Definition and Meaning of the 2011 Form 990

The 2011 Form 990 is a tax document used by tax-exempt organizations, nonexempt charitable trusts, and section 527 political organizations to provide the Internal Revenue Service (IRS) with detailed information regarding their financial activities. The form ensures transparency in the operations of such organizations and facilitates public access to important details regarding their financial health and governance. The form includes sections on income, expenses, assets, liabilities, and the organization’s executive compensation.

How to Obtain the 2011 Form 990

Organizations can obtain the 2011 Form 990 directly from the IRS website, where it is available for download. It may also be accessible through tax preparation software that offers support for federal tax filings. Additionally, organizations may contact the IRS directly to request a paper copy of the form or employ professional tax services familiar with nonprofit filings to handle the retrieval and completion of the form on their behalf.

Steps to Complete the 2011 Form 990

- Gather Necessary Data: Collect all relevant financial data, including income, expenses, assets, and liabilities from the fiscal year.

- Complete Identifying Information: Fill in the organization's name, address, and Employer Identification Number on the form.

- Section A - Organizational Details: Provide basic details about the organization’s structure and purpose.

- Section B - Financial Statements: Enter the details about the organization’s income, expenses, and financial position.

- Section C - Program Services: Describe the organization’s main programs and their purposes.

- Review and Triple-Check: Carefully review all entries for accuracy and completeness.

- Final Approval: Ensure the form is signed by an authorized officer of the organization before submission.

Legal Use of the 2011 Form 990

The legal use of Form 990 is to report an organization's financial activities and governance information to the IRS. This requirement upholds the transparency as mandated by tax laws and the regulations governing tax-exempt entities. Proper filing ensures compliance with federal tax obligations and helps maintain the organization's tax-exempt status. Additionally, the form must be available to the public, which offers insight into an organization’s operations.

Key Elements of the 2011 Form 990

- Summary Information: A snapshot of the organization’s mission, operations, and basic financial data.

- Financial Report: Details on revenue, expenses, and net assets.

- Governance: Information about the organization's governing body, officers, and key employees.

- Program Services: A detailed account of the organization’s major programs and accomplishments.

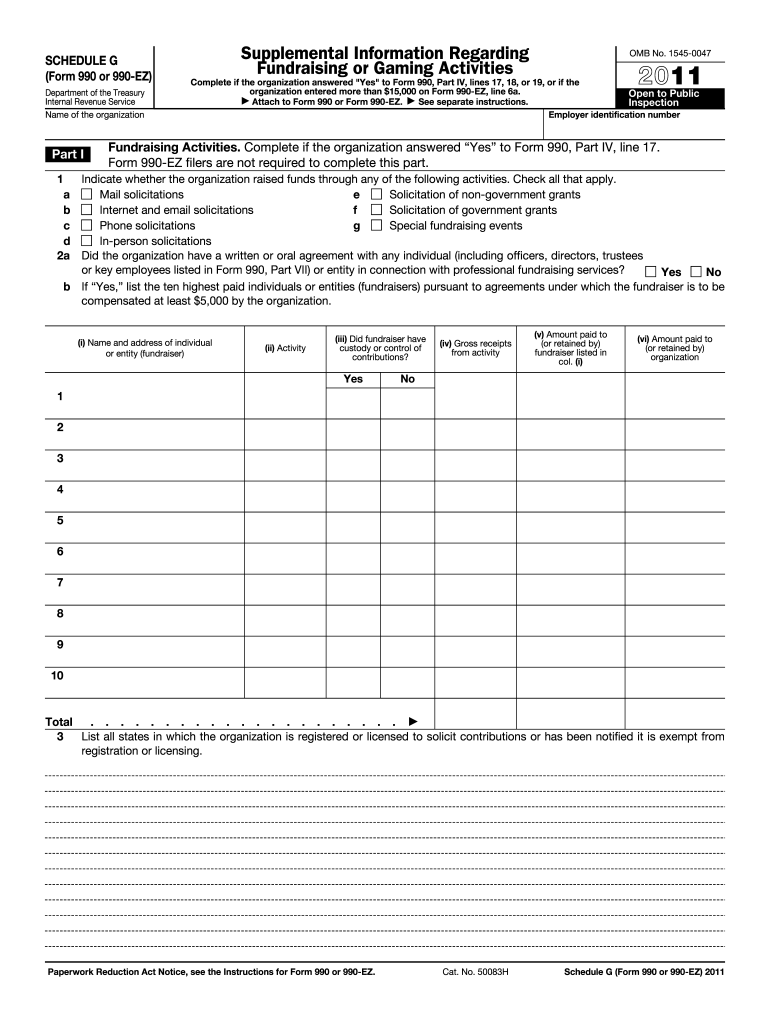

- Schedule Requirement: Forms and additional schedules attached to provide more details based on specific operations, such as fundraising and foreign activities.

Who Typically Uses the 2011 Form 990

Nonprofit organizations, tax-exempt entities, and political organizations are the primary users of the Form 990. The form is essential for organizations with gross receipts over $200,000 or total assets above $500,000. Smaller organizations may be eligible to file the Form 990-EZ or Form 990-N depending on their revenue.

Filing Deadlines and Important Dates for the 2011 Form 990

The 2011 Form 990 is due the 15th day of the fifth month after the close of the organization’s fiscal year. For instance, if the fiscal year ends on December 31, the form is due by May 15 of the following year. Extensions can be requested through the IRS for up to six months if filed before the original due date.

Penalties for Non-Compliance with the 2011 Form 990

Failing to file the 2011 Form 990 or filing inaccurately can lead to penalties. Organizations may face daily fines depending on their size, with smaller entities penalized up to $20 per day for a maximum of $10,000 or 5% of their gross receipts. Larger entities face harsher penalties of up to $100 per day. Persistent non-compliance may even result in the revocation of the organization’s tax-exempt status.