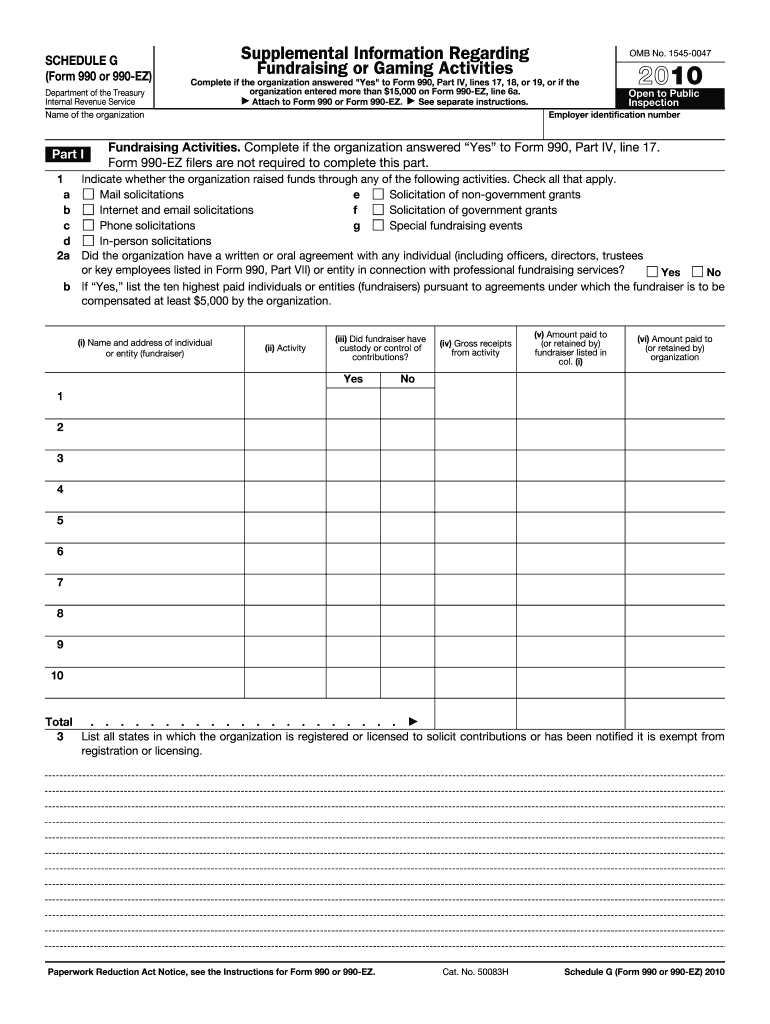

Definition & Meaning

Schedule G of the 2010 Form 990-EZ is designed to provide detailed information about an organization's fundraising events and gaming activities. This form is essential for understanding how nonprofits and similar entities raise money and manage funds. Primarily, it includes sections where organizations report their fundraising methods, contracts with professional fundraisers, and the financial overview of fundraising events. The goal is to promote transparency in financial dealings and ensure compliance with both federal and state regulations concerning charitable activities.

Key Sections of Schedule G

- Fundraising Activities: Covers specific details about different fundraising events, including the gross receipts, expenses, and net income.

- Professional Fundraisers: Requires organizations to disclose the terms of any contracts with professional fundraisers, including fees and obligations.

- Gaming Activities: This section captures the specifics of gaming operations, like bingo or raffles, detailing revenue, expenses, and payout structures.

How to Use the 2010 Form 990-EZ Schedule G

Nonprofit organizations must accurately complete Schedule G when filing their Form 990-EZ. Here’s a step-by-step approach to using this form:

- Identify Fundraising and Gaming Activities: Start by identifying all the relevant activities conducted by the organization during the fiscal year.

- Gather Financial Records: Collect detailed financial documents related to these activities, including receipts, expense reports, and contracts with fundraisers.

- Complete Each Section: Fill out the required sections for fundraising events and gaming activities, ensuring accuracy and completeness.

- Review for Accuracy: Before submission, double-check all entries against your financial records to ensure they reflect the actual transactions.

Practical Scenarios

- Annual Fundraising Gala: If an organization hosted a gala, it must report the total money raised, itemized expenses, and net proceeds.

- Charity Casino Night: For a gaming event, comprehensive details of income and expenses, along with compliance with licensing requirements, need to be reported.

Important Terms Related to 2010 Form 990-EZ Schedule G

Understanding the terminology used in Schedule G is crucial for accurate completion:

- Gross Receipts: This refers to the total amount of money received from fundraising activities before any expenses are deducted.

- Net Income: Represents the remaining funds after all expenses related to the activity have been paid.

- Professional Fundraiser: An individual or company hired by an organization to help raise funds through events or campaigns.

Edge Cases

- In-kind Donations: While typically not monetized, any substantial value donations that contribute to the event's success may need to be accounted for differently.

- Multiple Fundraisers by State-Level Branches: Organizations with separate branches must ensure activities are reported separately as needed by state laws.

Key Elements of the 2010 Form 990-EZ Schedule G

Several pivotal elements must be considered when working with Schedule G:

- Detailed Record-Keeping: Accurate record-keeping is essential for compliant reporting. Keep all receipts, contracts, and relevant documentation.

- Comprehensive Reporting: Provide detailed explanations where necessary to clarify any unconventional revenues or expenses.

- Compliance Monitoring: Understanding state-specific regulations is essential for maintaining compliance during gaming operations or specific fundraising activities.

Real-World Examples

- Community Bake Sale: Even for smaller-scale events, such as a local bake sale, the organization must report gross revenues and incurred expenses.

- Sports Fundraiser: If hosting a sports event, details like registration fees and voluntary donations should be accurately reflected.

IRS Guidelines

The IRS provides explicit guidelines on how to report fundraising and gaming activities using Schedule G. These rules ensure that organizations remain honest about their financial activities and that stakeholders, including donors and regulatory bodies, are fully informed:

- Complete Transparency: Organizations must fully disclose all financial aspects of their fundraising activities.

- Accuracy and Honesty: Ensure all reported numbers are verifiable against accounting records.

- Adherence to Deadlines: Submit forms within specified IRS deadlines to avoid penalties.

Common Compliance Challenges

- Complex Event Structures: Large-scale events with multiple income streams may require specialist advice to ensure compliance.

- Variance in Reporting Requirements: Balancing federal reporting standards with varied state laws can be challenging and may necessitate professional guidance.

How to Obtain the 2010 Form 990-EZ Schedule G

Accessing and acquiring this form can be straightforward:

- Download from IRS Website: The easiest method is to download it directly from the official IRS website.

- Request Physical Copies: Organizations may also request physical copies by contacting IRS customer service.

- Use Tax Software: Many tax preparation programs incorporate this form, providing guided instruction for completion.

Tools for Ease of Access

- DocHub: The platform allows you to upload, fill out, and securely save your 990-EZ Schedule G form, ensuring it is available when needed.

- Google Drive Integration: By storing completed forms in cloud storage, you can easily access and update them as required.

Steps to Complete the 2010 Form 990-EZ Schedule G

Here's a detailed guide to completing the form effectively:

- Prepare Financial Records: Gather all monetary details concerning the relevant activities.

- Fill Personal Information Sections: Enter the organizational identification details as required.

- Detail Fundraising Events: Accurately enter financial data from all fundraising events.

- Complete Gaming Activity Details: Report income and expenses from any gaming activities.

- Review and Correct: Carefully review for any inconsistencies or incorrect entries.

- Submit to IRS: Follow the appropriate submission channels to file the form with the IRS.

Common Penalties for Non-Compliance

Failure to accurately complete and submit Schedule G can result in:

- Monetary Fines: Organizations can incur fines for incomplete, inaccurate, or late submissions.

- Increased Scrutiny: Persistent inaccuracies may lead to increased scrutiny of the organization’s financial activities by the IRS.

- Revocation of Tax-Exempt Status: Severe non-compliance could risk losing an organization's tax-exempt status.

Prevention Tips

- Adopt Robust Filing Systems: Use secure document management platforms like DocHub to organize and maintain all records.

- Seek Professional Advice: For complex activities, involving a tax professional can ensure accuracy and compliance with IRS guidelines.