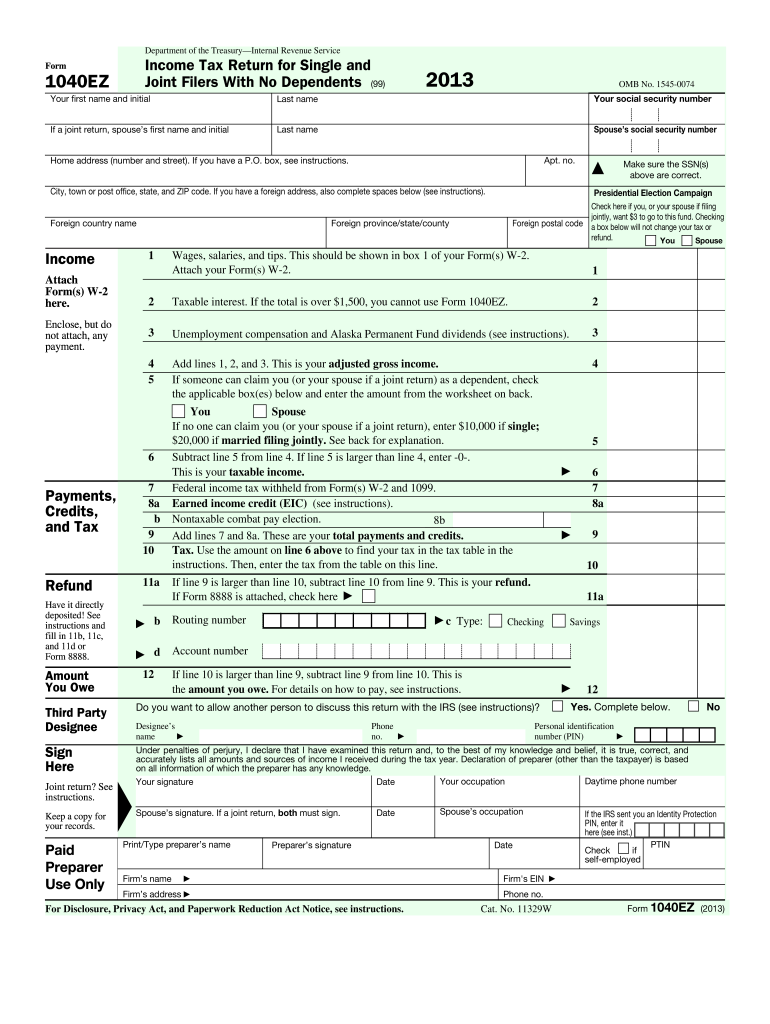

Definition & Purpose of the 1040EZ 2013 Form

The 1040EZ 2013 form is an income tax return document intended for use by single and joint filers without dependents. Designed by the IRS for simplicity, this form is suitable for individuals under 65 years old with a taxable income under $100,000 who do not claim dependents. The form allows taxpayers to report basic income types like wages, salaries, and tips, making it an efficient choice for those with uncomplicated tax situations.

Steps to Complete the 1040EZ 2013 Form

-

Personal Information: Enter your name, Social Security number, and home address. For joint filers, include the spouse's details.

-

Income Section: Record your total wages, salaries, and tips as listed on your W-2 form.

-

Filing Status: Choose either "Single" or "Married filing jointly." The 1040EZ does not support other statuses.

-

Taxable Interest: Note any taxable interest income if it fits within the $1,500 limit.

-

Adjustments and Deductions: Unlike other forms, the 1040EZ provides no deductions or adjustments other than the standard deduction.

-

Tax, Credits, and Payments: Use the provided tables to calculate your tax liability, and include any federal income tax withheld.

-

Refund or Amount Owed: Calculate whether you will receive a refund or owe additional taxes. Provide your bank details for direct deposit if expecting a refund.

-

Signature: Ensure both filers sign the form, if applicable. Unsigned forms will not be processed by the IRS.

How to Obtain the 1040EZ 2013 Form

The 1040EZ 2013 form can be acquired through several channels. It is available for download on the official IRS website or can be obtained at local IRS offices. Alternatively, some public libraries and post offices may provide physical copies. The form can also be filled out electronically using tax-preparation software or online platforms that allow for e-filing.

Who Typically Uses the 1040EZ 2013 Form

The 1040EZ 2013 form is specifically tailored for U.S.-based taxpayers with straightforward financial circumstances. It is most commonly used by young adults, part-time workers, students, and individuals with stable employment situations and no claimable dependents. The form's limitations on income types and deduction options make it unsuitable for complex tax situations.

Filing Deadlines and Important Dates for the 1040EZ 2013 Form

The deadline for filing the 1040EZ 2013 form was April 15, 2014. Taxpayers were urged to submit their returns by this date to avoid late filing penalties. Those unable to meet the deadline could file for an extension, typically granting an additional six months, specifically for preparing and submitting the complete return, excluding tax payment delays.

Required Documents for Completing the 1040EZ 2013 Form

- W-2s: All received for the year 2013, detailing income earned and taxes withheld.

- 1099 Forms: If required, to report additional income not covered by W-2s.

- 1099-INT: For reporting interest income, capped at $1,500 for the 1040EZ.

- Social Security Numbers: Must be provided for all individual filers.

- Bank Account Information: Optional but recommended for refund direct deposits.

Eligibility Criteria for the 1040EZ 2013 Form

Eligible filers for the 1040EZ 2013 form must meet specific conditions: they must be under 65, with a total income under $100,000 and not claim any dependents. Additionally, they cannot claim any deductions apart from the standard deduction and must have interest income of $1,500 or less.

Examples of Using the 1040EZ 2013 Form

Consider a single 28-year-old professional with yearly earnings of $45,000 and no dependents. This individual would use the 1040EZ to report their straightforward financial status. Similarly, a married couple both working, each earning $30,000, with no additional sources or claims, perfect candidates for the 1040EZ 2013 form.

IRS Guidelines for the 1040EZ 2013 Form

The IRS provides comprehensive instructions alongside the 1040EZ 2013 form, facilitating accurate completion and submission. Guidelines include step-by-step help on income reporting, tax calculations, and filing protocols. The document is particularly helpful for first-time filers and those with little tax law familiarity, simplifying compliance with federal requirements.

Form Submission Methods: Online, Mail, and In-Person

Taxpayers utilizing the 1040EZ 2013 form had the option to e-file or submit their completed documents via traditional mail. E-filing offers convenience and quicker processing times, whereas mailing remains viable for those preferring physical submissions. It was also possible to file in-person at an IRS office under certain circumstances, ensuring compliance through guided completion assistance.