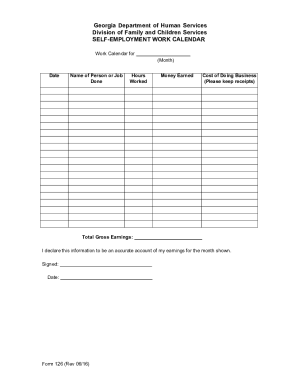

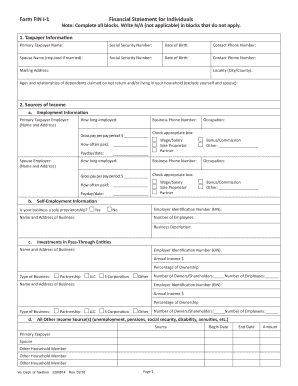

Edit and fill One year self employment Balance Sheet Templates and securely send them online. Organize your funds and obligations, complete, eSign, and save completed forms all in one location.

Record managing occupies to half of your office hours. With DocHub, it is simple to reclaim your time and effort and improve your team's productivity. Get One year self employment Balance Sheet Templates online library and explore all document templates related to your everyday workflows.

Easily use One year self employment Balance Sheet Templates:

Improve your everyday document managing using our One year self employment Balance Sheet Templates. Get your free DocHub profile right now to explore all forms.