Definition & Meaning

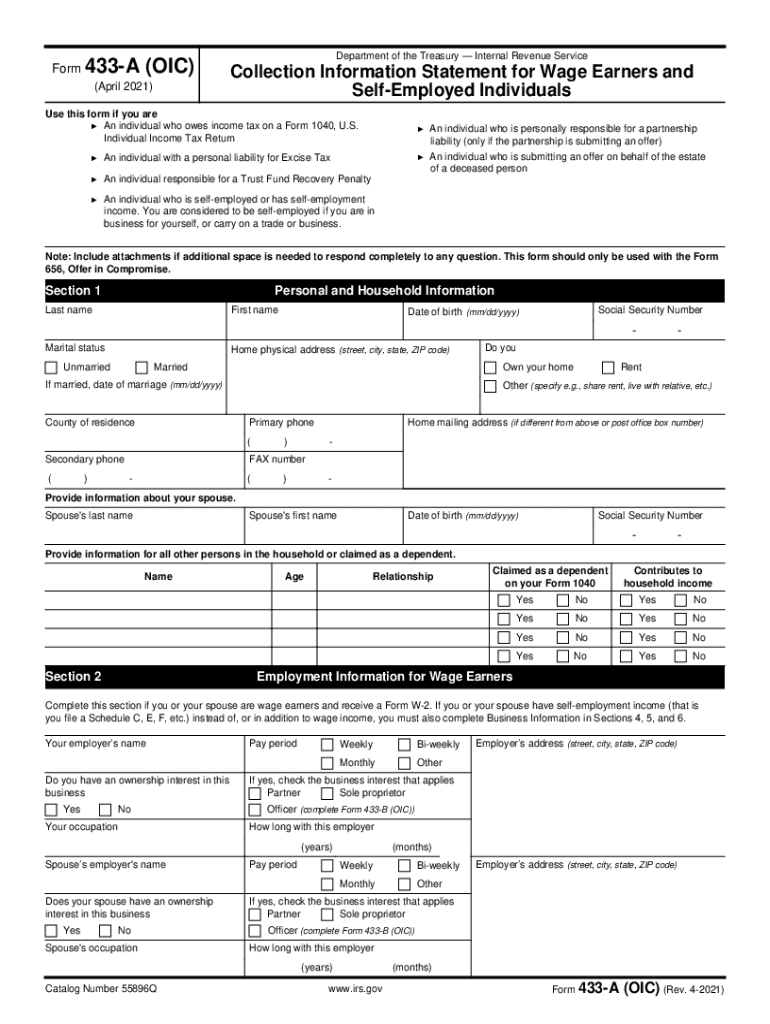

Form 433-A (OIC), also known as the Collection Information Statement for Wage Earners and Self-Employed Individuals, is employed by those with outstanding income tax or other tax obligations. Its primary function is to gather comprehensive personal, household, employment, asset, and income data from individuals seeking an Offer in Compromise (OIC) with the IRS. This form is essential for analyzing an individual's financial status to determine eligibility and terms for settling tax liabilities for less than the total owed amount.

How to Use Form 433-A (OIC)

To effectively use Form 433-A (OIC), individuals must follow specific steps:

-

Gather Necessary Information:

- Collect documents such as recent pay stubs, bank statements, and information about personal assets and liabilities.

-

Complete All Sections:

- Provide details on personal information, employment, and income. Sections will require information about financial accounts, real estate, vehicles, personal loans, and business interests for self-employed individuals.

-

Calculate Minimum Offer:

- Use the form to help calculate the minimum offer amount, which is based on an individual's ability to pay after accounting for expenses and assets.

-

Review and Double-Check:

- Ensure accuracy by reviewing all entered data before submission to prevent delays or misunderstandings with the IRS.

-

Submission:

- Send the completed form to the IRS along with supporting documentation of financial status.

How to Obtain Form 433-A (OIC)

Form 433-A (OIC) can be accessed and obtained in several ways:

-

IRS Website:

- The IRS website provides a downloadable PDF version of Form 433-A (OIC), ensuring easy access and the ability to print or fill digitally.

-

Tax Assistance Centers:

- Forms may be available at local IRS Taxpayer Assistance Centers for in-person retrieval if online options are not suitable.

-

Mail:

- You can request a paper version by contacting the IRS directly and asking them to send the form via mail.

Steps to Complete the Form 433-A (OIC)

Completing Form 433-A (OIC) involves several detailed steps:

-

Personal Information Section:

- Fill in name, address, Social Security Number, and employment details.

-

Asset and Liability Assessment:

- Document all financial accounts, investments, properties, and liabilities, including loans and credit lines.

-

Monthly Income and Expense Analysis:

- Provide precise details of income sources and monthly expenses to reflect financial status accurately.

-

Validation and Calculations:

- Use the calculations section to determine the minimum offer you can make in your Offer in Compromise application.

-

Review and Submit:

- After filling out the form, review thoroughly, attach required documents, and submit as per IRS instructions.

Who Typically Uses the Form 433-A (OIC)

Form 433-A (OIC) is designed for:

-

Wage Earners:

- Individuals employed and earning wages who seek to resolve tax debts.

-

Self-Employed Individuals:

- Those who own their own business or are freelancers and have different income variability and business expenses.

-

Taxpayers with Significant Debt:

- Individuals with substantial tax debts who require a structured agreement to manage and pay off their liabilities.

IRS Guidelines

Adhering to IRS guidelines when completing Form 433-A (OIC) is crucial:

-

Accuracy:

- Ensure that all financial data is factual and can be substantiated with necessary documents.

-

Timeliness:

- Be prompt in submitting the form and any additional requests from the IRS to avoid processing delays.

-

Compliance:

- Follow IRS guidelines for calculating offers and ensure all sections are completed in compliance with current IRS requirements.

Key Elements of Form 433-A (OIC)

Form 433-A (OIC) is structured into several critical sections:

-

Personal and Household Information:

- Captures basic information about the taxpayer and household members.

-

Asset Information:

- Details on financial accounts, real estate, and personal property.

-

Income Details:

- Lists all income sources, including wages, bonuses, and any investment income.

-

Expense Analysis:

- Outlines monthly living and business expenses to determine disposable income.

Penalties for Non-Compliance

Failing to comply with the requirements of Form 433-A (OIC) can result in:

-

Denial of Offer:

- Misrepresentation or incomplete data can lead to rejection of the Offer in Compromise.

-

Accrued Interest and Penalties:

- Continued non-compliance or delays can increase the total amount owed due to additional interest and penalties.

-

Enforced Collection Activities:

- The IRS can initiate collection actions, such as wage garnishments or bank levies, for those who do not resolve their liabilities appropriately.

Required Documents

When completing Form 433-A (OIC), the following documents are typically required:

-

Proof of Income:

- Pay stubs, profit and loss statements, and other income documentation.

-

Bank and Financial Statements:

- Recent account statements to verify assets and liabilities.

-

Expenses Documentation:

- Bills, invoices, and receipts providing evidence of standard living and business expenses.