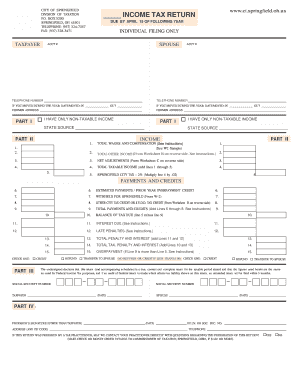

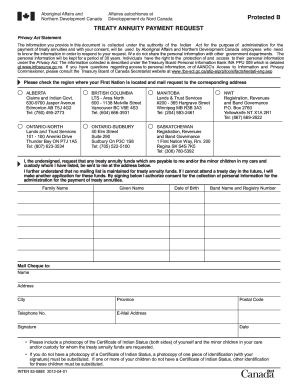

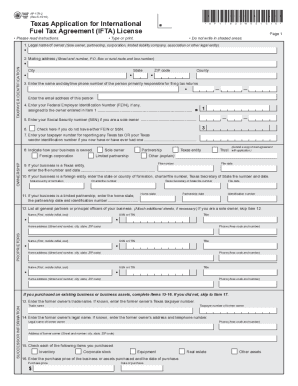

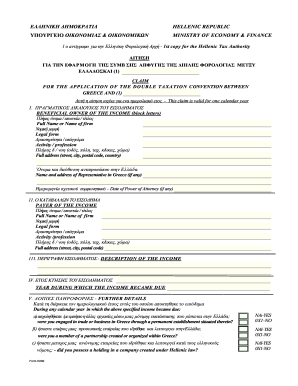

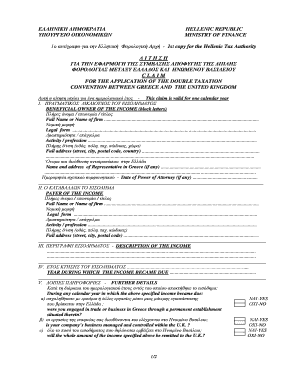

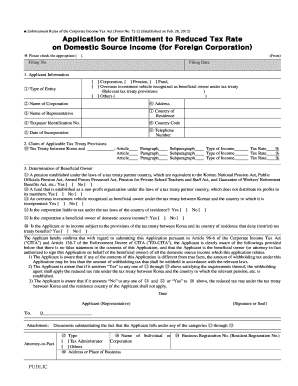

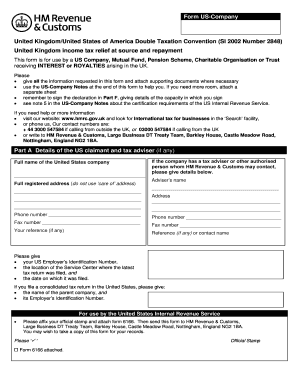

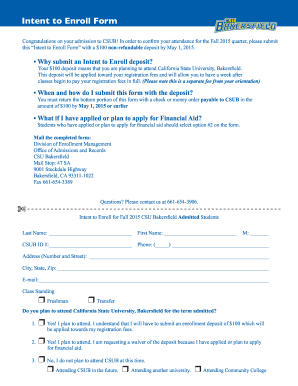

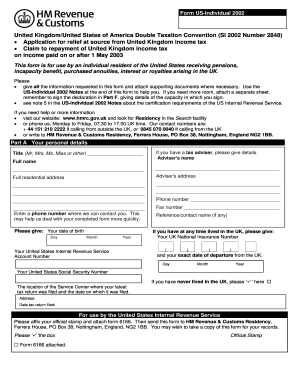

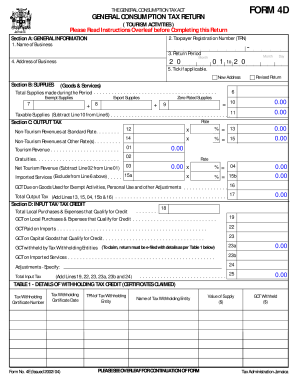

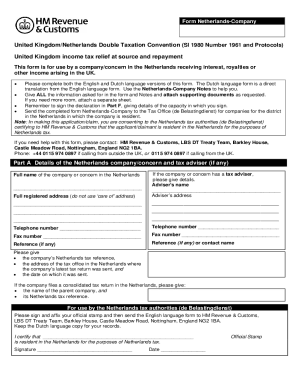

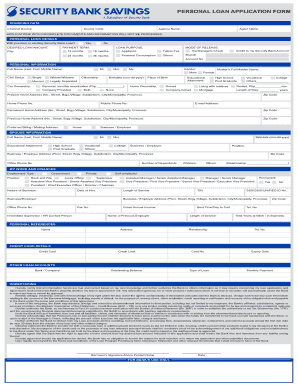

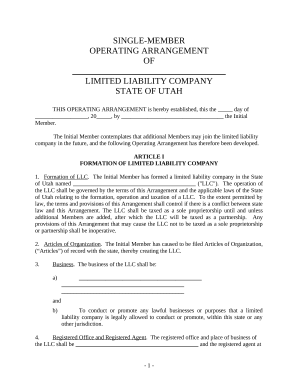

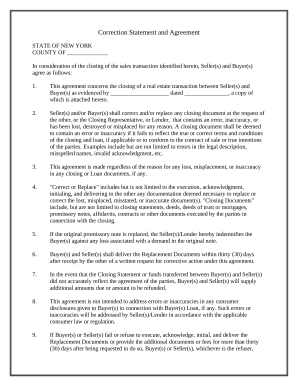

Track and maximize your Income tax convention Application Forms handling. Effortlessly locate, view, and complete documents for individual and commercial use with DocHub free account.

Boost your document managing with the Income tax convention Application Forms collection with ready-made templates that suit your requirements. Get the document template, edit it, complete it, and share it with your contributors without breaking a sweat. Begin working more efficiently with your forms.

How to use our Income tax convention Application Forms:

Examine all of the opportunities for your online file management with our Income tax convention Application Forms. Get your totally free DocHub profile today!