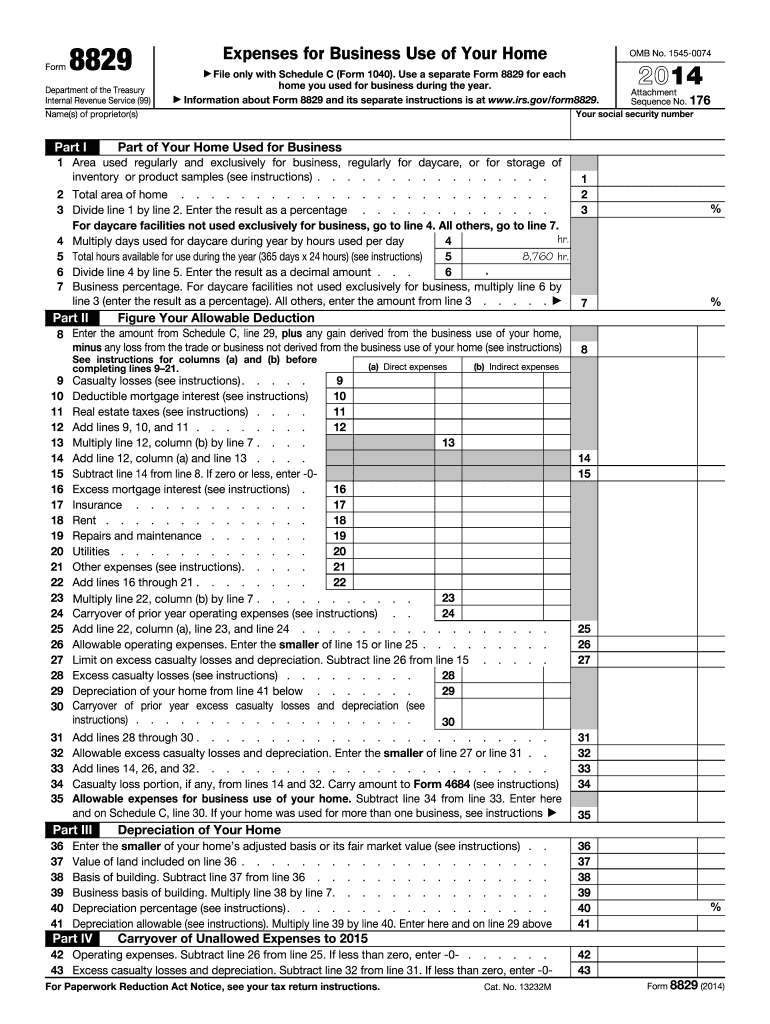

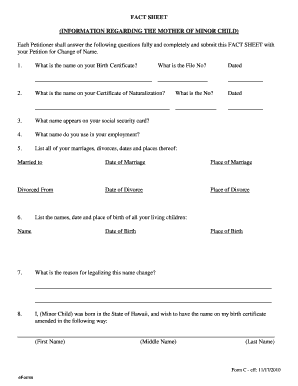

Definition and Purpose of the 2 Form

The 2 form, officially titled "Expenses for Business Use of Your Home," is a tax form used by self-employed individuals to report expenses related to the utilization of their home as a workspace. This form allows taxpayers to claim deductions for certain expenses associated with their home office. These expenses can be both direct and indirect, and may include various categories such as mortgage interest, property taxes, utilities, repairs, and depreciation.

The main objective of using the 2 form is to provide a structured way for taxpayers to calculate their allowable home office deduction. The eligibility for these deductions is contingent on the exclusive and regular use of part of the home for business activities. Taxpayers can report the percentage of the home used for business and apply it to the total expenses incurred, leading to potential tax savings.

Additionally, the form guides users through calculating their home office deduction, ensuring that they provide necessary documentation and accurately report their expenses. This serves both to comply with IRS regulations and to maximize potential deductions for those who qualify.

How to Use the 2 Form Effectively

Using the 2 form requires attention to detail and understanding of the specific sections that pertain to your situation. Upon obtaining the form, taxpayers should follow these steps:

-

Determine Eligibility: Confirm that your home office qualifies under IRS guidelines, which stipulate that the space must be used regularly and exclusively for business. Common scenarios include home-based businesses or offices where clients meet.

-

Collect Relevant Data: Gather all documents detailing home expenses. This includes mortgage statements, utility bills, insurance, and receipts for home office improvements or repairs.

-

Calculate Business Use Percentage: Determine the portion of your home's square footage that is dedicated to your business. This can be calculated by dividing the area used exclusively for the business by the total area of the home.

-

Fill Out Relevant Sections: Complete the different sections of the form that pertain to your specific expenses. This involves detailing both direct expenses, such as repairs made specifically to the home office, and indirect expenses, such as a percentage of utilities.

-

Stay Compliant with IRS Guidelines: Ensure all reported expenses align with IRS requirements, which frequently update. Attach any necessary documentation for verification if required during an audit.

Key Elements and Required Information on the 2 Form

Understanding the key elements of the 2 form is critical for accurate completion. The form consists of several parts:

-

Part I: Determining the Home Office Deduction: This section requires input on the percentage of home used for business purposes and the total area of the home.

-

Part II: Direct Expenses: Taxpayers must list any costs incurred that pertain solely to the business portion of the home, which directly contribute to its upkeep or operation.

-

Part III: Indirect Expenses: This section consolidates expenses like mortgage interest, property taxes, utilities, and homeowners insurance. Taxpayers must apply the previously calculated business use percentage to derive the deductible amount.

-

Part IV: Depreciation: If you are claiming depreciation on your home, detailed calculations concerning the adjusted basis, improvements, and the period used are required. Specific guidance must be adhered to in calculating depreciation to ensure compliance.

Examples of Using the 2 Form in Different Scenarios

The application of the 2 form varies based on individual taxpayer scenarios. Here are a few illustrative examples:

-

Self-Employed Consultant: A self-employed consultant works from a dedicated office space in their home measuring 200 square feet within a total of 1,000 square feet. They can claim 20% of direct and indirect expenses on the 8829 form, including their relevant amounts for internet bills and business insurance.

-

Freelance Graphic Designer: A freelancer using a specific room in their home exclusively for their design work can leverage the form to deduct costs associated with design software and office furniture. They may also include a proportion of the mortgage interest and utilities based on the percentage of square footage used for business.

-

Home-Based Bakery: An individual running a bakery from home would detail the expenses related to the part of the kitchen dedicated to business, such as costs for ingredients, renovation receipts, and a percentage of utility bills demonstrating the usage of business functions.

Filing Deadlines and Important Dates for 2 Form

Filing deadlines for the 2 form align with those for the individual income tax return. For most taxpayers, the following key dates are critical:

-

Tax Year End: The form is used for the tax year ending December 31, 2014, and must be submitted along with your annual tax return.

-

Filing Deadline: The usual deadline for submitting personal tax returns is April 15 of the following year (2015). However, if this date falls on a weekend or holiday, the deadline may be automatically extended to the next business day.

-

Extensions: If additional time is necessary, taxpayers can apply for an extension, pushing the deadline to October 15. Ensure that Form 8829 is included in any extensions filed for full compliance.

Important Terms Related to the 2 Form

Understanding terms associated with the 2 form can enhance comprehension and ensure compliance:

-

Direct Expenses: Costs incurred for the operation of the home office space itself, like painting or repairs done specifically for that area.

-

Indirect Expenses: Costs related to the maintenance of the entire home, such as utilities and property taxes, from which only the business-use portion can be deducted.

-

Home Office Deduction: A tax break allowing self-employed individuals to deduct certain expenses related to a home-based business workspace.

-

Exclusive Use: A provision stating that the portion of the home claimed must be used solely for business activities, not for personal use.

-

Square Footage Calculation: A method used to determine the ratio of business usage to total home space, integral to calculating deductions.

Each of these terms forms the foundation for effectively navigating the complexities associated with the 2 form, providing clarity on allowable deductions for home business usage.