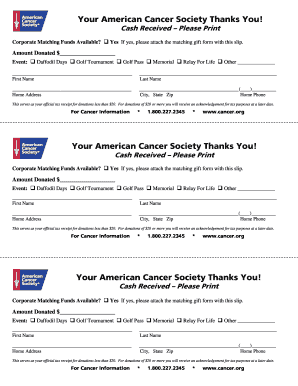

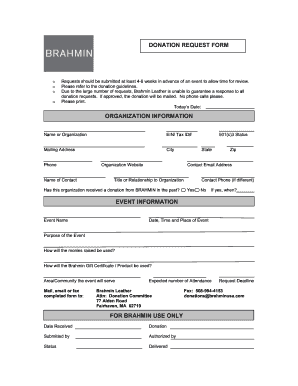

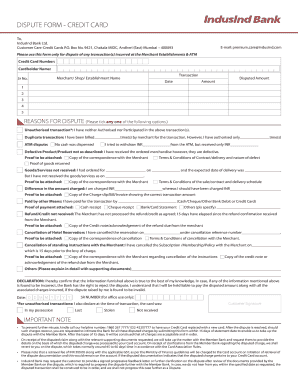

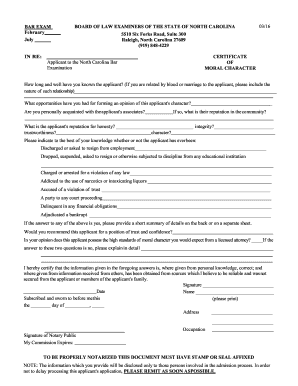

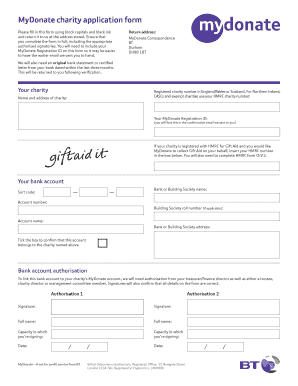

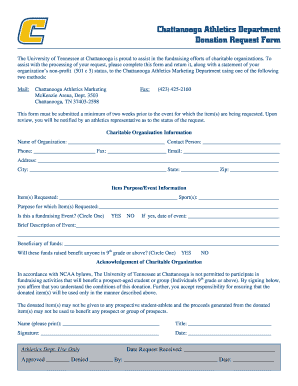

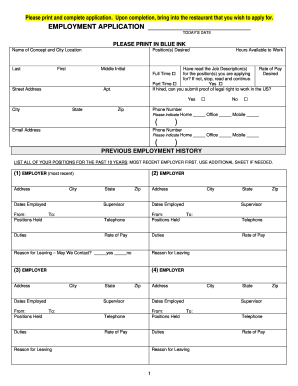

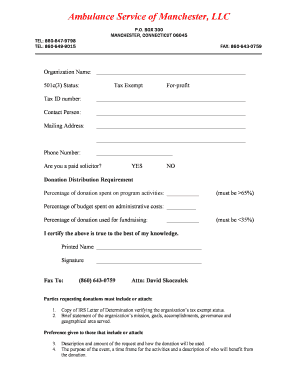

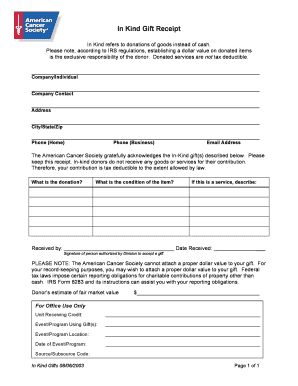

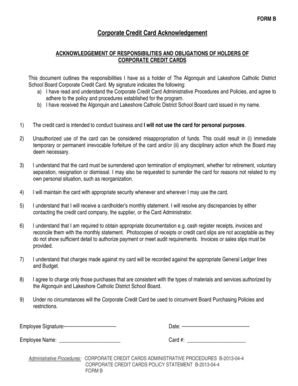

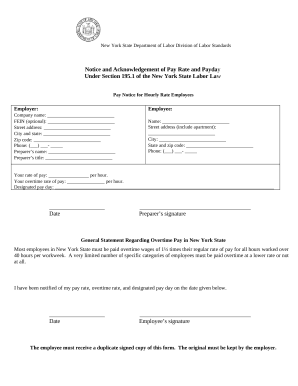

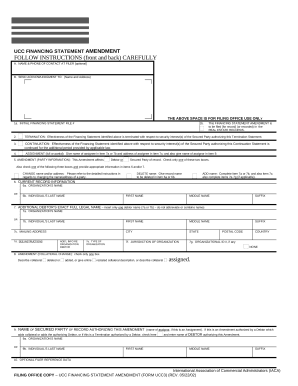

Access compliant and customizable Email acknowledgement Donation Forms. Locate and pick the forms appropriate to your daily document management processes.

Your workflows always benefit when you are able to get all the forms and files you require on hand. DocHub gives a huge selection of document templates to ease your day-to-day pains. Get hold of Email acknowledgement Donation Forms category and easily discover your form.

Start working with Email acknowledgement Donation Forms in a few clicks:

Enjoy fast and easy form administration with DocHub. Check out our Email acknowledgement Donation Forms category and find your form today!