Definition & Meaning

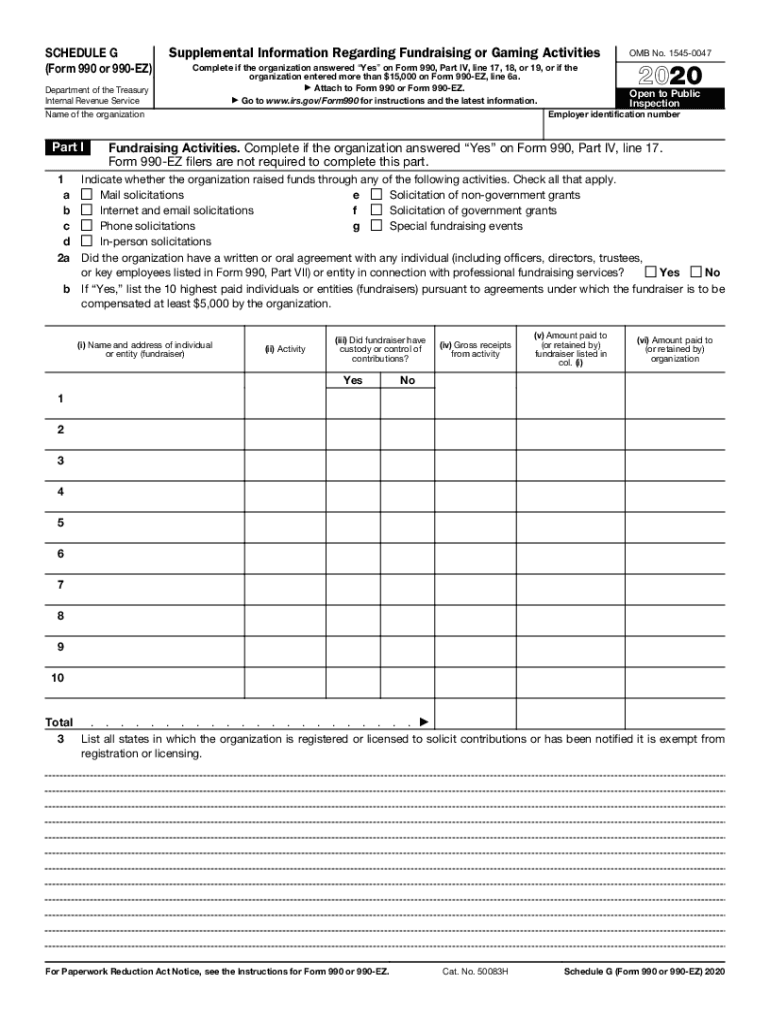

Schedule G is an important component of IRS Form 990 or 990-EZ, which provides supplemental information regarding a nonprofit organization's fundraising and gaming activities. It is required for organizations that engage in significant fundraising efforts or have substantial gross receipts. This schedule provides detailed insights into the methods used for fundraising, agreements with fundraiser professionals, expenses incurred, and revenue generated from events and gaming activities.

Key Elements of the Schedule G

Schedule G consists of several critical sections that nonprofit organizations must complete accurately:

- Fundraising Activities: This section details various methods employed for fundraising, such as mail campaigns, events, and online solicitations. Organizations must specify the type of activity and the income and expenses related to each.

- Professional Fundraiser Agreements: Organizations using outside professionals for fundraising must disclose agreements, compensation structures, and the identity of the fundraisers.

- Revenue and Direct Expenses: Organizations must report income earned and direct expenses related to specific fundraising events.

- Gaming Activities: If applicable, organizations should provide information about gaming licenses, gross receipts from gaming, prizes awarded, and expenses incurred.

How to Use the Schedule G

For organizations required to submit Schedule G, the process involves:

- Gathering Information: Collect data on all fundraising and gaming activities conducted during the fiscal year.

- Completing the Form: Carefully fill out each section, providing accurate details about activities, agreements, and financial transactions.

- Reviewing for Accuracy: Ensure all entered information aligns with other parts of Form 990 or 990-EZ.

- Attaching to Form 990/990-EZ: Submit Schedule G alongside the main tax forms for review by the IRS.

Steps to Complete the Schedule G

Completing the Schedule G requires meticulous attention to detail:

- Compile Financial Data: Gather financial reports that include income, expenses, and net proceeds from fundraising and gaming.

- Document Fundraiser Agreements: Outline contracts with professional fundraisers, specifying the terms, fees, and results.

- Detail Fundraising Activities: Fill in specifics of each fundraising method and its financial impact.

- Report Gaming Operations: Include data on gaming licenses, revenue, expenses, and any related state disclosures.

Important Terms Related to Schedule G

- Gross Receipts: Total income from all fundraising events before any expenses are deducted.

- Professional Fundraiser: An individual or company contracted specifically to conduct fundraising on behalf of an organization.

- Net Revenue: The final income remaining after deducting related expenses from fundraising and gaming activities.

Legal Use of the Schedule G

An accurate Schedule G ensures compliance with IRS requirements. The legal significance of the form lies in its ability to demonstrate transparency and integrity in an organization's financial activities. Misrepresentations or inaccuracies can result in penalties or audits, emphasizing the importance of precise and honest reporting.

IRS Guidelines

The IRS provides specific guidelines for completing Schedule G. Organizations must adhere to these instructions to avoid penalties:

- Comply with Timeline: Schedule G must be submitted with Form 990 or 990-EZ by the IRS-defined deadline.

- Accuracy and Completeness: All information should be current and complete, reflecting true financial activities.

- Record Keeping: Maintain thorough records of all fundraising activities and related agreements to support data provided in Schedule G.

Filing Deadlines / Important Dates

The filing deadline for Schedule G aligns with the deadlines of Form 990 or 990-EZ. Typically, this is the 15th day of the fifth month after the end of the nonprofit's fiscal year. Organizations should confirm the exact deadline for their specific fiscal calendar and file promptly to avoid late penalties.

Penalties for Non-Compliance

Failure to accurately complete or timely submit Schedule G can have serious consequences:

- Financial Penalties: Non-compliance may result in financial penalties imposed by the IRS.

- Increased Scrutiny: Inaccurate reporting can trigger an IRS audit, leading to further complications.

- Loss of Tax-Exempt Status: In severe cases, repeated non-compliance could jeopardize an organization's tax-exempt status.

Who Typically Uses the Schedule G

Schedule G is primarily used by nonprofit organizations that engage in substantial fundraising or operate gaming activities. These organizations include:

- Charitable Organizations: Those conducting large fundraising events or using professional fundraisers.

- Religious Institutions: Engaging in revenue-generating events needing detailed financial disclosure.

- Educational Nonprofits: Holding events or gaming activities as part of their fundraising strategy.

Understanding and accurately completing Schedule G is vital for these entities to maintain good standing and compliance with IRS requirements.