Overview of the 2013 Form 8829

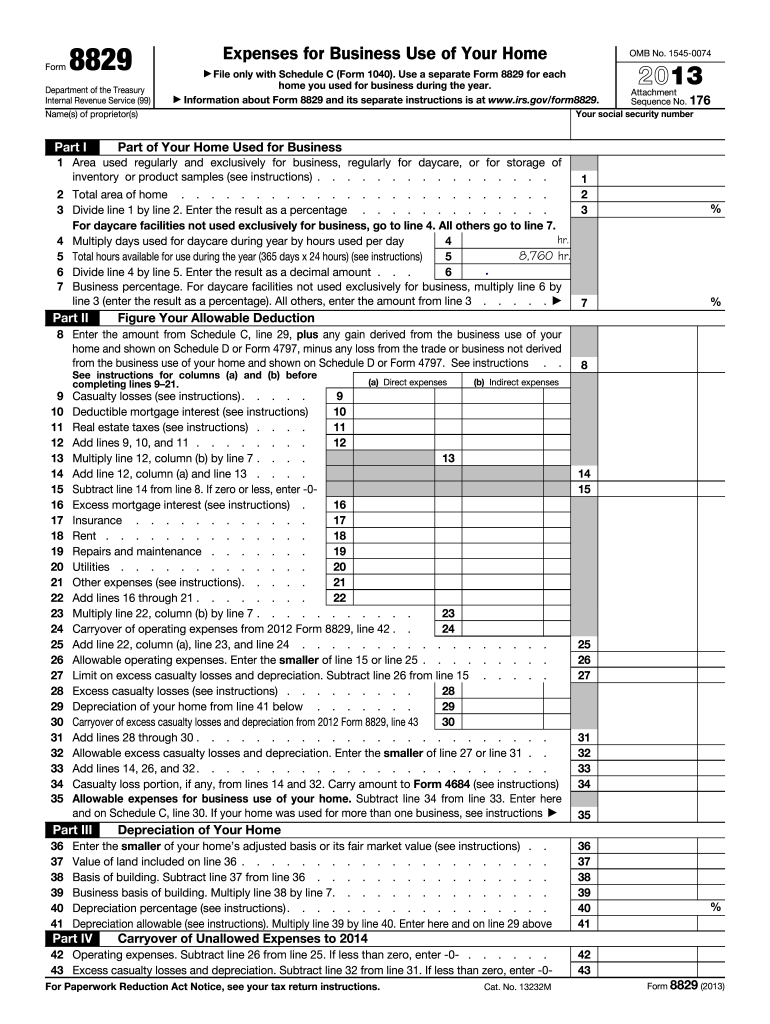

The 2013 Form 8829, titled "Expenses for Business Use of Your Home," is designated for taxpayers who operate a business from home. This form enables individuals to claim deductions related to the expenses incurred for the business's home office. It captures essential details regarding the area of the home used exclusively for business purposes and outlines the various expenses eligible for deductions. Key areas of the form include the calculation of both direct and indirect expenses, as well as depreciation costs associated with the home office.

Understanding the 2013 Form 8829 is crucial for maximizing tax benefits and ensuring compliance with IRS regulations. Taxpayers can significantly reduce their tax burden by accurately reporting eligible expenses related to the business use of the home.

Key Elements of the 2013 Form 8829

The form consists of several critical components designed to guide the taxpayer through the reporting process:

-

Home Office Area Calculation: Taxpayers must provide details about the square footage of the home office compared to the entire home. Identifying this area accurately is fundamental to determining allowable deductions.

-

Direct vs. Indirect Expenses: The form distinguishes between direct expenses, which are solely for the home office (e.g., repairs and maintenance), and indirect expenses, which benefit the entire home (e.g., utilities and mortgage interest).

-

Depreciation: Taxpayers can deduct depreciation for the portion of their home used for business. This requires an understanding of the depreciation method chosen and its implications on tax returns.

-

Actual Expenses vs. Simplified Method: Taxpayers have the option to use actual expenses or the simplified method for deductions. Under the simplified approach, a standard deduction per square foot is applied without the need for extensive documentation.

Detailed completion of each section ensures an accurate reflection of qualifying expenses, ultimately resulting in a more favorable tax liability.

How to Use the 2013 Form 8829

Using the 2013 Form 8829 requires careful attention to detail and a systematic approach:

-

Determine Eligibility: Confirm that your home office meets IRS criteria for exclusive and regular use.

-

Calculate Home Office Size: Measure the space used for business activities. Record both the total area of your home and the area allocated for business.

-

List Expenses: Compile a comprehensive list of direct and indirect expenses incurred for maintaining your home office. This may include utilities, repairs, and a portion of your mortgage interest.

-

Complete Sections: Fill out each relevant section of the form meticulously, ensuring all computations are accurate. Include calculations for depreciation if applicable.

-

Attach to Tax Return: Submit the completed Form 8829 alongside Schedule C of Form 1040 when filing your annual tax return. This helps the IRS process your deductions accurately.

Proper adherence to these steps maximizes the benefits associated with the home office deduction while maintaining compliance with tax laws.

Examples of Using the 2013 Form 8829

Illustrating the application of the 2013 Form 8829 can clarify its utility for various taxpayers. For instance:

-

Scenario 1: A freelance graphic designer uses a dedicated room in their home as an office. By accurately measuring the space and tracking their business-related expenses like internet service and office supplies, they can significantly reduce their taxable income by reporting these expenses using the form.

-

Scenario 2: A small business owner operates a consulting firm from their home. They measure the office area, document the utility bills, and incur costs related to office furniture in the home office. By completing Form 8829, they can report both direct and indirect expenses, ensuring they claim all eligible deductions.

Each scenario highlights the importance of the form in tax planning and compliance.

Filing Deadlines and Important Dates for the 2013 Form 8829

Timely submission of the 2013 Form 8829 is critical for proper tax filing. The following deadlines apply:

-

Tax Filing Deadline: Generally, the deadline for submitting Form 8829 along with your income tax return is April 15th of the following year. If this date falls on a weekend or holiday, the deadline extends to the next business day.

-

Extensions: Taxpayers may apply for an extension, moving the filing deadline to October 15th. However, any taxes owed must still be paid by the original deadline to avoid penalties.

Awareness of these deadlines ensures taxpayers do not incur unnecessary fines or complications with their tax return.

Important Terms Related to the 2013 Form 8829

Familiarity with specific terminology related to the 2013 Form 8829 can aid in its proper application:

-

Home Office Deduction: A tax deduction available to qualifying taxpayers who use part of their home for business purposes. The deduction can significantly lower taxable income.

-

Direct Expenses: Costs that are solely attributable to the home office, such as repairs specific to that area.

-

Indirect Expenses: Costs that benefit the entire home, such as mortgage interest, property taxes, and general maintenance.

-

Simplified Method: An alternative approach for calculating home office deductions, which allows for a set rate per square foot of home office space, minimizing record-keeping.

Understanding these terms enhances comprehension of the form and improves ease of use during tax filing.