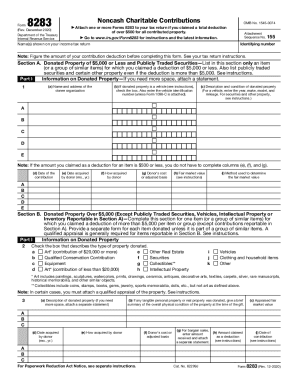

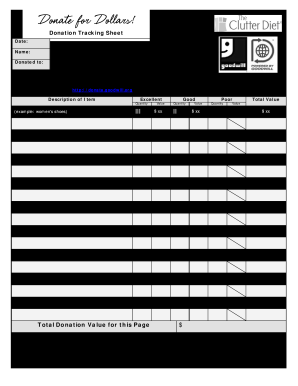

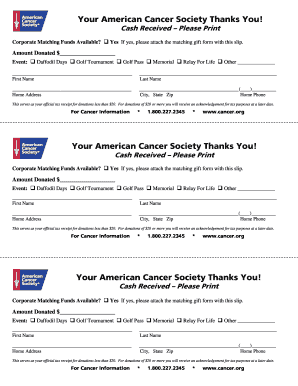

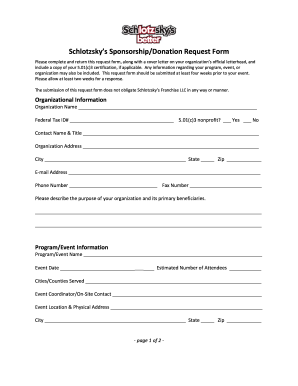

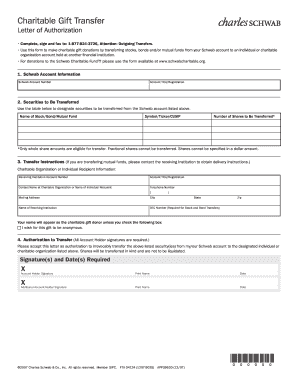

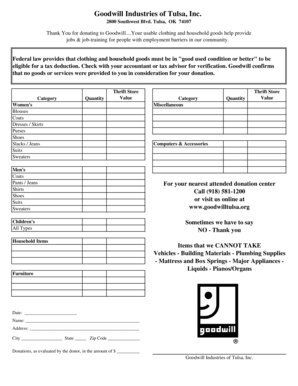

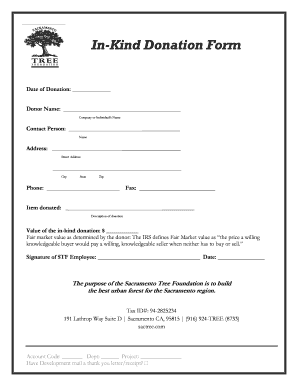

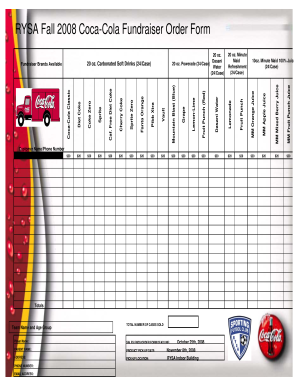

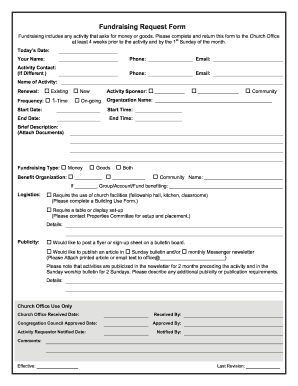

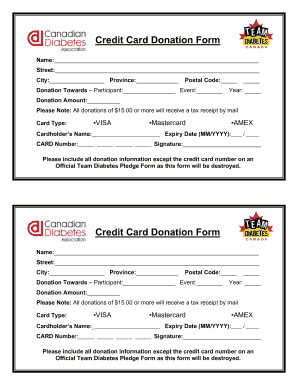

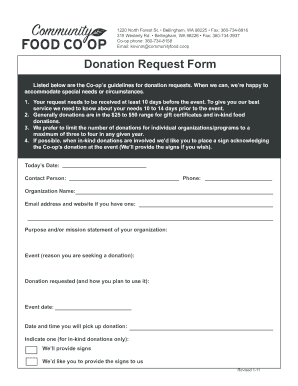

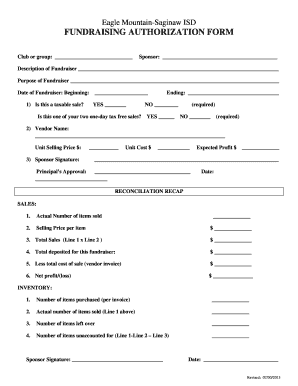

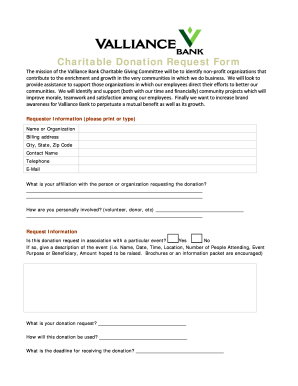

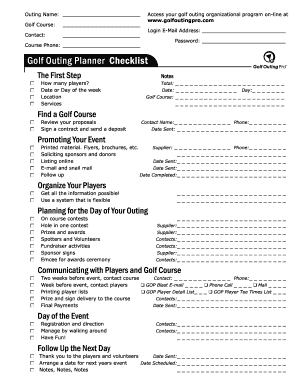

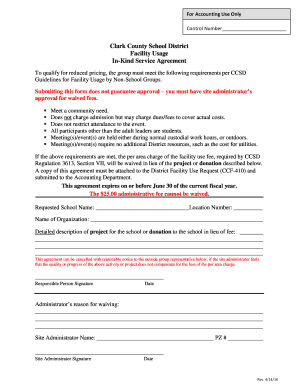

Keep track of all your donations easily with Receipt charitable events Donation Forms collection. Get them at any time, anywhere, and never miss crucial fundraising data again.

Document management can stress you when you can’t find all of the forms you require. Fortunately, with DocHub's vast form categories, you can get everything you need and promptly manage it without the need of changing among apps. Get our Receipt charitable events Donation Forms and begin utilizing them.

The best way to manage our Receipt charitable events Donation Forms using these easy steps:

Try out DocHub and browse our Receipt charitable events Donation Forms category with ease. Get a free profile today!