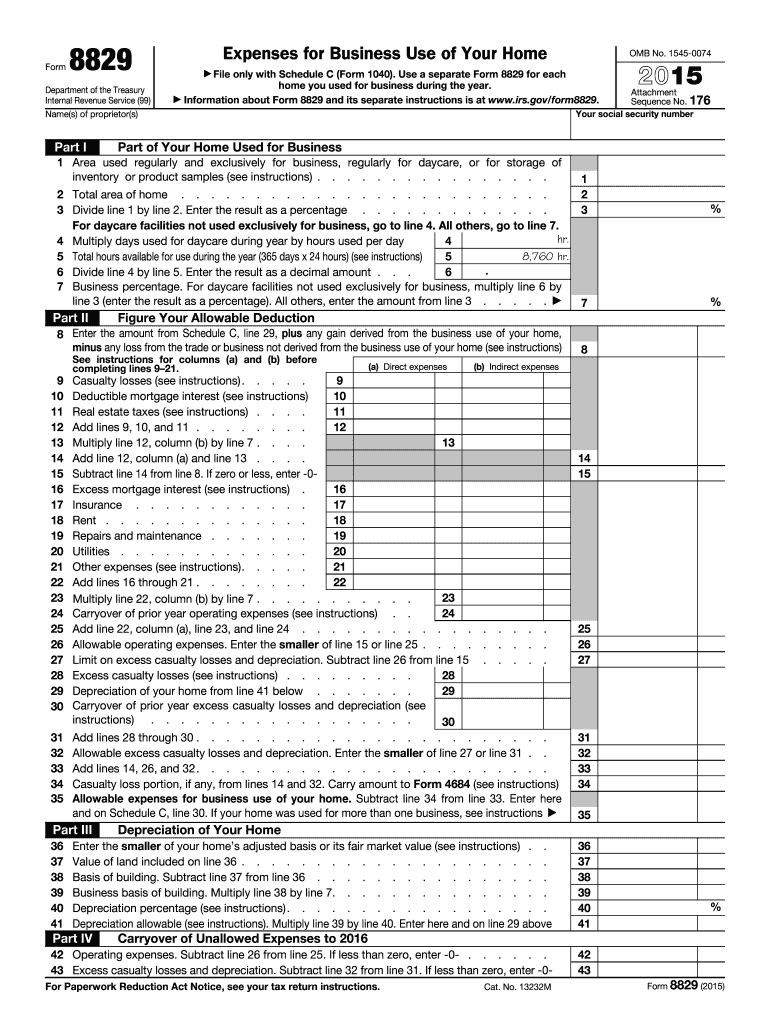

Definition and Overview of Form 8829 (2015)

Form 8829 is utilized for reporting expenses related to the business use of a home when individuals file their taxes using Schedule C (Form 1040). This form plays a crucial role in calculating allowable deductions linked to a home office, which can significantly reduce tax liability for eligible taxpayers. To complete Form 8829, users must provide specific details concerning the square footage of their home used for business activities, as well as itemized calculations of both direct and indirect expenses associated with the home office. Understanding the nuances of this form is essential for maximizing deductions and complying with IRS regulations.

Key Components of Form 8829

The form requires tax filers to detail:

- Total Area of Home: Indicate the total square footage of the residence and the portion used for business.

- Direct Expenses: List all expenses directly related to the home office, such as repairs and maintenance that only affect that part of the home.

- Indirect Expenses: Itemize expenses related to the entire home, such as mortgage interest, property taxes, utilities, and insurance. These are calculated based on the percentage of the home used for business.

How to Use Form 8829 (2015)

Using Form 8829 effectively involves a clear understanding of how to report all related expenses accurately. The process begins with determining the business-use percentage of the home, which is calculated by dividing the area designated for business by the total area of the home.

Steps to Complete Form 8829

-

Determine Business vs. Personal Use:

- Measure the square footage of the portion of the home used exclusively for business.

- Verify that the space is exclusively for business activities, as mixed-use areas do not qualify.

-

Calculate Total Expenses:

- Compile total home expenses, including costs for utilities, repairs, and insurance.

- Categorize these expenses into direct and indirect costs.

-

Complete the Form:

- Fill out the form per the instructions, detailing the calculated business-use percentage and the total monetary amounts derived from the expense categories.

-

Transfer Results:

- Once completed, the total deduction amount from Form 8829 will be transferred to the relevant line on Schedule C.

Important Considerations

It is important to maintain receipts and documentation for all expenses claimed to support deductions in the event of an IRS audit. Furthermore, understanding and utilizing the proper calculations will ensure compliance with IRS regulations and prevent potential penalties.

Obtaining Form 8829 (2015)

Form 8829 can be obtained directly from the IRS website. Here are the common methods for acquiring the form:

- Download from the IRS Website: The most efficient method is to download the PDF directly from the IRS website. The form is available for immediate printing.

- IRS Local Office: Taxpayers may also visit local IRS offices to collect a paper copy of Form 8829.

- Tax Preparation Software: Most modern tax software programs, such as TurboTax and H&R Block, automatically include Form 8829 as part of their offerings.

Legal Use of Form 8829 (2015)

Form 8829 is designed for individuals who are self-employed or who engage in business activities from home. This includes a variety of scenarios, such as freelancers, consultants, and home-based entrepreneurs. The key legal stipulations include:

- The space must be used regularly and exclusively for business purposes.

- Record-keeping must be meticulous to justify all expense claims during annual tax filings.

Examples of Using Form 8829 (2015)

Practical examples of Form 8829 applications can often guide correct utilization:

- A freelance graphic designer uses one room of a three-bedroom home as their office. That room, measuring 200 square feet, accounts for 10% of the home’s total area of 2,000 square feet. Assuming the total home expenses for the year are $18,000, the deductible portion would be $1,800, reported on Form 8829.

- A consultant working from a dedicated home office of 150 square feet within a 1,500 square foot residence can again use the business-use percentage to allocate parts of appliance expenses, alongside utilities, for deductions.

Important Terms Related to Form 8829 (2015)

A few essential terms often discussed in context with Form 8829 include:

- Direct Expense: Costs that apply directly to the business portion of the home.

- Indirect Expense: Costs that apply to the entire home and must be prorated based on business use.

- Exclusive Use: A requirement that the space used for business must not be used for personal activities.

Understanding these terms is essential for accurately completing Form 8829 and maximizing home office deductions when filing taxes.