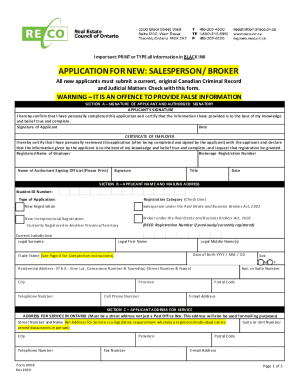

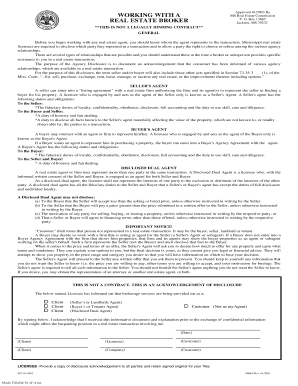

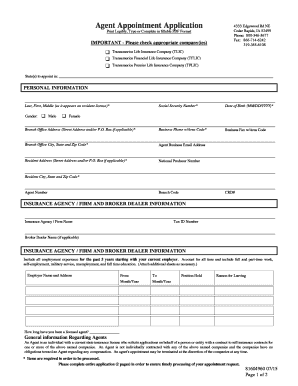

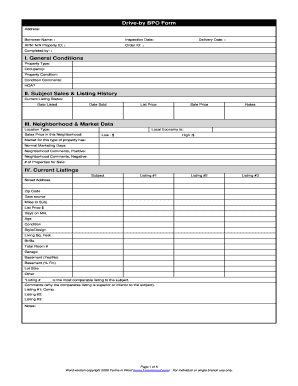

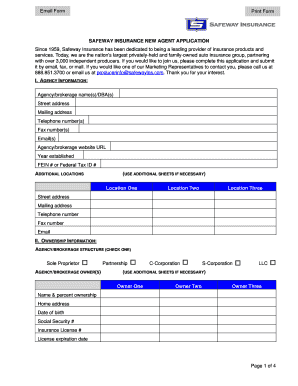

Get and retrieve Broker Application Forms to streamline your document submission procedure. Pick from a range of different ready-made forms and easily modify them in DocHub online editor.

Boost your file operations with the Broker Application Forms online library with ready-made templates that suit your needs. Access the document, edit it, complete it, and share it with your contributors without breaking a sweat. Start working more effectively with the forms.

The best way to use our Broker Application Forms:

Examine all the possibilities for your online document management using our Broker Application Forms. Get your totally free DocHub account right now!