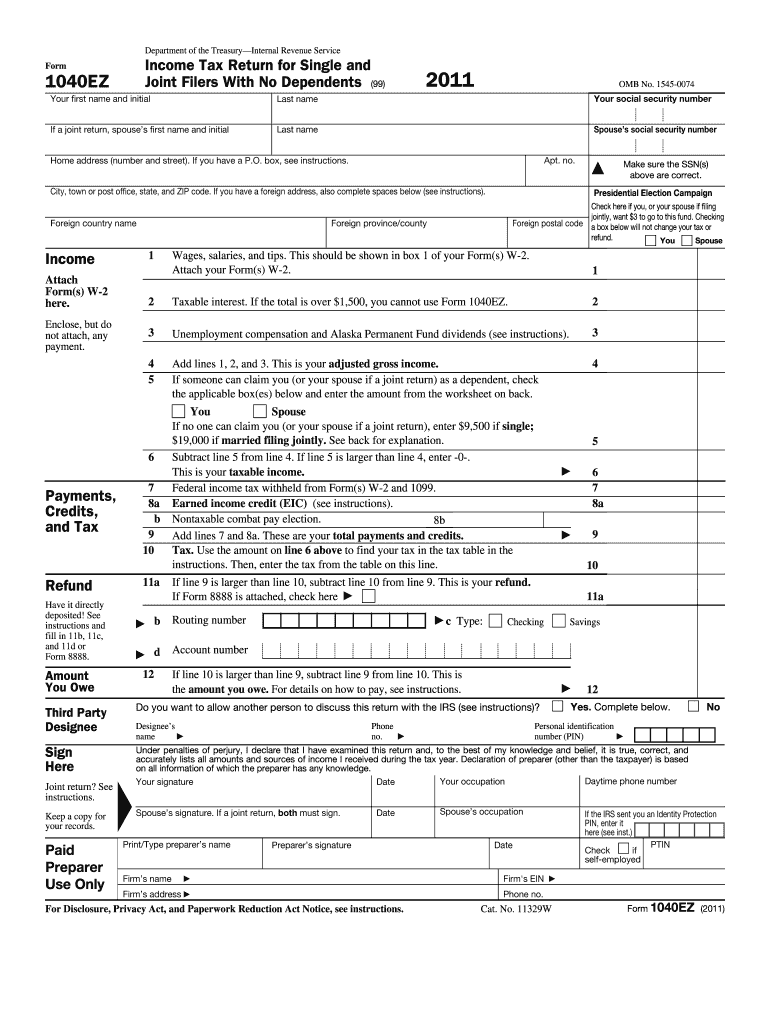

Definition and Purpose of the 2011 Form 1040EZ

The 2011 Form 1040EZ is the U.S. individual income tax return designed for single and joint filers with straightforward financial situations. This form is ideal for individuals who do not claim dependents and have limited sources of income such as wages, salaries, and tips. The simplified nature of the form streamlines the process of filing annual federal tax returns by consolidating essential information into a single document.

- Eligibility: Taxpayers who earned less than $100,000 in taxable income and claimed no dependents can benefit from using Form 1040EZ.

- Income Sources: Only specific income types, including wages and unemployment compensation, are reportable using this form.

- Deductions: The 1040EZ form does not allow for itemized deductions. Instead, it provides for the standard deduction.

Steps to Complete the 2011 Form 1040EZ

Successfully filing your tax return requires accuracy and attention to detail. Here are steps to efficiently complete the 2011 Form 1040EZ:

-

Gather Necessary Documents:

- W-2 forms from all employers.

- 1099 forms indicating any additional income.

- Social Security card for self and spouse.

-

Fill Out Personal Information:

- Enter name, address, and Social Security number. If applicable, include spouse’s details in the appropriate sections.

-

Calculate Income:

- Transfer total wages and unemployment compensation to the designated boxes.

- Calculate adjusted gross income using the figures provided in your tax documents.

-

Claim Standard Deduction and Calculate Tax Credits:

- Deduct standard deductions. The applicable amount varies based on filing status.

- Include any applicable tax credits, such as the Earned Income Credit if eligible.

-

Calculate Refund or Tax Due:

- Compare tax withheld to total tax liability to determine whether a refund is due or an amount is payable.

-

Sign and Submit:

- Both filers (if joint) must sign the document before submission. Ensure all required attachments accompany the form.

Required Documents for the 2011 Form 1040EZ

Gathering the correct documentation is essential for accurate tax filing. Essential documents include:

- W-2 Form: Essential for reporting wages and salaries.

- 1099 Form: Required for non-employee income, such as interest or dividend payments.

- Proof of Health Insurance: Though not relevant for tax year 2011, this may be required in future filings.

- Tax Deduction or Credit Documentation: Papers supporting any claims of eligible tax credits.

Filing Deadlines and Important Dates

Taxpayers must adhere to specific deadlines to avoid late penalties:

- April 15, 2012: Standard deadline for submission of Form 1040EZ for the 2011 tax year.

- October 15, 2012: Extended deadline available upon request if filed for an extension before April 15.

Failure to submit can lead to penalties, emphasizing the importance of meeting these deadlines.

Form Submission Methods

There are multiple methods for submitting Form 1040EZ:

- Online Submission: E-filing is a convenient option available via approved IRS vendors. Offers faster processing and quicker refunds.

- Mail: Paper forms should be mailed to the IRS address indicated for the taxpayer's state.

- In-Person: Submission can occur at IRS offices, although less common for standard taxpayers.

Who Typically Uses the Form 1040EZ?

Primarily, the 1040EZ form is designed for:

- Young Taxpayers: Those with early career stages showing simple income structures.

- Retirees: Those with uncomplicated income portfolios such as pensions.

- Low-Income Earners: Individuals meeting income thresholds below $100,000.

This form’s simplicity is ideal for those who don’t itemize deductions, claim dependents, or report extensive secondary income sources.

Key Elements of the 2011 Form 1040EZ

The Form 1040EZ consists of specific sections tailored for straightforward tax filing:

- Personal Identification: Entry of taxpayer's contact information.

- Income Declaration: Reporting of wages, salaries, and unemployment compensation.

- Payment and Refund Calculations: Areas for inputting tax withholdings and calculating net tax obligation.

- Signature: Mandatory to validate the form; ensures the document's legal acceptance.

IRS Guidelines for 2011 Form 1040EZ

The IRS offers guidelines to ensure compliance and accuracy:

- Instruction Booklet: Includes a step-by-step guide and instructions.

- Form Availability: Provides access to downloadable and printable copies on the IRS website.

- Helpline: Offers taxpayer assistance via phone or local IRS offices for queries related to form completion.

By following these guidelines, taxpayers can efficiently manage their tax filing responsibilities, mitigating errors and processing delays.