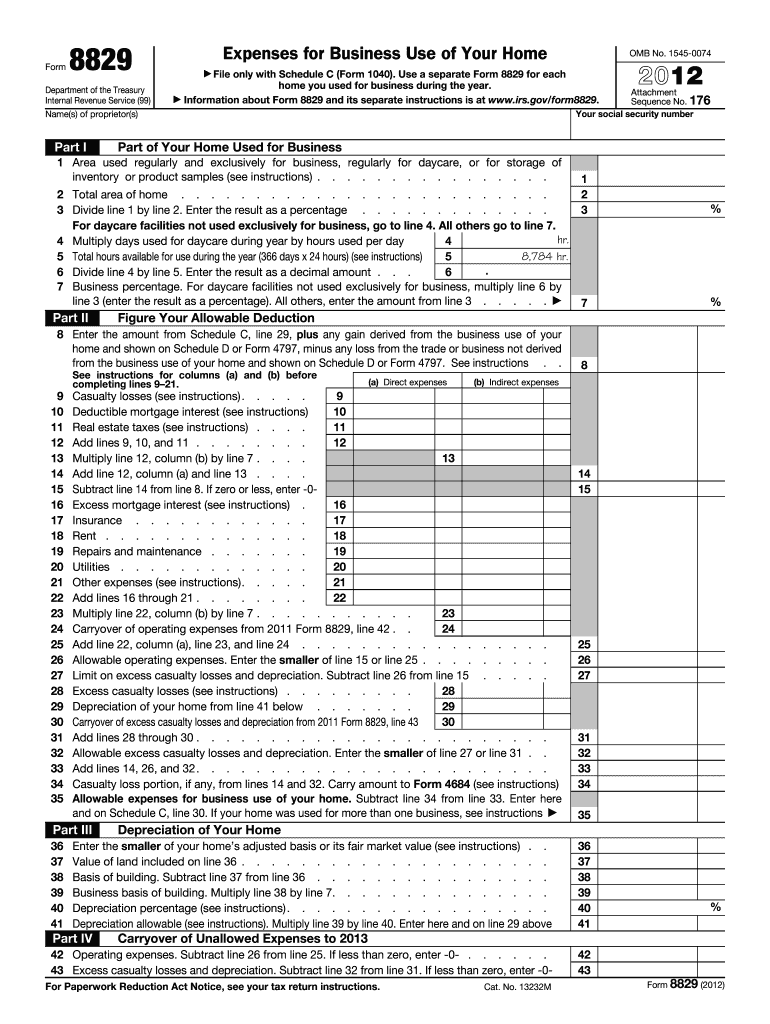

Definition and Purpose of the 2012 Form 8829

Form 8829, officially titled "Expenses for Business Use of Your Home," is a vital document utilized by self-employed individuals to detail and report the expenses associated with their home office. This form enables taxpayers to calculate the allowable business-use-of-home expenses when filing their taxes with Schedule C (Form 1040). By completing this form accurately, taxpayers can ensure they maximize their deductions related to the percentage of their home dedicated to business activities.

This form is specifically designed for those who use a portion of their home exclusively and regularly for business purposes. By distinguishing between direct and indirect expenses, taxpayers can well articulate the financial implications of operating a business from their residence. Understanding the nuances of this form can significantly affect the net taxable income of self-employed individuals.

Steps to Complete the 2012 Form 8829

Completing Form 8829 involves several steps, each designed to help taxpayers calculate their eligible home office deductions accurately.

-

Determine Business Percentage: Calculate the portion of your home used for business. This often involves measuring the square footage of your home office compared to the total area of your home.

-

Identify Direct Expenses: List all direct expenses related to your home office. These may include costs like repairs and maintenance that apply exclusively to the office space.

-

Calculate Indirect Expenses: Indirect expenses, such as utilities and mortgage interest, should be apportioned based on the business-use percentage you've calculated. For example, if your home office constitutes 10% of your home's total space, you can claim 10% of those indirect expenses.

-

Depreciation: In cases where taxpayers own the home, calculate the depreciation expense corresponding to the business use of the home. This usually involves determining your home's adjusted basis and useful life.

-

Complete the Form Sections: Fill out the relevant sections, including the calculations for each category of expenses. Ensure accuracy to avoid issues with the IRS.

-

Attach to Tax Return: Finally, submit Form 8829 with your Schedule C of Form 1040 when you file your annual tax return.

By following these steps methodically, taxpayers can streamline the process of reporting expenses related to their home office on the 2012 Form 8829.

Important Terms Related to the 2012 Form 8829

Understanding key terminology associated with Form 8829 can facilitate better comprehension of the form and the reporting requirements. Some essential terms include:

- Exclusively Used: A requirement indicating that the space must be used solely for business purposes to qualify for deductions.

- Direct Expenses: Costs that pertain specifically to the home office area, such as repairs or maintenance on that space alone.

- Indirect Expenses: Costs like utilities and property taxes that are shared among both personal and business use, requiring a prorated calculation.

- Depreciation: The allocation of the cost of your home office over its useful life, which can also affect tax planning.

- Business-Use Percentage: The ratio calculated by dividing the space used for business by the total space of the home, critical in determining the apportionment of expenses.

Having an understanding of these terms is crucial for accurately completing Form 8829 and effectively navigating the tax implications associated with a home office.

Examples of Using the 2012 Form 8829

Practical examples significantly enhance understanding and application of Form 8829. Consider the following scenarios:

-

Freelance Graphic Designer: A graphic designer operates from a dedicated 200-square-foot office in a 2,000-square-foot home. The business-use percentage is ten percent. They total an annual utility bill of $2,400, which translates to $240 claimed as a business expense.

-

Consultant Working from Home: A consultant uses a spare bedroom for their activities. The room is 150 square feet, while the total area of the home is 1,500 square feet. The individual can claim 10% of their mortgage interest and insurance costs, along with direct expenses such as paint purchased specifically for the office.

These examples illustrate the routine application of Form 8829, empowering taxpayers to calculate and claim the appropriate deductions associated with their home office accurately.

Filing Deadlines and Important Dates for the 2012 Form 8829

Understanding the key deadlines for filing Form 8829 is critical to ensuring compliance with IRS requirements. Form 8829 must be filed by the due date of your tax return, generally April 15 for most individual taxpayers.

-

Extension: If a taxpayer applies for a tax extension, they can also extend the deadline for submitting Form 8829.

-

Estimated Tax Payments: Taxpayers making estimated quarterly tax payments need to consider the impact that the deductions calculated on Form 8829 will have on these payments.

Timely submission of Form 8829 allows taxpayers to effectively claim allowable deductions that can lower their tax liabilities for the year.

Eligibility Criteria for Using the 2012 Form 8829

Form 8829 is specifically designed for taxpayers who meet certain eligibility criteria. To qualify for using this form, individuals typically must:

-

Self-Employed Status: Be in a trade or business for themselves or have income reported on Schedule C.

-

Exclusive Use Requirement: Utilize part of their home exclusively and regularly for business purposes.

-

Proper Documentation: Maintain proper records of related expenses incurred for the home office.

-

Ownership or Lease: Either own the home or have the right to use the residential unit as a home office.

Understanding these eligibility criteria helps ensure that taxpayers apply Form 8829 correctly and avoid complications with the IRS due to ineligibility.