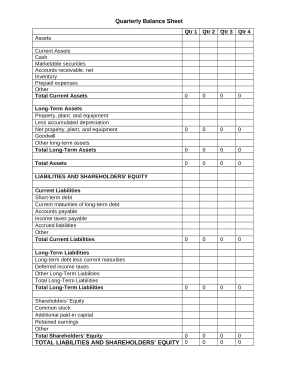

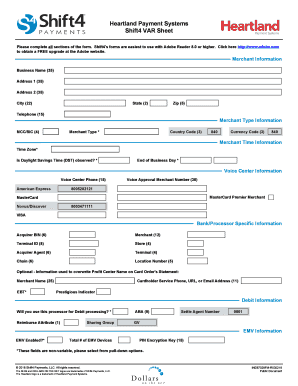

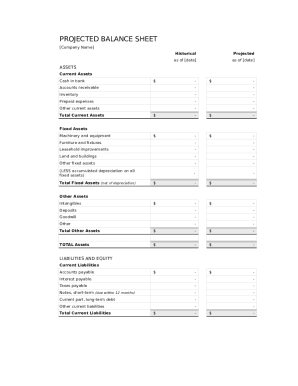

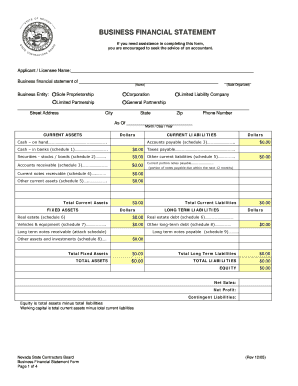

Collaborate and adjust Diy bill pay Balance Sheet Templates in real-time. Sign up for a free DocHub and manage your finances with accuracy, stay ahead your competition, and secure your data.

Boost your form operations with our Diy bill pay Balance Sheet Templates online library with ready-made templates that meet your requirements. Access your document template, alter it, complete it, and share it with your contributors without breaking a sweat. Start working more efficiently together with your forms.

How to use our Diy bill pay Balance Sheet Templates:

Discover all the possibilities for your online file management with our Diy bill pay Balance Sheet Templates. Get your free free DocHub profile right now!