Understanding the 990 Tax Returns

The 990 tax returns are essential documents filed by tax-exempt organizations to provide the IRS with annual financial information. This return is crucial for maintaining compliance with tax laws and offers transparency regarding the organization's operations and finances.

Eligibility Criteria for Filing a 990 Form

Tax-exempt organizations, including charities and nonprofits, typically file the 990 tax returns. To determine eligibility, an organization must assess its gross receipts and total assets. Organizations with gross receipts over $200,000 or total assets over $500,000 are generally required to file Form 990. Smaller organizations may need to submit Form 990-EZ or 990-N.

Distinctions Between 990 Forms

There are several variations of the 990 form, each tailored to different levels of organization size and complexity:

- Form 990: For large organizations with gross receipts over $200,000 and total assets above $500,000.

- Form 990-EZ: For medium-sized organizations with gross receipts between $50,000 and $200,000.

- Form 990-N (e-Postcard): For smaller organizations with gross receipts less than $50,000.

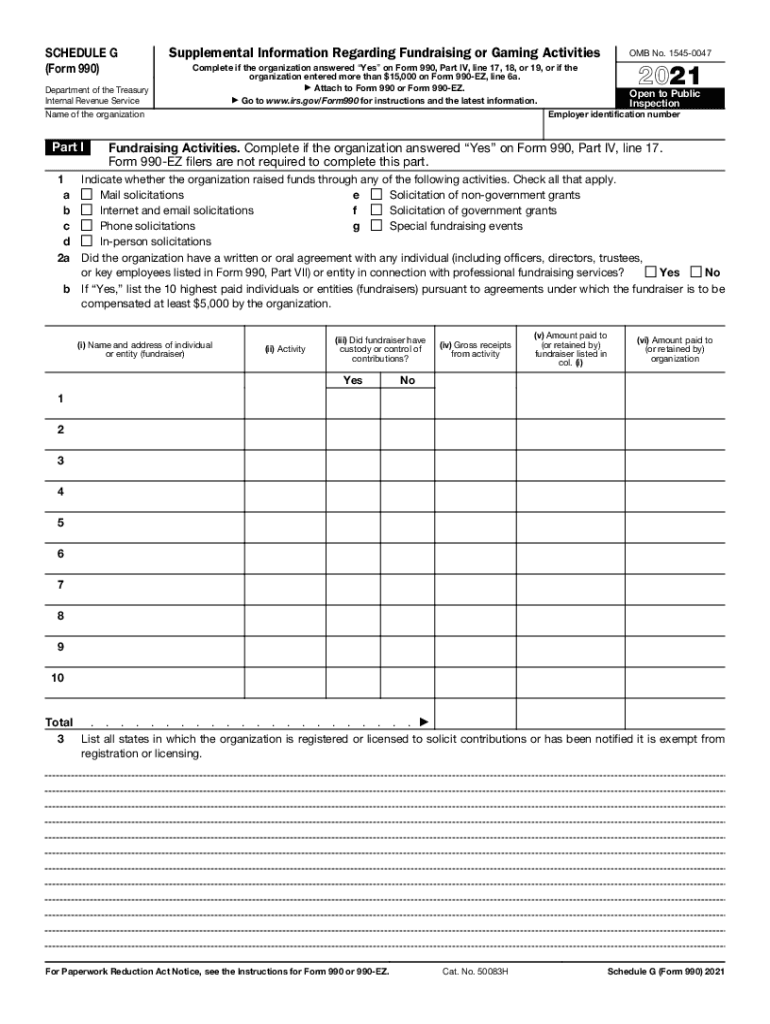

Key Elements of the 990 Tax Returns

Understanding the core components of the 990 forms will ensure precise completion:

- Part I: Summary of the organization’s mission, significant activities, and financial highlights.

- Part II: Signature block to verify the information with the signature of an authorized officer.

- Part III: A detailed narrating of the organization’s missions and activities.

- Part IV: Checklist of schedules - determines applicable schedules to accompany the form.

- Parts V-XI: Pertinent information such as governance, management policies, and financial statements.

Steps to Complete the 990 Tax Returns

Filing Form 990 involves understanding each section's requirements and ensuring accuracy:

- Gather Necessary Documents: Compile your financial records, including revenue, expenses, and balance sheets.

- Complete Identification Information: Fill out details regarding your organization, including name, address, and EIN.

- Revenue and Expenses Assignment: Enter precise details of all income sources and expenses.

- Functional Expense Analysis: Break down expenses based on function to provide detailed financial information.

- File Compliance Schedules: Depending on the organization's specifics, additional schedules might be required.

- Review and Sign: Ensure every section is filled accurately and have an authorized individual sign the form.

Legal Use and Importance of the 990 Form

The 990 tax return is crucial for legal compliance and maintaining tax-exempt status. It serves several purposes:

- Transparency: Offers public insight into how tax-exempt organizations manage and utilize their funds.

- Regulatory Compliance: Adhering to IRS requirements to avoid penalties.

- Fundraising Tool: Demonstrates accountability and operational integrity to donors.

Consequences of Non-Compliance

Failing to file Form 990 results in penalties and could jeopardize tax-exempt status. Repeated non-compliance might lead to the automatic revocation of tax-exempt status.

IRS Guidelines and Submission Methods

Tax-exempt organizations must follow specific IRS guidelines when completing Form 990:

- Filing Deadline: Generally due on the 15th day of the 5th month after the end of the tax year.

- Submission Options: Organizations can file electronically for convenience, or through traditional mail methods.

State-Specific Rules

Different states may have additional requirements related to the 990 forms, which can affect the filing process. Familiarity with both federal and state requirements ensures all obligations are satisfied and the nonprofit remains in good standing.

Software Compatibility and Paper Version

Filing can be simplified using tax preparation software such as TurboTax or QuickBooks, which provide step-by-step guidance either in digital formats or traditional paper methods. These tools ensure accurate calculations and efficient submissions.

Examples of Using 990 Tax Returns

A nonprofit poetry organization uses Form 990 to report its annual fundraising events, revealing sources of donation income and specifying how much was spent on poetic education programs. This detailed financial reporting helps reassure their donors about their responsible management of funds.

Such examples highlight how the 990 tax returns facilitate transparency and trust within a variety of sectors.