure transparency and compliance with tax laws concerning charitable giving, allowing the IRS to track and verify the authenticity and value of noncash donations.

Form 8283 plays a crucial role in accurately reporting contributions, helping to avoid any potential fraudulent claims that can arise from overstating a charitable contribution's value. Moreover, this form provides structured sections where donors can detail the items donated and their respective values, ensuring both taxpayers and the IRS have a clear understanding of the donations made.

Who Needs to Use Form 8283

Various taxpayers may be required to utilize Form 8283, primarily those who have made significant noncash donations.

- Individuals: This includes anyone who has contributed items valued over $500, such as clothing, furniture, or collectibles, to a qualified charitable organization.

- Corporations: Businesses may also need to file this form if they donate assets for charitable purposes.

- Partnerships and Trusts: These entities must report significant contributions made on behalf of partners or beneficiaries.

Form 8283 is especially relevant for those who donate property that may require a formal appraisal, particularly when the fair market value exceeds $5,000. This requirement ensures that both the donor and the receiving organization maintain proper records for tax purposes.

Key Elements of Form 8283

Form 8283 consists of several critical sections that taxpayers must complete to substantiate their noncash contributions.

-

General Information: This section captures taxpayer details, including the name, address, and taxpayer identification number, along with the chosen charitable organization.

-

Description of Donated Property: Donors must provide detailed descriptions of the items contributed. This includes listing the type of property and its potential use by the charitable organization.

-

Valuation of Donated Property: There are specific guidelines for valuing the donated items. Taxpayers must follow IRS standards for fair market value calculations and, if necessary, provide documentation or appraisals for high-value items.

-

Signature and Acknowledgements: Certification from both the donor and the charitable organization is required to confirm the legitimacy and receipt of the contribution. This confirmation helps in validating the claim during audits.

-

Additional Information: For donations exceeding $5,000, additional documentation may be required, ensuring that all relevant details are captured accurately.

Steps to Complete Form 8283

Completing Form 8283 involves several methodical steps to ensure compliance with IRS regulations.

-

Gather Necessary Information: Before beginning, consolidate your personal details, information about the charitable organization, and relevant documentation proving the value of your donated items.

-

Fill Out the Form: Start with your personal information at the top of the form, followed by the details of the charity. Proceed to describe each item being donated, ensuring clarity and accuracy.

-

Determine Fair Market Value: Calculate the fair market value of the donated items according to IRS guidelines. If the value exceeds $5,000, obtain a qualified appraisal and attach it to the form.

-

Obtain Signature: After filling in the necessary details, ensure both the donor and the authorized representative from the charity sign the form to validate the transaction.

-

Attach to Tax Return: Once the form is completed and signed, attach it to your income tax return. This submission is essential for claiming the deduction for your noncash contributions.

Important IRS Guidelines for Form 8283

The IRS provides explicit instructions and guidelines that dictate how Form 8283 should be completed and submitted.

-

Claim Limitations: Ensure that the deduction claimed corresponds with the value reported on the form. The IRS mandates that donations cannot exceed the fair market value established at the time of the donation.

-

Record Keeping: Taxpayers must maintain thorough records to support the deduction, including receipts, appraisals, or other documentation that substantiates the value and nature of the donated property.

-

Submission Deadlines: Form 8283 must be submitted with the taxpayer’s annual return. For most taxpayers, this means completing the form by April 15 of the following tax year, unless an extension applies.

Filing Form 8283 with accurate and complete information not only supports deduction claims but also aligns with IRS compliance, reducing the risk of future audits or penalties.